Don’t Fight The Fed

07 November 2022

Hi, The Investor’s Podcast Network Community!

📝 Do you like what we write? You could do it too — We’re hiring new writers to join our team. Apply here.

Chinese health officials doubled down on their strict Covid-19 policies over the weekend, while Apple (AAPL) warned that these same restrictions would impact its iPhone 14 production, meaning you might have to wait a few extra weeks for your new device📱

In other news, UBS launched the first “digital bond” that’ll straddle both blockchains and traditional exchanges.

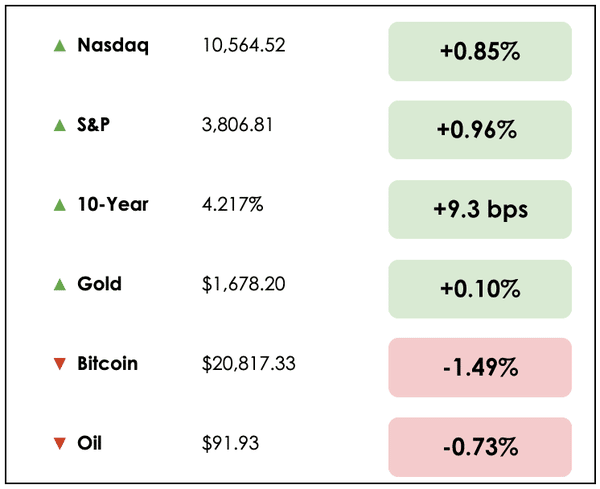

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss the upcoming elections in the U.S. and why travel spending is hurting retailers, plus our main story on how to know when the bear market in stocks is ending.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🗳️ How Mid-terms Could Affect the Stock Market (Reuters)

Explained:

- Investors will be watching U.S. midterm Congressional elections closely on Tuesday, and the outcomes will be widely felt.

- Polls show Republicans have picked up momentum and prediction markets see a split government — with the GOP winning the House of Representatives and possibly the Senate, which would likely hinder President Biden’s agenda.

Why it matters:

- A split government could also result in political gridlock that halts major policy changes, which comes as welcome news to markets that typically prefer stability. Stocks have historically done quite well during periods of political impasse.

- Partisan stand-offs over raising the federal deficit limit are more likely in a divided government as well, thus elevating concerns of a U.S. default.

✈️ Retailers’ New Holiday Headache — Travelers (CNBC)

Explained:

- Retailers have a new threat this holiday season as consumers are increasingly spending discretionary income on travel experiences.

- Retailers are already struggling with excess inventory, persistent inflation, and trying to woo back shoppers who, perhaps, went overboard with their online shopping during the pandemic.

- Mastercard (MA) CEO Michael Miebech said on an earnings call, “We saw notable strength in airline, lodging, and restaurant spending with a shift away from categories like home furnishings and appliances.”

Why it matters:

- Travel spending has skyrocketed due to pent-up demand from lockdowns during the pandemic and flexible office policies that are allowing more workers to work remotely.

- Airline ticket sales were up 56%, and lodging sales increased 38% compared to a year ago.

- Tim Quinlan, senior economist at Wells Fargo (WFC), expects this holiday season to be “the last hurrah” for consumers. He said, “People are spending more than they are making, and that’s sort of the definition of unsustainable. The consumer is on borrowed time.”

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

WHAT ELSE WE’RE INTO

📺 WATCH: Rich Dad Poor Dad (guide to financial freedom), a book review by Shawn O’Malley

👂 LISTEN: Macro and the energy market, with Lyn Alden on We Study Billionaires

📖 READ: How inflation and a “debt black hole” distort society, Jeff Booth’s Twitter thread

THE MAIN STORY: HOW POLICY TIGHTENING CAN BREAK INFLATION

Overview

As we continue along the “tightening cycle,” where central banks globally raise interest rates in response to inflation, it’s important to pause and reflect on where we are in this process.

So we continue to track research and commentary from the well-known hedge fund Bridgewater Associates. The firm’s Chief Investment Officer, Bob Prince, provides a nice update.

Let’s go through it.

To recap

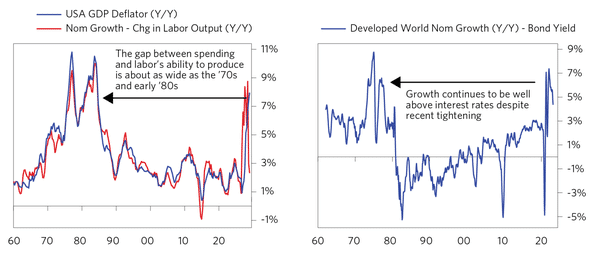

He explains that, throughout 2020 and 2021, large government spending programs backed by new debt (funded by the Federal Reserve) stimulated a level of spending that the labor force’s output capacity couldn’t support, which produced a “self-sustaining, monetary-induced inflation.”

In other words, more demand for goods and services than could be supplied, thanks to policies that grew the money supply and people’s incomes.

But now, central banks are undergoing the most severe and fastest tightening in 60 years.

