“Death Spiral”

29 November 2022

Hi, The Investor’s Podcast Network Community!

The World Cup is heating up, and we cheered on Team USA as they rolled past Iran 1-0 to advance to the next round, where they’ll play the Netherlands.

So long as the U.S. is still in the tournament, we presume it’s okay to call it “soccer”? ⚽

Jokes aside, Apple (AAPL) stock pulled down the market indexes after a prominent analyst projected that there would actually be 15-20 million fewer iPhone 14 Pros than expected, which tops the shortage of 6 million that we wrote about yesterday 😳

And Disney’s (DIS) CEO Bob Iger shot down rumors that the iconic company might be sold to Apple, calling them “pure speculation.”

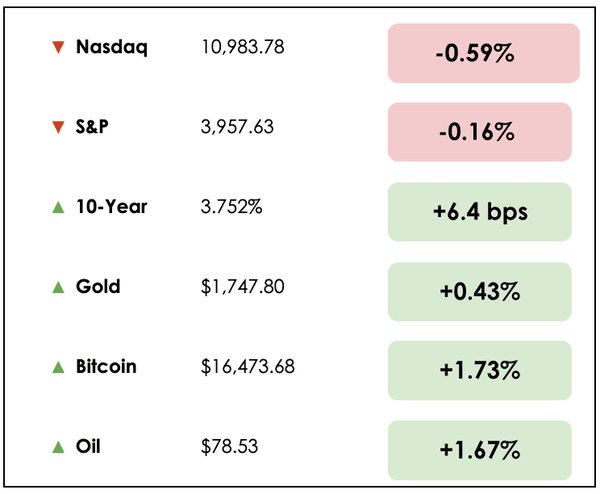

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: How the London Metals Exchange prevented a financial crisis, and the Chinese yuan’s increasing use in Russia, plus our main story on what really matters in investing.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

😱 Nickel Market Saved From $20 Billion “Death Spiral” (Bloomberg)

Explained:

- Earlier this year, in March, the London Metals Exchange (LME) made the unprecedented decision to cancel an entire day’s worth of trading to prevent “significant systemic risk to the wider financial system” as a huge short squeeze in nickel markets generated $20 billion worth of margin calls.

- Some market participants weren’t prepared to pay up billions of dollars at a moment’s notice when their bets dramatically surged against them, with nickel prices soaring 250% in just over 24 hours.

- We’re learning more after the LME provided its most detailed account of the event yesterday. At least two firms are seeking nearly $500 million in total damages due to the exchange’s decision to cancel trades they stood to profit from.

Why it matters:

- With speculators facing margin calls (demands to add more cash to their accounts) 10x higher than the previous record, up to a dozen clearing members (intermediary firms who help settle trades) stared down imminent default. Such an event could’ve caused a “death spiral” that forced the entire exchange to collapse.

- Although controversial, if we take the LME at their word, it appears they acted dramatically to stabilize markets thrown into chaos by Russia’s invasion of Ukraine.

- This event will surely be studied for years, with the hour-by-hour accounts reading like a gripping Hollywood movie.

👀 The Chinese Yuan Becomes The New Dollar In Russia (Reuters)

Explained:

- Russia’s economy is quickly undergoing “yuanisation” as the country seeks to deepen relations with China while limiting the U.S. dollar’s role.

- China’s currency, the yuan, had made gradual inroads into Russia, but Western sanctions have turned that transition into a sprint over the last nine months.

- Total transactions in the yuan-rouble pair on the Moscow Exchange jumped to an average of $1.25 billion worth per day last month. Previously, an entire week’s worth of transactions between those currencies would’ve been around $100 million worth.

Why it matters:

- China’s share of Russian foreign exchange markets has risen from just 1% to 45% this year. The managing director of one Moscow-based investment firm explains “that it became suddenly very risky and expensive to keep traditional currencies — dollar, euro, British pounds.”

- Since April, Russia has become the fourth largest user of the yuan outside mainland China, as captured by inbound and outbound financial flows, lagging only Hong Kong, Britain, and Singapore.

