Disruptive Innovations

24 October 2022

Hi, The Investor’s Podcast Network Community!

💵 October is National Financial Planning Month.

🍾 Speaking of which, I (Patrick) am going to sit down this very evening and “celebrate” with my wife by pouring over our income and expenses and figuring out our new budget. Thankfully, many of the recent expenses from our wedding and honeymoon are non-recurring!

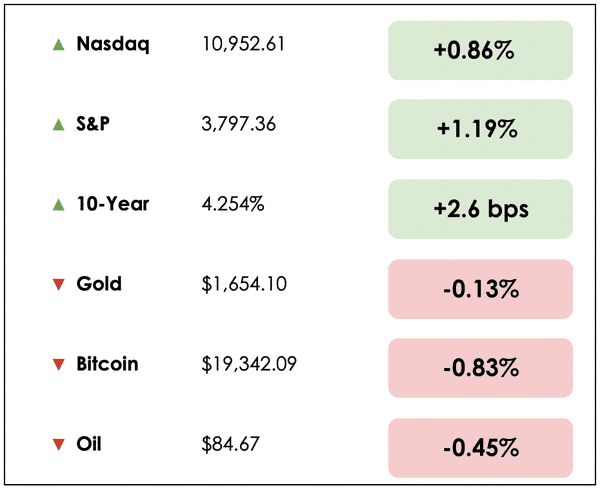

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: The bloodbath in Chinese stocks and Biden’s plan to refill America’s oil reserves, plus our main story on Cathie Wood and her thoughts on today’s macro environment.

All this, and more, in just 5 minutes.

Read on 📚

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🇨🇳 Chinese Stocks Get Crushed (WSJ)

Explained:

- U.S.-listed Chinese tech companies, such as Alibaba (BABA), Baidu (BIDU), and Pinduoduo (PDD) fell by double-digit percentages after China’s ruler, Xi Jinping, consolidated power over the weekend.

- Xi packed his leadership team with staunch loyalists after securing his 3rd term as President, which investors worry will embolden him to take harsher actions in regulating China’s tech industry and even reclaiming Taiwan sooner, with the head of the U.S. Navy warning it could happen by the end of this year.

- Diana Choyleva of Enodo Economics says, “Investors are now repositioning for a China where Xi Jinping rules supreme in an echo chamber of sycophants. For him, ideology and national security trump all other considerations, including growth.”

What to know:

- This comes as China appears to be cozying up next to Russia, as Reuters reported that China’s exports to the isolated country are up more than 20%, despite growth slowdowns elsewhere.

- Although overall export growth increased by just 5.7% year-over-year, Chinese goods shipments to Russia recently rose by 21.2% (in dollar terms), indicating that China is filling the void created by sanctions from Western countries.

- To add to this, annual imports from Russia to China increased by 55% since last year, driven in part by a 22% annual rise in oil imports.

😬 Biden Pitches Plan To Refill Oil Reserves, But Producers Are Skeptical (WSJ)

Explained:

- In light of the largest release ever from the U.S. emergency petroleum reserve in recent months, the Biden administration is signaling that it will undergo the multibillion-dollar process of refilling it while encouraging more robust domestic drilling activity.

- On Wednesday, Biden said that the Energy Department may refill the reserve if oil prices fall to between $67 and $72 a barrel, or less, by making use of fixed future price contracts that would foster the sort of price stability necessary for producers to willingly ramp up production.

What to know:

- Despite plans to potentially refill the Strategic Petroleum Reserve, the U.S. government will draw down an additional 15 million barrels of oil that will be delivered to the market in December. This marks a sale of over 180 million barrels this year from the reserve.

- Years of capital misallocation and targeting from the ESG movement have rendered shareholders in U.S. oil producers mostly unwilling to support boosting production, though, as investors push for dividends and share buybacks instead.

- And oil prices may still rise dramatically soon, with some expecting prices to return to $120, as experts point to OPEC production cuts, sanctions on Russian oil, and a possible rebound in demand from China as it reopens from Covid lockdowns. Releases from the petroleum reserve are then, at best, a temporary solution to oil shortages.

BROUGHT TO YOU BY

Are you worried about inflation? There are few better ways to beat inflation than real estate, but even real estate isn’t all sunshine and rainbows. Learn about the 7 Red Flags for Passive Real Estate Investing from PassiveInvesting.com.

