Dopamine Hit

Hi, The Investor’s Podcast Network Community!

(Want to listen to this newsletter? Checkout the link at the top.)

That was fast. Regional banks rallied Tuesday after Monday’s rout, a sign that regulators’ emergency measures to contain the Silicon Valley Bank crisis are calming investors 🙏

Stocks soared into the close as investors anticipated the Federal Reserve will shift its focus back to inflation.

Consumer prices rose 6% last month from a year earlier, Tuesday’s CPI report revealed. It’s the slowest annual pace since September 2021.

Here’s the rundown:

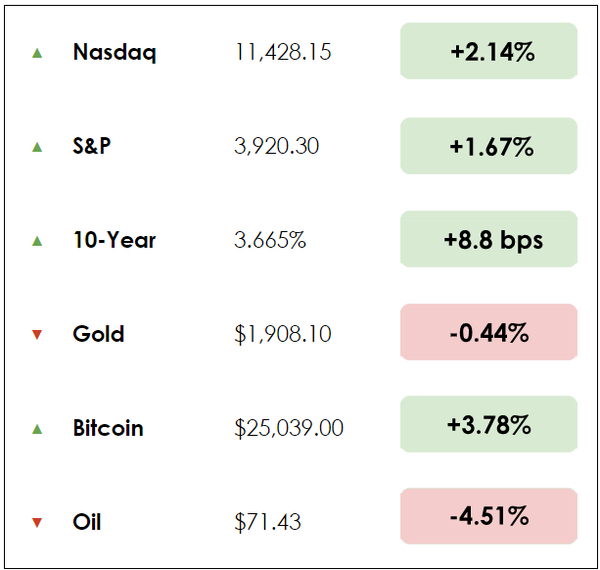

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Bank collapse = regulatory flaws

- Tuesday’s CPI report puts Fed in tough spot

- Plus, our main story on the power of dopamine

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Simple setup for new Bitcoiners ✅

Advanced features for Bitcoin veterans ✅

The Bitcoin wallet for your every need ✅

Blockstream Jade is the only hardware wallet designed for your whole Bitcoin journey. Visit store.blockstream.com and use coupon code: ‘Fundamentals’ to get 10% off your Blockstream Jade.

IN THE NEWS

💬 Bank Collapse Reveals Regulatory Flaws (FT)

Explained:

- Commercial banks were supposed to benefit from rising rates, but that assumed that they managed their balance sheets responsibly. The now-closed Silicon Valley Bank (SVB) did not. As a result, the California-based lender, known for its relationships with start-up companies, became the second-largest bank failure in U.S. history.

- While emergency actions from authorities over the weekend prevented the worst-case scenarios, systemic risks to markets and the economy remain. The Financial Times (FT) Editorial Board argues, “Widely-flagged vulnerabilities caused by fast-rising rates were allowed to boil over by both banks and their regulators. Lessons must be learnt.”

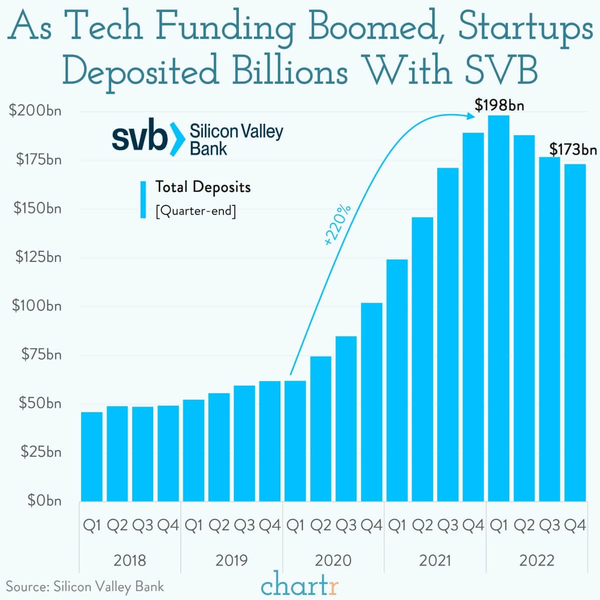

- Deposits soared at SVB as money poured into start-ups amidst the low-rate boom period during the pandemic, which the bank invested in mortgage bonds and Treasury bonds deemed ultra-safe.

