Confessions

26 August 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

The big day investors had been looking forward to this week finally came. Jerome Powell took the hot seat at Jackson Hole. More on that below.

The Dow tumbled 1,000 points, and the S&P 500 fell 3.4% after the Fed chairman said the central bank will continue to raise rates and hold them at a higher level until they are confident inflation is under control.

Good news for investors in Chinese companies listed on American stock exchanges…After a ten-year battle, the U.S. and China reached an agreement that will allow U.S. accounting regulators to inspect Chinese company audits.

We also wanted to thank our readers who took the time to write in and share their favorite summer dishes. Feel free to send in your favorite recipes, too.

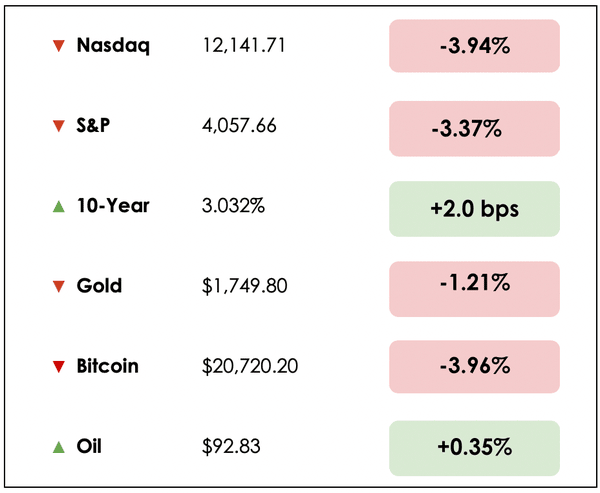

Here’s the market rundown for today:

*All prices as of today’s market close at 4pm EST

Today, we’ll discuss Powell’s Jackson Hole speech, pain in the grain markets, state governments raking in the cash, and Confessions from The Psychology of Money

Lastly, after you read today’s newsletter, please take a moment to fill out our reader survey — this helps us better create content for you.

All this, and more, in just 5 minutes to read.

Let’s go! ⬇️

IN THE NEWS

💬 Powell Delivers Hawkish Speech On Fighting Inflation (FT)

Explained:

- As expected, Fed Chair Jerome Powell delivered a speech narrowly focused on one thing: bringing down inflation before it spirals out of control. This happens through the distortion of our collective long-term inflation expectations which Powell is desperately hoping to prevent from happening.

- While shocks, like covid-19 or a Russian invasion of Ukraine, can spur inflationary imbalances over shorter time periods, over decades inflation is largely believed to be shaped by expectations. For example, if you expect prices for your normal daily basket of goods to rise by an average of 5% annually, you’re likely to, at minimum, demand a 5% pay raise correspondingly.

- This can create what’s known as a wage-price spiral though, whereas wages rise, so does nominal spending, which further drives prices up, and then compels workers to demand higher pay and so on leading to a total unraveling of price stability.

What to know:

- For Powell, the need for action is necessary and desperately clear. He was unequivocal in highlighting his determination to fully bring down inflation to the Fed’s 2% goal, but to do so will likely require sustained pain for millions of people.

- To slow the economy, higher interest rates must dissuade individuals and businesses from further spending and investments that drive economic activity, and correspondingly, drive inflation higher.

- In other words, the Fed must enforce a decline in economic growth and possibly invoke a recession, so as to cool spending in the economy enough that the rate of price increases can slow and match supply. For many, this may also mean layoffs and rising unemployment as the economy is pushed toward contraction.

🌽 Midwest Drought Adds To Pain In Grain Markets (WSJ)

Explained:

- In the Corn Belt, the worst drought in a decade is magnifying challenges for farmers already struggling with surging input costs. A broad survey of corn and soybeans across the Midwest this week revealed significant crop damage with double-digit percentage cuts to expected yields in some places.

- With food supplies at risk, the surveys helped fuel a rally in grain prices in futures trading. On top of droughts, a string of hailstorms across Nebraska wreaked havoc for farmers in June.

What to know:

- World grain supplies are desperately tight in light of Russia’s invasion of Ukraine (one of the world’s largest grain producers) on top of poor weather across South America, Europe, and China.

- Year-over-year in July, food prices rose 11% in the U.S., while energy prices rose 33% in the same time frame. Higher energy costs add further strains on farmers hoping to churn a modest profit from their labor. We recently covered the global food and energy crisis, which you can read about here.

