Dollar Death Cross

11 January 2023

Hi, The Investor’s Podcast Network Community!

✈️ Despite the chaos at airports nationwide, with the FAA grounding all departures this morning due to a system outage, it was a calm day in markets as investors await tomorrow’s inflation report from December.

Notably, the dollar is on track to hit a “death cross,” where its 50-day moving average crosses below the 200-day moving average ☠️

The last time this happened was in July 2020, highlighting a major loss in momentum after the dollar’s monster year in 2022 relative to other currencies.

Here’s the rundown:

MARKETS

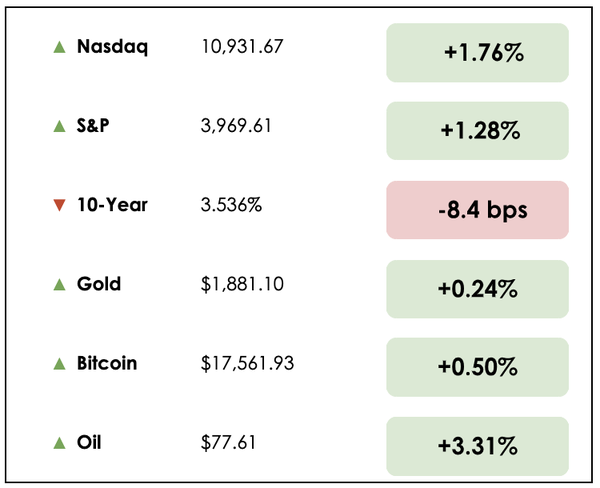

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Why solar panel manufacturing in the U.S. is booming, and an FTC probe into price discrimination by Coke and Pepsi, plus our main story on contrarian investor Dan Niles, a portfolio manager for the Satori Fund.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

☀️ U.S. Solar Manufacturing to get a $2.5 Billion Boost (WSJ)

- A South Korean Conglomerate, Hanwha Group, plans to spend $2.5 billion in building out an entire solar-manufacturing supply chain in Georgia, the largest solar investment yet spurred by major tax incentives introduced in the U.S. last year.

- New facilities in the Atlanta area would manufacture 3.3 gigawatts of solar panels a year, enough to supply around 18% of U.S. demand in 2022. And tax incentives, which have changed the economics of many renewable energy projects, could amount to $561 million in tax credits annually for this investment alone.

- The conglomerate’s Qcells unit is also considering other plants in the U.S., possibly in Texas, with one company official remarking, “This is just the beginning…The U.S. is one of the biggest markets for solar power in the world.”

- The facilities would manufacture nearly all the components that go into panels, including solar cells, ingots, and wafers, which had previously not been meaningfully produced in the U.S. The country is now on track to quadruple its manufacturing capacity from just two years ago.

- The plan is important in fostering renewable energy adoption and American energy security, as the U.S. hopes to be less dependent on foreign supply chains for energy infrastructure.

- Since signing legislation six months ago that offers generous tax credits and other incentives for the clean-energy industry, this latest announcement is yet another example of how the space is booming.

🔎 Pepsi and Coke Face Price Discrimination Probe (Politico)

- Beverage giants, Coca-Cola (COKE) and PepsiCo (PEP), are under preliminary investigation by the U.S. Federal Trade Commission (FTC) over possible price discrimination in the soft drink market.

- Antitrust laws prevent major brands from engaging in price discrimination against small businesses. The FTC is reaching out to large retailers, including Walmart (WMT), to acquire information about how they purchase and price soft drinks.

- Coca-Cola is the largest U.S. soda company with more than 46% market share, followed by Pepsi with a 26% share. The aim is to determine whether beverage suppliers are offering better prices to large retailers at the expense of their smaller competition.

- In undertaking these investigations, the FTC is reviving a “decades-old, but largely dormant law banning the practice” under an obscure law known as the Robinson-Patman Act. This marks the Biden Administration’s latest effort to rein in big companies and “flex its anti-trust muscles” outside of just the technology world.

- It’s thought that the FTC is using this investigation as a test case for more frequently implementing the Robinson-Patman Act once again. Critics of the regulation argue that enforcement would raise prices at the largest chains, ultimately harming consumers.

RECOMMENDED LISTENING: INVESTING MASTERMIND PODCAST

Michelle Marki and Signe Lonholdt started the Investing Mastermind Podcast to share their journey of investing like the best investors, Warren Buffett and Charlie Munger.