WHAT ELSE WE’RE INTO

📺 Watch: Macro Investing with Cullen Roche, a We Study Billionaires interview

👂 Listen: Trey Lockerbie interviews Josh Wolfe on investing in futuristic tech

📖 Read: Two key portfolio diversification concepts, a 10-K Diver thread on Twitter

THE MAIN STORY: CATHIE WOOD AND ARK INVEST

Cathie Wood of Ark Invest is down but not out.

Ark has struggled to perform in today’s higher interest rate environment and has received significant criticism this year.

We sat down and listened to Trey Lockerbie’s recent interview with her here on We Study Billionaires. They discussed her fund’s performance and the opportunities and threats she sees in today’s investment landscape.

Backstory

For those unfamiliar with Cathy Wood, she is the founder,CEO, and CIO of Ark Invest and was named the best stock picker of 2020 by Bloomberg News. She was also mentored by economist Arthur Laffer, who gained prominence during the Reagan administration.

Ark was founded in 2014, and its strategy focuses on public companies that are the leaders in disruptive technologies. Some sectors they focus on include companies involved in the genomic revolution, fintech innovation, 3D printing, space exploration, and mobility-as-a-service.

Wood, who is a devout Christian, was reading the One-Year Bible and named the company after studying about the Ark of the Covenant.

The Numbers

Wood’s flagship fund, Ark Innovation ETF, has been battered recently and is down approximately 61% year-to-date. The fund is now underperforming the S&P 500 for the trailing five years. At one point, though, the fund was up over 300% from its bottom in 2020 to its peak in February of 2021. The ETF is currently trading around $35 a share, down from a high of $156.

Inflation and the Federal Reserve

In a rising interest rate environment, the present value of future cash flows will decrease, making speculative tech stocks with distant profits worth less. And rates have shot up this year, but Wood believes the inflation and interest rate concerns are way overblown. But she also didn’t anticipate inflation to last as long as it has and didn’t expect supply chain issues to last for nearly two years.

She commented that when Federal Reserve Chairman Paul Volcker was fighting 15 years of inflation in the early 80s, he raised the Fed funds rate two-fold from 10% to 20%. Chairman Powell, however, is battling just 15 months of inflation, yet he’s using the same sledgehammer of dramatically increasing interest rates. He has increased them 13-fold from .25% to 3.25% within six months, and Wood believes Powell’s policies will prove to be a big mistake.

Trouble Brewing?

According to Wood, an early indication of trouble is that the liability-driven investment schemes in the U.K. experienced a Lehman Brothers moment in the last few weeks, which required the Bank of England to step in and resolve the problem.

She foresees the same issues with the bond market potentially arising here in the U.S. and notes that credit default swaps in the strongest banks have been moving up toward Covid-level highs, which may be cause for real concern and indicate rising systemic risks.

Deflation Coming

Wood believes that the Fed’s policies will ultimately prove deflationary. She notes many commodities are down 30% to 80% in price and the Baltic Dry Index (BDI), a shipping freight-cost index, is down roughly 75%, thus indicating that supply chain issues are resolving.

Bitcoin as Insurance

Ark has been a proponent of Bitcoin since 2015, and Trey discussed how its narrative is continually changing. With inflation rising and Bitcoin down nearly 70% in the past year, it hasn’t fulfilled expectations as an inflation hedge.

Wood mentioned when they first started investing in the space, the main counternarrative alleged Bitcoin was a Ponzi scheme. So the changing rhetoric amongst serious investors, from labeling it as a fraudulent Ponzi to posing more nuanced criticisms around its viability as an inflation hedge, reflects its evolution as an asset class.

Ark remains convinced that Bitcoin is the first global private digital rules-based monetary system, and is the “biggest idea” in the crypto asset world. They still view it as an insurance policy against monetary debasement.

Not one to shy away from bold and controversial predictions, Wood believes Bitcoin will get to $1.3 million per coin by 2030 due to increased institutional demand, rising volumes in emerging markets, and from strong demand from high-net-worth individuals.

Dive Deeper

Trey touched on many more points in his interview with Cathie Wood. We’d encourage you to check out more of her thoughts on the macro environment, disruptive technologies, and American innovation here.

Readers — Let us know, what do you think of Ark’s strategies.

Would you consider buying shares of her fund at these depressed prices?

ONE MORE THING!

A newsletter we love: Katie Gatti, the author of the Money with Katie newsletter, is obsessed with personal finance—specifically, the loopholes, nuances, and big questions that traditional advice tends to lack.

Her weekly newsletter takes a spicy approach to spending habits, investing best practices, tax strategies, and more. Get simple and practical ways to live a rich life delivered straight to your inbox for free.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.