Fed Pivot

31 October 2022

Hi, The Investor’s Podcast Network Community!

🎃 Happy Halloween!

Before you dive into candy, let’s break down the biggest news in markets.

🇧🇷 In a nail-biting election, Luiz Inacio Lula da Silva beat out Brazil’s incumbent President Jair Bolsonaro, but Bolsonaro has yet to concede.

Given his tight grip on power and willingness to question the election’s integrity, the world is watching to see how this transition of power unfolds in South America’s largest economy, though Brazilian stocks have reacted positively so far.

🌾 In other news, wheat prices soared after Russia suspended a deal guaranteeing the safe passage of Ukrainian grain exports in the Black Sea.

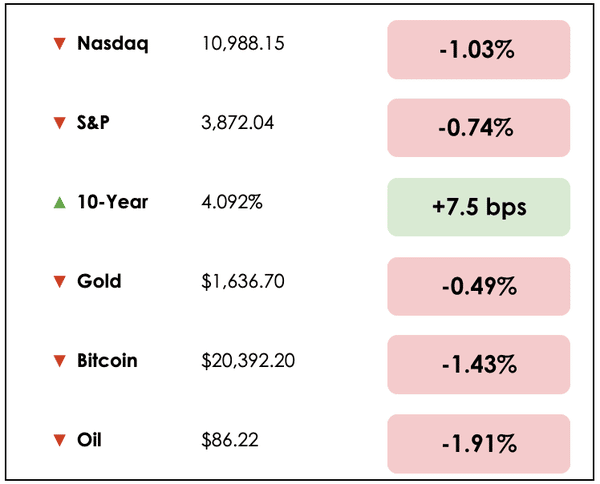

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss the Fed’s impending rate hike moves and one volatile asset that’s been surprisingly stable lately, plus our main story on whether Meta is worth buying after its recent selloff.

All this, and more, in just 5 minutes.

Let’s go! ⬇️

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

💭 Nearing the End of Fed Tightening? (Bloomberg)

Explained:

- Morgan Stanley strategist Michael Wilson says the end of the Federal Reserve’s interest rate hikes may be approaching.

- The inversion of the yield curve between the 10-year and 3-month Treasuries is a recession indicator with a perfect record, which “supports a Fed pivot sooner rather than later,” according to Wilson.

- UBS Global Wealth Management argued, though, that a Fed pivot is unlikely until the official data shows inflation is receding and under control.

What to know:

- Stanley added, “this week’s Fed meeting is critical for the rally to continue, pause, or even end completely.”

- All eyes will be on the Fed’s decision on Wednesday. Expectations are that they will raise rates by 75 basis points for the fourth consecutive time.

- Wilson, ranked the best portfolio strategist in the latest Institutional Investor survey, expects the bear market to end sometime in the first quarter of 2023.

💤 Retail Losing Interest in Bitcoin— Smart Money Accumulating (CNBC)

Explained:

- Digital currencies have experienced a brutal sell-off this year, losing $2 trillion in value since the height of the 2021 rally, which saw bitcoin climb as high as $68,990.

- For the past several months, bitcoin’s price has bounced around $20,000, showing signs that the volatility in the market has settled with prices down 70% off its highs.

What to know:

- One analyst said, “Bitcoin being stuck in such a range does make it boring, but this is also when retail loses interest and smart money starts to accumulate.”

- Goldman Sachs suggested we may be close to the end of a “particularly bearish” period and said there were parallels with bitcoin’s trading in November 2018, when prices steadied for a while before rising steadily.

- The primary catalyst that may lead to more bitcoin buying would be a pivot from the Fed, indicating that it plans on easing its aggressive interest rate hikes. The next Fed meeting is November 2nd, and a 75 basis point rate hike is expected.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

WHAT ELSE WE’RE INTO

📺 WATCH: Bitcoin and macro hang, with Preston Pysh, Jeff Booth, Greg Foss, and John Vallis

👂 LISTEN: Current market conditions with Richard Duncan, on We Study Billionaires

📖 READ: The surprising benefits of scaring yourself silly this Halloween, from the Wall Street Journal

THE MAIN STORY: IS FACEBOOK TODAY THE SAME AS MICROSOFT IN 2011?

