ETF Graveyard

21 November 2022

Hi, The Investor’s Podcast Network Community!

⚽ The World Cup kicked off yesterday, but it’s not light on controversy.

Who’s your pick to win?

In markets, does the Nasdaq falling 30% in the last twelve months mean the bottom is almost in?

Going back to its launch in 1971, the Nasdaq has been down by 30% or more over a one-year trailing period only four times. In three of those periods, it went on to fall by more than 50%.

Not a reassuring statistic 😅

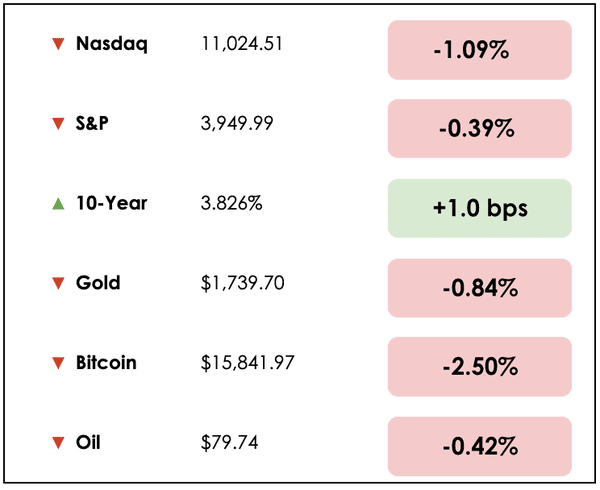

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss a shocking shake-up at Disney and a concerning report from S&P about corporate financial health, plus our main story on what happens when ETFs “die.”

All this, and more, in just 5 minutes to read.

Do you want to write for this newsletter? Apply here.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

[/fusion_builder_column_inner][/fusion_builder_row_inner]

IN THE NEWS

🏰 Disney Brings Back Bob Iger (WSJ)

Explained:

- Walt Disney’s (DIS) board of directors replaced its CEO, Bob Chapek, last night with its former chairman and long-time CEO, Bob Iger, who retired last year. The stock jumped 9% at the open this morning following the announcement.

- After reporting weaker-than-expected financial results this month, especially in its steaming division with Disney+, the company has found itself in a “pivotal period” of “industry transformation.” Apparently, “Iger is uniquely situated to lead the company” through uncertain territory.

Why it matters:

- Disney faces pressure to reform itself from multiple activist hedge funds like Trian Fund Management LP, which recently purchased $800 million worth of its stock. They hope to spark operational improvements and cost efficiencies, though it’s believed that Trian isn’t a fan of Iger returning as CEO.

- Despite stating twice in the last year that he had no interest in returning to Disney, it’s clear that the company is leaning on him for stability after its stock fell more than 40%.

- One Wells Fargo analyst wrote, “Iger will be viewed as a catalyst to improve the content aspects of Disney, and we expect bigger potential strategic changes.”

😱 S&P Sees Corporate Default Rates Doubling In Shallow Recession (Bloomberg)

Explained:

- According to S&P Global Ratings, the default rate for U.S. companies will jump to 3.75% should the Fed’s rate hiking efforts push the economy into a mild recession.

- A weaker economy and higher debt-financing costs are anticipated to leave around 69 speculative-grade companies behind on servicing their debt by next year.

Why it matters:

- In a more pessimistic scenario, S&P’s models indicate that an alarming 6% of high-yield (less financially sound) corporate debt issuers could default, which is considerably higher than the long-term average of 4.1% since 1981.

- One analyst wrote, “Much will depend on the length, breadth, and depth of a recession should one occur, and if the Fed will continue to raise rates through a recession.”