- And seven Russian corporate giants have recently raised a total of 42 billion yuan in bonds. For Chinese businesses, particularly its financial industry, the Russia-Ukraine war has presented opportunities to establish new ties with the Russian economy.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

THE MAIN STORY: WHAT REALLY MATTERS IN INVESTING?

Overview

In legendary investor Howard Marks’ most recent memo for Oaktree Capital Management, he seeks to answer the question: “What really matters or should matter for investors?”

He begins by addressing the questions frequently thrown at him, which are often macroeconomic in nature, such as how bad will inflation get?

How much will the Fed raise rates?

Will rising rates cause a recession?

Futile efforts

He provides a short series of logical responses.

Firstly, most investors can’t do a superior job of predicting these short-term phenomena. Therefore, they shouldn’t weigh their own or others’ opinions on these matters too heavily.

And even if they do predict these changes correctly, they’re unlikely to make major adjustments in response anyways. If they do make adjustments, it’s uncertain whether their response will be correct.

Thus, these macro predictions just don’t matter that much.

Financial models

He rails further against forecasting generally since “most forecasts are extrapolations, and most of the time things don’t change, so extrapolations are usually correct but not particularly profitable.”

It’s challenging, then, to profit from a short-term focus because “it’s very difficult to know which expectations regarding events are already incorporated in security prices.”

How pricing works

Marks explains that “security prices are determined by events and how investors react to those events, which is largely a function of how the events stack up against investors’ expectations.”

Take, for example, a company that reports growing earnings only to see its stock price fall the next day.

Evidently, a positive event (higher earnings) doesn’t always correlate with higher stock returns because what matters are the expectations already baked into that stock’s price.

If investors expected earnings to grow by a greater margin, then the report fell below expectations.

This constant re-pricing of assets against investor expectations drives fluctuations that wildly exceed the real fluctuations in economic output or company profits.

Gambler’s mindset

Marks credits this volatility to swings in investor psychology. Put differently, investors’ moods alter their expectations enough to produce unintelligible ups and downs in market prices.

The flaw here, argues Marks, is that most people buy stocks with the hopes of flipping them at a higher price instead of owning them over time.

He likens this mentality to disregarding your sports team’s chances of winning the championship to, instead, bet on what’s going to happen in the next play, period, or inning.

So what does matter?

Marks tells us that what truly matters is your investment performance over the next five or ten years (or longer) and how that value compares to your initial investments and financial needs.

Instead of obsessing over short-term questions and macro trends, he believes that investors would be better off garnering superior insights into fundamentals over a multi-year horizon.

He provides a few recommendations for doing this:

- Study companies to assess their earnings potential

- Buy stocks available at attractive prices relative to this potential

- Hold onto them as long as the company’s earnings outlook and price attractiveness remain intact

- Lastly, only make changes when these points become uncertain or an even better opportunity presents itself.

Takeaways

Of course, it’s easy to lay out an investor’s purpose. Executing on these aims is the challenging part.

However, we know that “average decision-making is reflected in security prices and produces average performance. Superior results have to be based on superior insights.”

You have to think differently than the crowd and be right to invest exceptionally well.

And as a passive or active investor, Marks encourages us not to forget that our primary goal is to participate in the secular growth of economies and companies while benefiting from the magic of compounding.

Go deeper

Marks is an excellent and principled thinker who provides deep insights into value investing and financial markets.

To learn more about him and his career, check out Clay Finck’s podcast about him on We Study Billionaires.

RECOMMENDED READING: CHART STORM

Keeping up with the market can be difficult with so much information coming from so many different areas.

There’s a way, however, to get concise, insightful, and professional analysis delivered straight to your inbox to prepare you for the week ahead (and beyond).

The Weekly S&P 500 #ChartStorm brings you 10 hand-picked charts covering: Macro, technicals, valuations, and more — It’s a good and easy way to stay on top of the market outlook.

Click here to sign up (for free, always) today.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.