Corporate Drama

Hi, The Investor’s Podcast Network Community!

Score one for team recession: The Institute for Supply Management’s (ISM) manufacturing index was 47.7 in February, marking a fourth-consecutive monthly decline in factory output (any reading below 50 is contractionary) 🏗️

More important, though, are the ISM findings for the services sector coming out Friday since services comprise a larger chunk of the U.S. economy.

🍽️ If restaurant stocks are any indication of how the services sector is holding up, then the report might be quite strong. Year-to-date: Wingstop is up 24%, 18% for Cheesecake Factory, 19% for Brinker International (the owner of Chili’s), and Texas Roadhouse is up 12%.

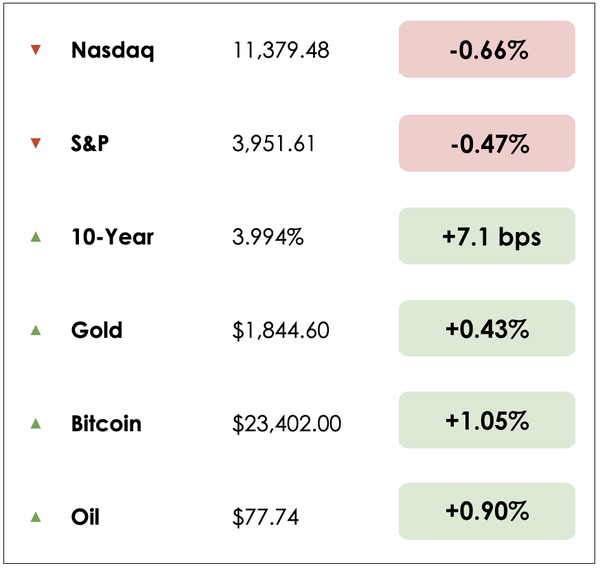

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- The financial challenges facing young adults

- High-stakes drama at Salesforce

- Plus, our main story on the surprising history behind Monopoly (the game)

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

Real estate investing, made simple.

17% historical returns*

Minimums as low as $5k.

EquityMultiple helps investors easily diversify beyond stocks and bonds, and build wealth through streamlined CRE investing.

*Past performance doesn’t guarantee future results. Visit equitymultiple.com for full disclosures

IN THE NEWS

👨👩👦 Living with Mom & Dad (NYT)

Explained:

- High costs of living, student debt, and family obligations or traditions are keeping young Americans living at home for longer than expected.

- Half of Americans ages 18 to 29 were living with their parents last summer, according to Pew Research Center analysis using Census Bureau data. Many young people say living at home helps them get closer to reaching their financial goals, and many aren’t leaving until they feel stable in their career or get married.

- Said one 23-year-old: “It is not what I want, but I am putting up with it because it is helping me put a big dent in my loans.”

Why it matters:

- As we wrote about Monday, rent prices are falling but remain high. One way in which some people are combatting the high rents is by not renting at all.

- Young Americans say living at home takes a toll on dating and social life, and not all parents would welcome back children, especially without helping pay bills. But saving money that would otherwise be spent on rent and other expenses is helpful. Others say living at home allows them to contribute more to their 401(k) plans, build emergency savings, pay off debt, and save for a home or car.

- This trend has accelerated because of the pandemic and the ensuing surge in inflation. That many workers can work remotely also has driven up the number of young Americans moving back home. Further, high rents in 2021 and 2022 left many with few options.

- Added another young woman: “We stay home until we’re stable enough to move out, and usually it’s until you’re married or until you have a career where you can provide for yourself completely.”

🤧 Drama at Salesforce (WSJ)

Explained:

- Salesforce (CRM) faces many challenges, including a rapidly falling stock price (down 20% in the last year) and drama around management decisions. It got a boost today, though, reporting earnings that beat on both the top and bottom lines while giving optimistic forward guidance that pushed its stock up more than 14% after hours.

- The company paid Matthew McConaughey, a friend of CEO Marc Benioff, over $10 million a year to be a creative advertiser and spokesman, including in a $5 million Super Bowl ad.

- Salesforce, the largest employer in San Francisco, was once awash in perks, including specialty-coffee baristas at its headquarters and use of a 75-acre wellness retreat. Those have been drastically scaled back, drawing complaints from the 22,000 employees who’ve joined an internal Slack channel called “airing of grievances.”

Why it matters:

- Benioff added about 30,000 employees from the start of 2020 until the end of last year, a roughly 60% increase. But Salesforce over-hired during the pandemic stock bubble like many other growth companies and has already laid off 10% of the workforce, or 8,000 people.

- “Layoffs are always hard,” Benioff said. “You can continue to keep a company going with excess employees, but it’s not healthy for the company,” he said. “If you don’t have a performance culture, and you don’t operate the company with that kind of efficacy, you’re not doing anybody any favors.”

- The tech industry last year was estimated to have laid off more than 150,000 employees, according to Layoffs.fyi, a website tracking news reports and company announcements. We also covered tech layoffs on Monday.

WHAT ELSE WE’RE INTO

📺 WATCH: Morgan Housel on the most important thing for investors.

👂 LISTEN: Top stock picks for 2023.

📖 READ: The ten worst-paying college majors.

A beloved game

For almost a century, no game has more iconically represented Americana than the best-selling board game Monopoly.

