Crypto Carpet Bombing

14 February 2023

Hi, The Investor’s Podcast Network Community!

Happy Valentine’s Day, folks ❤️

January inflation data is out, and investors have mixed feelings about it. More on those numbers below ⬇️

By the way, do you prefer to watch and listen to the biggest stories in markets? Our YouTube channel, hosted by the wonderful Weronika Pycek, publishes weekly videos rounding up the news, diving deeper into the stories you read here.

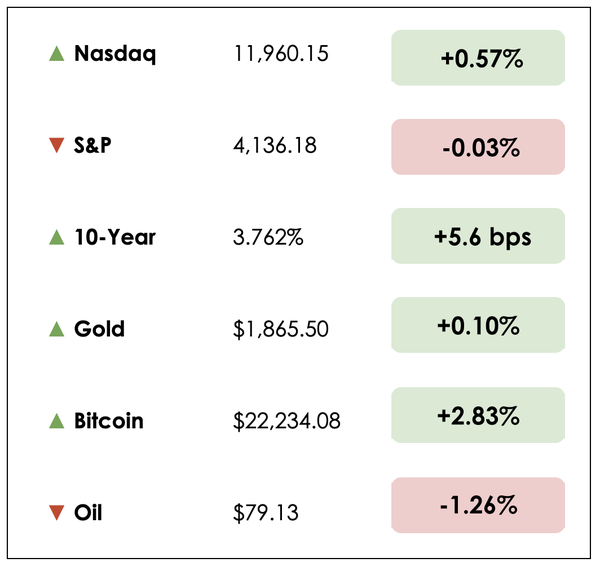

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- The latest inflation numbers and what they mean

- More crypto crackdowns?

- Plus, our main story on the business of Valentine’s Day

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Get the data and visuals you need to understand today’s world and take your office small talk to the next level.

Join 300,000+ data-driven professionals who love the #1 visual newsletter from our friends at Chartr, filled with snackable charts on business, tech, entertainment, and society.

IN THE NEWS

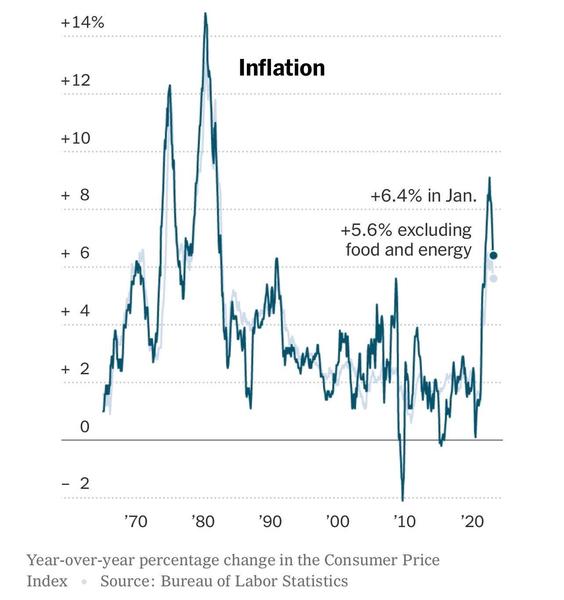

🏷️ U.S. Inflation Remains Elevated (Bloomberg)

Explained:

- Inflation, as measured by changes in the Consumer Price Index (CPI), remains a persistent problem in 2023, with the overall CPI rising 0.5% in January. That’s the most in three months, boosted largely by increases in energy and shelter costs (owning or renting a home, hotels, etc.).

- The latest report shows a 6.4% year-over-year change in consumer prices. When paired with January’s blowout jobs report, it highlights a resilient consumer and durable economy despite aggressive Fed policy. Still, headline inflation figures have fallen for seven months after reaching 9.1% last summer, the highest since 1981.

- Increases in shelter costs were “by far” the largest contributor to the monthly advance, accounting for nearly half of the rise. This comes, in part, from new changes to how CPI is calculated implemented in January, which gave a higher weight to shelter components. Adjustments to CPI calculations are made periodically to more accurately capture Americans’ spending habits.

Why it matters:

- We say this every month, but these inflation reports are important to markets and their expectations for future rate hikes. And this one was particularly noteworthy given the changes in calculation methodology.

- The broad-based nature of the price increases is particularly concerning, with gas prices jumping 2.4%, apparel costs rising 0.8%, and groceries increasing 0.5%, showing that many swathes of the economy are caught up in inflation’s grip.

- After the report, traders expected rates to reach as high as 5.2% by August before falling to 5% later in the year, presumably from rate cuts in response to a recession. Should the economy remain firm or inflation stay elevated, though, investors might be in for a rude awakening with the Fed keeping interest rates higher for longer.

- That would certainly weigh on stock prices given that much of this year’s rally is seemingly from optimism that we’re nearing a “pivot” point where the Fed will return to easing financial conditions similar to 2021.