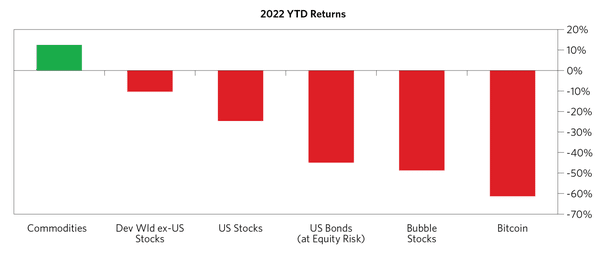

The most visible effect has been the selloff in financial markets as yields (inverse relationship with prices) must be driven higher to compete with the interest rates offered on lower-risk cash deposits and Treasuries.

Where we are now

Prince predicts that “the next stage of the tightening cycle is likely to be a significant slowing of economic activity.”

Whether a downturn sufficiently lowers inflation, though, depends on the magnitude and duration of this economic weakness, which will be determined by how the labor market holds up.

He explains that “inflation is too high because nominal spending growth is far greater than the ability of labor to produce more output.”

Meaning unemployment must rise to suffocate spending across the economy.

How tightening works

Reduced spending happens for a variety of reasons as interest rates rise.

Less debt-financed consumption happens quickest, as new mortgages and auto loans become too expensive. And we’ve already seen this, according to Prince, but spending declines must extend elsewhere to be meaningful.

And lower asset prices (i.e. a falling stock market) destroy wealth and minimize/delay spending. For example, retirees now have fewer assets to fund their lifestyle and may be pressured to slow their spending.

To rein inflation back towards 2%, though, spending declines in these areas will not be enough.

What has to happen

Prince argues, “The tightening will have to first produce a contraction in the number of people working and raise the unemployment rate by enough and for a long enough period of time to reverse the supply/demand imbalance…only after wage growth slows will inflation stabilize.”

But he warns that a significant economic downturn, an extended period of elevated inflation, and a second round of tightening (in case current efforts fail) are not priced into financial markets.

If any of these conditions prove true, there’ll be continued pain.

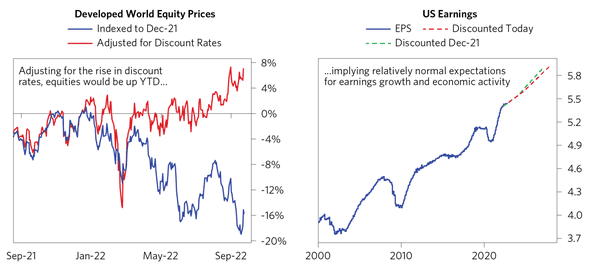

This is evident in the stock returns for 2022, where the fall this year is mostly attributable to rising interest rates rather than declining corporate earnings, as should be expected at this point in the tightening cycle. Yet, analysts’ earnings estimates have remained largely unchanged.

The problem

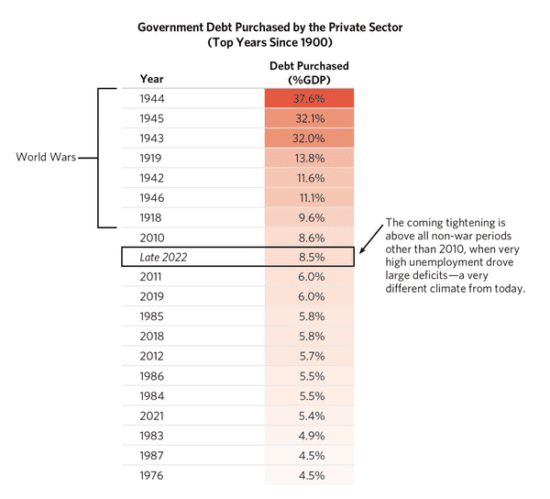

On top of this, with the Fed no longer helping to finance the government’s spending but instead actually offloading government bonds for the private sector to absorb, there’s a “liquidity hole.”

“The amount of government debt that will need to be absorbed by the private sector in the coming months is larger than at any time outside of world wars and the global financial crisis.”

With private investors now pressured to allocate their cash to bonds, this restricts the funds available to buy other assets like stocks, which Prince believes will fuel a weaker stock market for the foreseeable future.

Going forward, this dynamic is “getting worse, not better.”

Wrapping up

Prince’s assessment here is simple but logical and rooted in well-researched principles.

So long as the Fed continues tightening until inflation reaches its target of approximately 2% per year, spending will decline across the economy.

That will drive layoffs and push unemployment higher while companies’ earnings fall. This comes at the same time that institutional investors have less money to direct towards stocks since they’ll absorb a huge supply of Treasury bonds from the Fed.

The takeaway amounts to a bearish outlook for stocks going forward, at least according to Prince and Bridgewater.

The caveat is that inflation will likely weaken considerably when we see unemployment rise, which sets the stage for the Fed to reverse its tightening cycle. Once that happens, a clear path out of this bear market will emerge.

Until then, as the old Wall Street axiom goes, ‘don’t fight the Fed.’

Dive deeper

Let us know whether you agree with Prince’s outlook, and you can read his full article here.

To hear more about current market conditions, we recommend Trey Lockerbie’s interview with Richard Duncan.

RECOMMENDED READING:WEB3 DAILY

Web3 Daily is a (free) newsletter where you can find the most important and interesting Web3 and crypto news, written in a way that everyone can understand.

Get it straight to your inbox, Monday to Friday.

[ Sign Up Now ]

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.