Monopoly has remarkable staying power, cementing its spot in American households since before the Great Depression. It serves as a reminder of America’s love for business, entrepreneurship, and promises of rags to riches.

There’s arguably no better way for parents to teach children the basics of money, life, and capitalism’s competitive nature than indulging in this great American pastime.

You may be surprised to learn Monopoly’s real origins and purpose.

“All a lie”

For years, Monopoly’s origin story was written at the top of the game’s rulebook, claiming that the unemployed Charles Darrow designed the game to pass the time, bringing it to the game company Parker Brothers in 1934, hoping to make a little money.

Mary Pilon, author of The Monopolists: Obsession, Fury, and the Scandal Behind the World’s Favorite Board Game, decided to verify the game’s origins, but “things weren’t adding up, there were inconsistencies in dates, and I felt like an idiot.”

She soon discovered that the story is “all a lie.”

The true story starts in 1879 with 13-year-old Lizzie Magie in a small town in Illinois. Curled up by a fire, she reads a book from her father called “Progress And Poverty,” by Henry George.

In it, George offered a sharp critique of capitalism to an America undergoing fundamental change and near-miraculous wealth creation following the end of the Civil War.

He wrote, “So long as all the increased wealth which modern progress brings goes to build up great fortunes, to increase luxury and make sharper the contrast between the house of have and the house of want, progress isn’t real and cannot be permanent.”

Planting the seeds of ideology

George was a folk hero at the time, gaining fame for his damning analysis of the extreme concentrations in wealth and businesses’ monopoly power during the era.

Lizzie’s father, a staunch progressive who at one point traveled alongside Abraham Lincoln, was a firm proponent of George’s ideas. This instilled in Lizzie that land ownership was deeply connected with wealth. Landowners, especially then, could disproportionately extract profits from those who wished to work or live on their property.

Lizzie went on to befriend Henry George’s son, bonding with him over his father’s popular idea called “single-tax theory.” The premise was that most taxes stifle productive behavior.

But a tax on land ownership to solely fund the government might reduce inequality with the fewest side effects.

The message resonated with intellectuals and everyday Americans; of course, the government was much smaller back then.

Building a game

To spread the word about George’s ideas, Lizzie Magie turned to an emerging fad: board games.

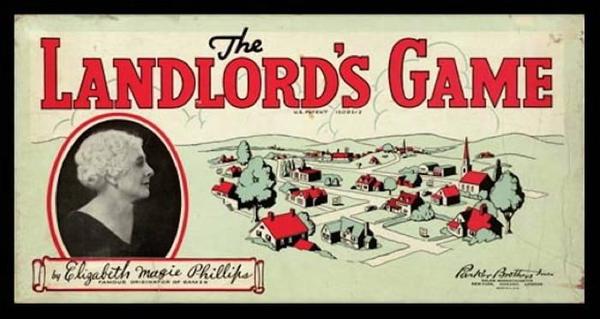

With the single-tax theory in mind, she invented the first iteration of modern Monopoly, what she called “The Landlord’s Game.” For her, it was a teaching tool showing regular folks that the quickest way to accumulate wealth and power was to acquire land in the best localities and simply hold onto it.

She hoped that people would see for themselves the similarities between the game and real life, realizing the injustices often created by unregulated economies.

In 1904, she patented The Landlord’s Game, and it’s strikingly similar to today’s Monopoly. But there’s one big difference, the original version had two sets of rules: The monopolist’s rules and the anti-monopolist’s rules.

The monopolist version, the one we know well today, rewarded players for crushing their competition, whereas the anti-monopolist version rewarded every player when wealth was created.

Overnight success

The game spread widely. But, Lizzie never tried to profit from the game, allowing people across the country to make their own adjustments to the board and figurines.

Enter Charles Darrow, the man best known for “inventing” Monopoly. As we know, that honor belongs to Lizzie Magie, but Darrow is the one who discovered the game at a dinner party and worked to turn it into a mass-manufactured household game.

He formalized the rules, redesigned the board, and enlisted a cartoonist friend to assist with the illustrations. He pitched it to Parker Brothers, citing himself as the sole inventor.

The game became a national sensation, appealing to Americans’ love of bargains and business dealing. Darrow created a fairytale story about designing Monopoly in his basement after a eureka moment that inspired him to create a game to help him provide for his family.

In exchange for $500 (about $10,000 today), Lizzie agreed to give up her patent for the game and, with it, Monopoly’s real origin story. The decision wasn’t just for the money.

What she cared about was that her ideas, and those of Henry George, would permeate the collective consciousness at a scale she could’ve never dreamed of.

Takeaways

Monopoly remains an enduring artifact of American history and values, despite the reality that its backstory is hardly known.

The powerful lore surrounding the game carries memories of enduring inequities and some of the ugliest parts of our history while embodying the promise of American life, where anyone with just a little cash can rise from rags to riches.

It’s a story and game that people worldwide continue to embrace.

Dive Deeper

To learn more about the origins of Monopoly, check out this podcast from NPR.

RECOMMENDED READING

Tobias Carlisle is a regular contributor to our Mastermind Groups at The Investors Podcast. He’s also an author, financial commentator, and owner of The Acquirer’s Multiple website (TAM).

TAM provides a range of screening tools that investors can use to analyze stocks using the Acquirer’s Multiple.

Tobias also provides a great weekly newsletter that includes value investing news, superinvestor updates, stock analysis, investing podcasts, and latest research.

Check it out!

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.