Dud Year

30 December 2022

Hi, The Investor’s Podcast Network Community!

We need a breather 😅

At last, stocks have completed a rough year with a dud as the most challenging year in more than a decade ended with another red day.

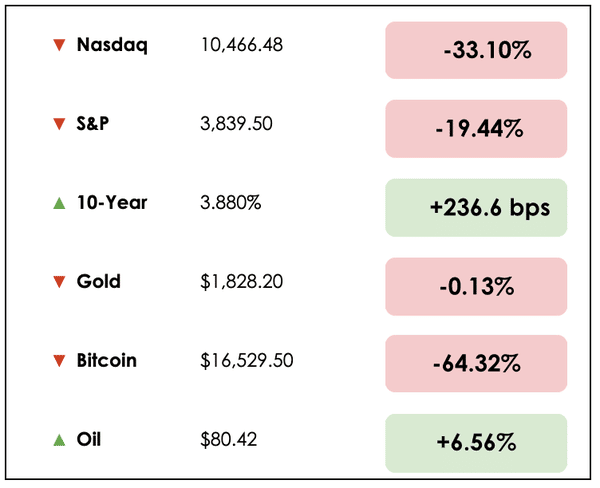

The S&P 500 closed 2022 down about 20% from its all-time high in January. The Nasdaq retreated 33.10% this year and risk assets like Bitcoin (64.32%) fell further.

The S&P posted just its third negative return since 2003 (2008, 2018, 2022).

What does 2023 have in store?

Here’s the rundown (YTD performance):

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Asia stocks close out a tough year and the potential return of “stealth” monetary easing, plus our main story on harnessing the power of regret to improve investment decisions.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

IN THE NEWS

👎 Asian Stocks Close Out Tough Year As Hang Seng Sees Worst Returns in a Decade (WSJ)

Explained:

- A strong dollar resulting from U.S. interest rates rising at a faster clip than most of the rest of the world added to equity markets’ pain broadly this year as growth slowed and investor enthusiasm faded.

- For some Asian stock benchmarks, specifically Hong Kong’s Hang Seng Index, which fell over 15% in its third consecutive year of declines, and South Korea’s Kospi Composite which tumbled 25%, 2022 marked the worst annual performance in over a decade.

- Other regional stock indexes fared poorly as well: the Shanghai Composite Index lost 15%, Japan’s Nikkei 225 dropped over 9%, while Australia’s S&P/ASX 200 saw more moderate losses at 5.5%. India’s Sensex broke the trend to actually close the year higher with 4.4% gains that capped its seventh straight positive year.

Why it matters:

- By the end of 2021, it was apparent that the U.S. stock market was comparatively overvalued, with many American companies commanding huge premiums relative to their peers. While 2022 was hardly a good year for U.S. or global equity markets, certain pockets proved they had less room to fall than U.S. counterparts.

- The S&P 500 closed the year down 19.44%. Comparatively, Japan, which has seen tepid stock returns for decades, seemingly didn’t have much more room to drop even with a near-collapse in the yen’s value. For Australia, its relative strength is largely attributable to higher commodity prices as a large exporter of natural resources. With its vibrant demographics and ample room to continue industrializing, India stands out as a bastion of strength.

- On the opposite end of the spectrum, Chinese stocks, whether listed domestically or in Hong Kong, faced tremendous struggles in a year of heightened uncertainty at home due to pervasive Covid lockdowns, sweeping tech regulations, and unprecedented protests against the government. At the same time, tensions with the U.S. military spiked in the region over Taiwan.

🤐 Is Quantitative Easing Returning by Stealth? (FT)

Explained:

- Financial Times journalist Michael Howell estimates that global investors lost $23 trillion of wealth in housing and financial assets in 2022 after policymakers triggered a “near-ten-trillion liquidity drop.”

- However, beneath the headlines, central banks are seemingly still trying to strategically employ monetary stimulus to reduce strains on markets, similar to the much-discussed quantitative easing (QE) programs of the last decade.

- For example, the federal government’s $450 billion Treasury General Account (TGA), a deposit account at the Federal Reserve, is likely to be spent down in the coming months ahead of upcoming debt ceiling negotiations.

- Additionally, the Fed’s $2.52 trillion reverse repo facility removing short-term liquidity has likely peaked. And although higher rates constrain money supply growth through less lending, higher interest payments on reserves held at the Fed by banks could amount to billions of dollars in 2023. Lastly, the dollar has potentially peaked, falling 9% from its high. If the dollar continues to fall, debt burdens globally denominated in dollars will ease.

Why it matters:

- “The cycle of global liquidity is bottoming out…because the financial sector has become so dependent on easy liquidity the very act of quantitative tightening creates systemic risk that demand more QE.”

- Howell continues, “The markets no longer serve as pure capital-raising mechanisms. Rather, they’re capital refinancing systems, largely dedicated to rolling over our staggering global debts of well over $300 trillion.” Hence, he focuses on the ebb and flow of liquidity.