Overview

Facebook, and yes, we know it’s “Meta” now, but Facebook is the brand we all know and love (or hate), is down more than 70% this year.

It’s been a brutal beating for one of the world’s most well-known companies, and its pain only worsened after reporting a disappointing quarter last week.

No matter how bearish you are on Mark Zuckerberg’s plans for building the seemingly dystopian Metaverse, where we would all exist as digital avatars in a simulated reality, at some point, the stock becomes too cheap to ignore given the underlying business’s fundamentals.

Fortunately, Andrew Walker of Yet Another Value Blog, did some of the heavy lifting for us in exploring whether Facebook is worth owning in your portfolio today.

He does so by comparing Facebook today to Microsoft (MSFT) in 2011, because between 2011 and 2021, Microsoft went on an epic 10-year run, and Walker has been on a quest to find companies positioned to do the same.

Let’s discuss.

Microsoft’s conditions prior to outperformance:

- It was one of the largest companies in the world but only traded at 10x earnings

- Investors worried that its core product (Windows) would lose its dominant market share

- The stock became heavily discounted due to concerns that the CEO was wrongly positioning the company for the evolving tech landscape and was horribly misallocating capital

Now compare this to Facebook (META) today:

- It’s also one of the largest companies in the world, and it’s trading at a approximately 10x price-to-earnings ratio despite having roughly 10% of its market cap in net cash

- Investors are concerned that its core product (Facebook) is losing social media dominance to platforms more popular with younger generations like TikTok

- The stock is being discounted, in part, due to concerns that Zuckerberg’s bets on the Metaverse will prove to be a total misallocation of capital

Sounds similar, right?

Going deeper

He continues on by highlighting that for years now, fears that Microsoft Windows would be supplanted have proven completely unsubstantiated, as the signature business unit is still “printing money.”

Windows and the Microsoft Office Suite are deeply ingrained network effects, and such things are not so easily overtaken.

Think about how many individuals and businesses are deeply familiar with only the Windows operating system or rely heavily on Excel (and its many nuanced shortcuts). This sort of brand loyalty and moat will be difficult to erode.

And Walker argues that the same is true for Facebook. Billions of people use it for a reason, and it’s difficult to escape entirely, even if you don’t use it as much as you used to.

What to know

So, Facebook isn’t going anywhere, and it’s likely to remain a cash cow for many years to come. On top of this, Facebook, perhaps now more appropriately referred to by its broader parent company name, Meta, has a number of other valuable assets, including Instagram and Whatsapp, which Walker argues are under-monetized.

While these popular units are focused on growth currently, should Meta need to, they can probably pull a number of levers that would make these businesses more profitable, thus making the stock’s earnings multiple even cheaper.

Walker does emphasize, though, that Facebook isn’t the “buy of the century,” and the fight over consumer eyeballs is intense. It’s hard to say how this will unfold in the coming years.

With that, Walker continues by stating, “I think there’s a very good chance (in tens years) I’m writing an article on “looking for stocks that mirror the epic Facebook 2021-2030 run” and kicking myself for missing out.”

Takeaways

Despite the market being pessimistic about Zuckerberg’s investments in the Metaverse and likely preferring to see that cash reinvested into share buybacks, he deserves some credit given his past successes in buying Whatsapp and Instagram, starting Facebook, and pivoting to mobile after the iPhone swept the world.

Given the company’s massive cash position and significant incoming free cash flows, should the company move to increase buybacks which have slowed dramatically this year, this could provide the sort of support that would help the stock form a bottom and begin its uphill run.

We’re still on the sidelines with this one, but the stock is becoming increasingly hard to ignore.

Dive Deeper

You can read Andrew Walker’s full post here, and we firmly recommend subscribing to his newsletter, where he frequently posts phenomenal deep value research.

Click here to sign up.

And our Trey Lockerbie did a podcast for We Study Billionaires on investing in Facebook as well, so don’t miss his interview with Bill Nygren on the company.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.