As Millennial individual investors, they seek to inspire and encourage people to become their own investors.

Listen to the Investing Mastermind Podcast on your favorite podcast app: Apple Podcasts or Spotify.

WHAT ELSE WE’RE INTO

📺 WATCH: The world ahead in 2023, five stories to keep an eye on

👂 LISTEN: The Q1 Bitcoin & macro mastermind discussion, on BTC Fundamentals

📖 READ: Studies of what works in investing and drives exceptional returns

Overview

When much of Wall Street stayed bullish into 2022, Dan Niles diverged from the crowd, signaling to investors a simple motto for the year: Don’t fight the Fed.

It’s one of the commandments in financial markets, but many investors and traders ignored or underestimated it in 2022.

Niles is the founder and senior portfolio manager for the Satori Fund, founded in 2004. He started his Wall Street career in 1990.

A year ago, he was coming off a successful 2021 in which he held positions in Alphabet, JP Morgan, and energy stocks. But he turned cautious before the Federal Reserve began raising interest rates in March 2022.

His favorite position in 2022: Cash.

As a new year begins, Niles just reiterated his view that cash in 3-month Treasury bills is his favorite area to be this year alongside healthcare and Japanese banks, among other bets on uranium and META.

Staying cautious

A Stanford-trained electrical engineer who once worked at the old minicomputer giant Digital Equipment, Niles has focused on tech stocks for 30 years, initially as a sell-side analyst at Robertson Stephens and Lehman Brothers.

He moved to the buy side in 2004 and now runs the Satori Fund, a tech-focused hedge fund. Many of his selections come with a relatively short time horizon of less than a year, though he has lately written a disclaimer to the effect of:

“For investors who don’t trade the market, we recommend higher cash levels until inflation, Fed tightening, and economic slowing run their course over the next one to two years.”

Niles forecasted a 20% dip in the S&P 500 last year, largely because he saw a hawkish Fed in store amid high inflation. He quoted Charlies Darwin when explaining his view on markets:

“It is not the most intellectual or strongest of the species that survives, but the species that is best able to adapt and adjust to the changing environment in which it finds itself.”

His work shows continued trouble for equities in the first half of 2023 due to a challenging earnings season, especially for technology companies because of consumer weakness and slashed budgets. He correspondingly expects the S&P 500 to hit 3,000

This isn’t investment advice, and it’s important to take anyone’s market views with a grain of salt. Niles explains that everyone’s investment style, time horizon, and objectives vary.

Sitting in T-bills

Niles says sitting on cash, particularly 3-month treasury bills earning about 4.3% per annum (vs. just 0.03% a year ago), offers investors a modest return.

A big reason for the caution: Niles expects initial guidance to be “horrible for 2023 when companies report poor Q4 results.”

Rather than guess when the stock market will bottom, Niles argues that a higher-than-normal cash position allows investors to “wait for the fundamentals to bottom and make calculated investments that maximize reward while minimizing risk.”

Healthcare

The Health Care Select Sector SPDR Fund (XLV) has typically performed well during downturns, and 2022 was no different: XLV dropped only 4% while the S&P 500 fell 19%.

When the S&P collapsed 37% in 2008, the healthcare sector dropped only 23%. And in 2001 and 2002, when the S&P fell 19%, healthcare gained 22%.

Of course, the sector already performed well in 2022, but it could still help minimize downside risks relative to other sectors. He’s specifically interested in companies focused on obesity, Alzheimer’s, and cancer, especially as the Baby Boomer generation ages.

Japanese bank stocks

As bond yields go higher, Japanese bank stocks could be more profitable.

In December, the Bank of Japan (BOJ) acknowledged rising inflation by loosening its yield curve control policies. Then they raised their inflation forecast to 2.9%, the highest annual rate since 1989.

“As a result of these changes, we believe rates will eventually rise, especially with the appointment of the next head of the BOJ in April.”

For decades, Japanese banks have contended with low yields on Japanese government bonds (JGBs). 10-year JGBs often yielded below 2% and occasionally strayed into negative-yield territory. But in December, the 2-year JGB yield turned positive for the first time since 2015.

In short, Niles believes Japanese banks should finally be able to make money in lending, and valuations fail to fully capture these shifting dynamics yet.

Dive Deeper

Niles is a compelling contrarian investor, and we enjoy reading his thoughts periodically, which you can find here.

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.