🧑⚖️ Crypto Braces For More Crackdowns (WSJ)

Explained:

- The walls are closing in on crypto as regulators take dramatic action against the industry’s biggest players. On Monday, New York regulators shut down the issuance of the world’s third-largest stablecoin from the crypto exchange Binance. At the same time, banking regulators are quietly directing banks to sever ties with crypto-related companies, hoping to limit their ability to plug into the broader financial system.

- This comes a few days after a crackdown on another prominent exchange, Kraken, for its popular “crypto-yield” product that regulators see as an unregistered security.

- The Securities and Exchange Commission (SEC) is seemingly looking to stop companies from offering these “staking” services, where customers deposit cryptocurrencies in exchange for promised interest rate-like yield. SEC Chair Gensler said as much: “This really should put everyone on notice in this marketplace.”

Why it matters:

- After years of stagnant investigations and debate, the FTX collapse has spurred regulators to action. Now, some are warning that the risk is that the response may be too heavy-handed. The CEO of Blockchain Association remarked, “It certainly feels, from an industry perspective, like there’s a crypto carpet bombing going on.”

- Some are complaining that the SEC is taking “opportunistic and uneven actions designed to try to bring major industry players and platforms within (its) jurisdiction” by suddenly throwing the traditional rulebook at these companies rather than crafting a unique regulatory regime for the emerging space.

- Regardless, crypto firms aren’t going down without a fight: Coinbase’s CEO pledged to take on the SEC directly over its yield products, tweeting, “We will happily defend this in court if needed.”

Introduction

Two days after the frenzy of the Super Bowl, Valentine’s Day is the latest holiday that has become big business. It’s the fifth-largest spending event in the U.S., after the winter holidays and Mother’s Day, according to the National Retail Federation (NRF).

In 2023, a little more than half of Americans polled said they planned to celebrate the romantic holiday. They planned to spend in record amounts.

The National Retail Federation estimates that total spending for Valentine’s Day in 2023 will be $25.9 billion, up from $23.9 billion in 2022.

Spending on Valentine’s Day has increased by about 30% since 2009, according to the NRF.

Here’s a look at the big business of Valentine’s Day.

Big spending

Consumers will spend an average of $192.80 on the holiday. The top five gifts that consumers plan on giving their partners this year:

- Candy

- Greeting cards

- Flowers

- A night dining out

- Jewelry

For Valentine’s Day, Americans go big. In 2023, they’re expected to spend $2.3 billion on flowers and floral arrangements alone.

Spending on candy is expected to be around $1.8 billion, with Hershey’s (ticker) anticipating a nice payday. Hershey’s has said Valentine’s Day ranks as the company’s fourth-biggest season behind Halloween, Easter, and Christmas. (Brands such as Reese’s, Twizzlers, and Kit Kat also benefit from Valentine’s Day.)

Clothing and lingerie companies also can bring in earnings for the Valentine’s season. Victoria’s Secret (ticker) stands as the biggest lingerie retailer.

Adore Me, a New York-based lingerie business, has grown rapidly since 2012. Sales volume picks up about five times around Valentine’s Day, sometimes more.

This pales in comparison to jewelry, with total expected spending at about $6.2 billion. The National Retail Federation says 21% of people plan to give their partner some sort of jewelry for Valentine’s Day in 2023.

Economic boost

More than 10% of spending, or about $2 billion, will go toward flowers. And this one day represents 13% of the annual flower sales.

Of course, you don’t have to spend much to simply give someone a Hallmark card. The first Valentine’s Day postcards were sold in 1910, with the first greeting cards hitting shelves in 1916.

Total expected spending on greeting cards: $933 million. Per the Greeting Card Association, about 1 billion Valentine’s Day cards are sent each year, making Valentine’s Day the second largest card-sending holiday of the year (2.6 billion cards are sent during Christmas).

Consider that consumer spending drives nearly 70% of the country’s total output. It’s the largest component of GDP.

Valentine’s Day spending helps many large and small businesses. We can thank nifty marketing and advertising for a large chunk of the growth in recent decades. And given Americans place a lot of value on consumerism and gifts, Valentine’s Day sales have continued to soar.

It wasn’t always designed that way.

History of celebrated love

The 8th-century Gelasian Sacramentary recorded the celebration of the Feast of Saint Valentine on February 14.

The day became associated with romantic love in the 14th and 15th centuries when notions of courtly love flourished, apparently by association with the “lovebirds” of early spring.

The details of the holiday’s origin remain a mystery. What we know is that February has long been celebrated as a month of romance, and St. Valentine’s Day contains vestiges of Christian and ancient Roman tradition. It originated as a Christian feast day honoring a martyr named Valentine.

Over the years, the week leading up to Valentine’s Day has essentially turned into a significant line item for many businesses.

Not just for couples

Surveys indicate it’s not just about romance. People will show love for:

- Family members (59.4%)

- Friends (21.7%)

- Teachers (20.4%)

- Colleagues (12.1%)

Nearly 20% will also show extra appreciation for their pets. And then there’s a contingent of people who simply use the day to practice self-love and kindness.

Dive deeper

We know A.I. is pretty smart, but is it emotionally intelligent yet? The New York Times asked ChatGPT to capture the most human of emotions: love.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.