- He explains that by selling its portfolio of Treasury bonds, thus undoing 2020 & 2021’s massive stimulus, while at the same time allowing liquidity to rise elsewhere (TGA spending, declining reverse repo, interest on bank reserves), the “Fed is trying to have its cake and eat it!” Consequently, this “stealth QE” may reduce the pain in markets next year.

WHAT ELSE WE’RE INTO

📺 WATCH: Learn from the billionaires (New Year’s Special) including insights from Bill Gates, Mark Cuban and Jeff Bezos

👂LISTEN: A value analysis of Warner Bros, Lithia Motors, and Meta, with Bill Nygren and Alex Fitch

📖 READ: Clean-energy funding remained strong in a weak market

A MESSAGE FROM SEEKING ALPHA

Seeking Alpha, one of our favorite platforms for finding stock picks and reading commentary from other investors, is having a New Year’s sale!

For just $39, you can get Seeking Alpha Premium access (normally $239).

With Seeking Alpha, you can take control of your financial future.

Use our link here for a special 83% discount.

Don’t miss this flash sale — time is running out!

THE MAIN STORY: THE POWER OF REGRET

Overview

How many investment or personal finance decisions in 2022 do you regret? Forget the “r” word, even: How many decisions do you wish you had handled differently?

As we reflect on our investments this year, it’s natural to feel some regret. It could be regret about not saving enough emergency cash, not diversifying effectively, or regret about taking on too much risk with stocks that have fallen sharply.

All of us have something we wish we had done differently or some action we wish we had taken or not taken. Even the best investors, including Warren Buffett and Charlie Munger, are candid about their investing regrets, mistakes, and errors over the years. Perhaps it’s this openness about their past that helps them to make better decisions in the future.

Regret is ingrained in the human condition, argues author Daniel Pink, whose bestseller, The Power of Regret: How Looking Backward Moves Us Forward, explores the role of regret in our lives and what we can do about it.

As we plan our 2023 investments, there are many insights we can derive from Pink’s work to make better, more informed investment decisions.

Plus, his framework may help you refine your New Year’s goals in all areas of your life.

Types of Regret

For more than two years, Pink has hosted the World Regret Survey, with participation from about 30,000 people from over 100 countries. He studied each response and boiled down all of that regret into four, simple categories.

- Foundation regrets: Regretting that you didn’t complete your MBA or that stock course, or passing on an invitation to attend the Berkshire Hathaway Annual Meeting. “If only I’d done the work.”

- Moral regrets: Insider trading, lying to your employees or shareholders, embezzlement, etc. “If only I’d done the right thing.”

- Boldness regrets: “If only I’d taken that chance and invested a little bit in Amazon 15 years ago.”

- Connection regrets: Pink says this is the most common. For example, not staying in touch with your college finance professor, or not replying to an old friend who asked for your thoughts on how to save for retirement during bear markets, for example.

Harness the power

Pink urges readers to replace self-judgment with compassion. “Being imperfect, making mistakes, and encountering life difficulties is part of the shared human experience,” Pink writes.

Pink also points out that we usually regret most of the investments we missed out on rather than those we tried but lost on.

Many people would regret missing out on a business that grew rapidly more than they would regret investing in a company with promising growth prospects stalled by management errors.

This is because you can often correct or fix past decisions (not always, of course), whereas failing to act at all could equal missed opportunity entirely. Pink argues that we can sometimes recover from an ill-timed or poor investment decision, but when we don’t attempt, we might never have the chance again.

To minimize potential bad outcomes, Pink encourages one to ask: Will this matter in five years? What will my future self think of this decision? Or, before making a decision, ask yourself: What would I advise my best friend to do?

Another strategy Pink advises lies in distancing yourself from the regret, using a third-person view. This aligns with the self-distancing mental model, a variation of zooming out: Distancing ourselves from our trifles lowers our blood pressure and improves clear thinking.

Investors also can anticipate regret by envisioning how they’ll feel if they don’t perform a particular action. Expecting how you’ll feel if you don’t make an investment is challenging, but it’s worth trying to see if it works in your investment process.

Action items

Pink offers a few intriguing views for embracing regret. For starters, he suggests sitting to jot down just one or two investment or financial decisions you wish you had made differently.

He recommends compiling a “failure resume” listing several investment decisions you regret most during your career. Be specific about when they happened, why, and what you learned from the experience. Pink says this is a robust framework for understanding your past and improving your clear decision-making skills.

Lastly, you can reframe the regret using an “at least” statement to anchor the positive. Perhaps you aren’t satisfied with your investment performance in 2022, but reframing it as “at least I learned several lessons, including how to perceive rate hikes and bear markets more clearly” can help.

Dive Deeper

Pink’s insights aren’t limited to just investing. Regret impacts all areas of our life, from health and family life to how we spend our free time.

You can buy Pink’s bestseller here.

Happy New Year!

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.