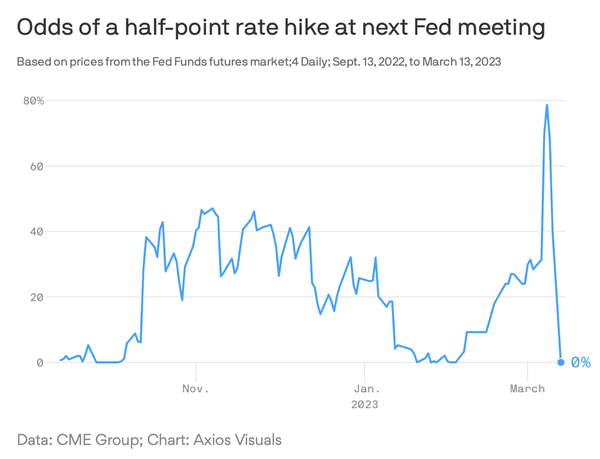

- Yet, the Fed’s campaign to raise interest rates by 4.5% in a year to tackle inflation crushed the value of these “risk-free” bond portfolios while funding for the venture capital space, where the bank sourced much of its deposits from, dried up.

Why it matters:

- To meet withdrawal requests, SVB had to sell its bond holdings at a loss, creating a hole in its balance sheet and sparking panic that other regional banks may face similar vulnerabilities. In the social media age, a single tweet can spawn a bank run.

- The FT argues that “authorities responded rapidly and extensively — but that they needed to is a reflection of monitoring failures, especially with regard to smaller banks.” Remarking further that “rising interest rates are no act of God. The root problem here, SVB’s defective risk management, is rightly in the spotlight.”

- Particularly concerning were “arbitrary regulatory thresholds based on total assets.” In other words, SVB was just small enough to avoid the stringent stress tests and liquidity requirements for the biggest U.S. banks, yet large enough to still cause considerable collateral damage. Based on a bank’s size, these regulatory thresholds and the fact that SVB fell below them, will remain a contentious point as we sift through the fallout.

Introduction

Dopamine-producing cells constitute only 0.0005% of the brain. Yet the molecule holds a passport to every nook and cranny of it.

Dopamine’s job is to maximize the resources available to us in the future – the pursuit of better things.

It’s why we seek more money, better investments, nicer homes, and new clothing.

By understanding dopamine, we can better understand ourselves, plus our spending, saving, and investing habits.

From dopamine’s point of view, “it’s not the having that matters. It’s getting something—anything—that’s new.”

The bestselling book The Molecule of More teaches us that having things is “uninteresting.”

“It’s only getting things that matter.”

The power of the brain

The key is that dopamine lies in the getting. We don’t necessarily want stuff or even new stuff. Rather, dopamine makes us want to engage in the process and anticipation of getting new stuff.

Which is why you might notice that the shine of a new item wears off quickly. Most of the joy and dopamine hit happens in the buildup to the purchase, not after it.

Dopamine also explains why someone with a functional car wants a nicer car, and why newly minted millionaires dream of then hitting eight figures, and so on.

The Molecule of More reveals how one brain chemical kindles our desires, fuels our creativity, and makes us fall in love.

Using the latest insights from psychology, neuroscience, and social studies to investigate the role of this powerful brain chemical in our thoughts and behavior, it explains what science can teach us about drug addiction, mental illness, political disagreements, saving, investing, and more.

The rush

In 1905, author William Dawson wrote in his book The Quest for The Simple Life that the hardest thing to understand about money is the thrill of the chase.

As Morgan Housel has noted, something you can easily afford brings less joy than something you must save and struggle for. “The man who can buy anything he covets values nothing that he buys,” Dawson wrote.

Think of the rush you get when you check your bank account and realize you have more money than you thought.

Or when you post a better-than-expected return on an investment. Or when you hear back from the job you didn’t think you’d get.

Those are all dopamine highs of unexpected, good news, which the brain loves.

Despite all our technology and advancement, evolution is slow. “We are stuck with our ancient brains,” the authors state. We seek dopamine and new adventure, just as humans have for thousands of years.

How to respond

Dopamine is a powerful force. In The Molecule of More, we also learn that happiness is essentially about events and expectations, with low expectations helping drive happiness.

For some: Happiness = events – expectations

One example is a painter or construction worker who works with their hands, taking abstract plans and making them real. They use their mind, flex creativity, and use their hands. They also might work with others and enjoy a high degree of camaraderie.

“Fixing things also boosts self-efficacy and increases one’s sense of control.”

Cooking, gardening, and playing sports are also proven activities that combine intellectual stimulation with physical activity to satisfy the brain. In a way, these activities help reduce the need for a traditional dopamine hit.

“These activities can be pursued for a lifetime without becoming stale.” The key is to enjoy the things we have before us, rather than the things in a possible future. Our brains must transition from future-oriented dopamine to present-oriented chemicals.

Dopamine motivates us to seek out new things, explore, and learn. Without it, humanity might not have innovated and evolved enough to survive to the present day. It’s released when we encounter the new and unexpected.

By intentionally building in opportunities for moments of awe, wonder, and surprise, we can satisfy our brain’s dopamine needs without breaking the bank. Examples include, but aren’t limited to:

- Mixing up your routine or commute

- Changing your work environment

- Traveling to new neighborhoods, towns, countries,

- Trying a new hobby, ideally with movement and camaraderie involved

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.