- Wall Street will keenly watch how at-risk companies fare in this challenging environment. Rising default rates will surely weigh on markets if they come to fruition as S&P expects.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

WHAT ELSE WE’RE INTO

📺 WATCH: How to build self-confidence as an investor, a breakdown of the book The Magic of Thinking Big with Weronika Pycek

👂 LISTEN: Q4 Mastermind, with Stig Brodersen, Tobias Carlisle, and Hari Ramachandra

📖 READ: How Qatar spent $220 billion on the world cup, a Twitter thread

THE MAIN STORY: WHAT HAPPENS WHEN ETFS DIE?

Overview

Every year, some exchange-traded funds (ETFs) fail to attract enough assets under management (AUM) to operate profitably.

Because ETFs typically rely on a fixed percentage fee of their AUM to cover expenses, such as salaries for the investment managers who run the funds, if their fund can’t stay above a certain size, then it must close.

In a year when financial markets have broadly taken a beating and investors are fleeing more speculative strategies, this has left a particularly large “graveyard” of dead ETFs in 2022.

What exactly does this mean, though, and what are the ramifications?

We listened to a podcast with Katie Greifeld and Athanasios Psarofagis of Bloomberg to learn more.

Breaking it down

Athanasios explains that the ratio of new ETF launches to closures is approximately 2.5 in a normal year.

In the euphoria that consumed markets during much of 2020 and 2021, this ratio climbed to 7. Meaning that for every ETF that closed, seven new ones opened. Clearly, this wasn’t a sustainable trend.

While 2022’s ratio is still above average at 4, Athanasios emphasizes that the trend has reversed and is falling rapidly, raising concerns that a spike in fund closures will ripple across markets over the next year.

What to know

It’s not uncommon for this dynamic to switch in down years. In fact, it’s expected. But given the unprecedented number of new funds launched in 2021, which account for nearly one-third of the entire industry, the reversal is more significant.

These funds launched at all-time highs in the markets, and many have been down hugely since then. Poor past performance histories like that make it very difficult to attract new money to their strategies going forward.

What happens when an ETF closes?

This year alone, over a hundred ETFs have closed.

When ETFs call it quits, they sell their holdings and return the proceeds to investors who own shares in their fund.

As an investor in the fund, you’ll receive a notice about this plan, and a final trading date is set. After that point, the fund functionally no longer exists.

Because this last trading date becomes publicly known, as the fund’s managers seek to liquidate their portfolio, others may try to front-run them, especially if the underlying stocks are less liquid.

This means that if you hold your shares through the last trading day, the capital returned to you could come at a discount.

In other words, it’s probably better to sell your shares in the fund yourself in advance of this final trading day. At least, that’s what Todd Rosenbluth of VettaFi encourages people to do.

Until that last trading day, the fund’s shares will trade normally and track its benchmark index.

What to know

To clarify, this isn’t like a bank run where your investments in an ETF may be lost forever if you don’t sell in time. It’s primarily an inconvenience since it forces you to find a new use for the money you had allocated to that ETF while also generating potential taxes on your gains from the liquidation/sale of your shares.

In addition to this, as mentioned above, there’s a possibility that a forced liquidation of the fund would result in you receiving cents on the dollar for your shares.

This is less likely to happen for funds that track large benchmarks like, say, the S&P 500.

For niche strategies, though, which are the types of ETFs that usually go under, the risk is that there’s insufficient liquidity in the underlying stocks for the ETF to exit the market without having an outsized influence on those shares.

Takeaways

As investors, this requires us to be vigilant.

Firstly, we should generally be aware of our holdings in ETFs, with a closer eye on those more vulnerable to closing. These are typically funds with less than $50 million of assets under management.

(You can google the ETFs in your portfolio and visit their websites to see their AUM.)

And if one of your ETFs does inform you that they’re closing, especially if it operates an obscure strategy (like the Korean Pop fund we wrote about a few weeks back), you’ll want to sell those shares as soon as possible to avoid a liquidation discount.

Wrapping up

To learn more about ETFs, we have a full course created by our co-founder Stig Brodersen.

And you can listen to the full podcast on ETFs that have closed this year here.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.