🤑 State Governments Rake In The Cash (Economist)

Explained:

- According to Pew Charitable Trusts, state government saved a whopping $217.1 billion in 2021 which exceeds the previous record by over $100 billion. This comes after large injections from the Federal government during the pandemic that spared states from draining down their savings, while tax revenues soared with stimulus checks, tax credits, and unemployment benefits powering a tidal wave of consumer spending.

- Higher inflation has also boosted the prices of goods, thus resulting in higher sales tax collections, and higher wages, which means more revenue from state income taxes.

What to know:

- On average, states carry around $3,6000 of debt per resident, yet states are broadly holding off on paying down these obligations despite historically strong financial footing. Instead, thirty-three states have now passed some sort of tax relief, ranging from suspending taxes on gas and food to sending out tax rebates. Some states have opted for tax credits to struggling households, while others have sought to broadly lower income taxes for individuals and businesses.

- Similar to Federal stimulus, such state-led stimulus may have similar effects in further provoking inflation, while others raise concerns that savings should be preserved in anticipation of an upcoming recession.

FEATURED SPONSOR

Enjoy the ups and downs of roller coasters, but not when it comes to your money? Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

CONFESSIONS FROM THE PSYCHOLOGY OF MONEY

Have you ever thought you needed a financial therapist?

We think it could be a new burgeoning industry in the investment field.

Seriously. Money brings out a little crazy in all of us, and it helps to optimize your financial mental models. Where to turn, though?

We’re not talking about a financial planner, which can certainly be useful in strategizing for your investments, but someone who helps you understand your personal money psychology.

Luckily, if you don’t have a good financial therapist on hand (if you know of one, please let us know), you can pick up a fantastic book by Morgan Housel called, appropriately enough, The Psychology of Money.

Morgan is a former columnist at The Motley Fool and a partner at The Collaborative Fund. Trey Lockerbie, host of We Study Billionaires, did a great interview with him here, which is an informative listen for understanding behavioral finance.

It’s one of our favorite personal finance books, and the final chapter, called Confessions, may be the best one.

Morgan points out that succeeding financially has little to do with how smart you are and much more so with how you behave. Investing is one of the few games a person with average smarts and training can outperform the pros by following some tried and true investment principles.

Show me the money

Mohnish Pabrai often talks about how he’s not interested in hearing investors’ latest hot tips or their latest market theories. He says, “just show me what’s in your portfolio.” According to Morningstar, half of U.S. portfolio managers do not invest a penny in their own funds.

In his Confessions chapter, we get a peek into Housel’s portfolio and how he manages his financial affairs. It’s packed with simple, actionable advice you can follow if you’re not already.

The goal

Housel says independence has always been his personal financial goal. He has little interest in chasing high returns or leveraging his assets to live a luxurious lifestyle.

Instead, he just wants to be able to do what he and his family want to do on their own terms. Every financial decision they make revolves around that goal.

Independence doesn’t mean you stop working, but only to do work you like, with people you like, at the times you want for as long as you want. This, to Morgan, is “the grandmother of all financial goals.”

He advises keeping your expectations in check and living below your means. Your savings rate drives independence at every income level. Not falling prey to hedonic adaptation and increasing your lifestyle costs as your income increases is the main method for accomplishing this.

Forget “the Joneses” and optimize for peace of mind.

Some of Housel’s financial decisions go against conventional wisdom. For example, he holds 20% of his portfolio in cash. This seems a bit high to us, but it allows Morgan to sleep well at night, knowing he can take care of any financial emergency and will not be forced to sell stocks he owns. As Charlie Munger put it, “The first rule of compounding is to never interrupt it unnecessarily.”

Housel also owns their house without a mortgage which any rational financial planner would advise against. Rather, they’d likely recommend taking advantage of cheap money and investing the extra savings into higher return assets. The psychological comfort of owning his house outright, though, and not having a monthly mortgage payment, builds towards his goal of independence.

Morgan recommends keeping things simple and to dollar-cost average into a low-cost index fund. He has nothing against being an active stock picker but recognizes it is very difficult to outperform the market averages. In fact, statistics show that 85% of large cap fund managers didn’t beat the S&P 500 over the decade ending in 2019.

Below is an index card of rules and reminders to himself Housel penned that we came across recently on Twitter. We love checklists and thought this was a good one to share for those aiming towards the goal of financial independence.

Let us know your thoughts.

Have you read The Psychology of Money?

What do you think of Housel’s advice?

For more advice on managing money and financial independence, check out our Ultimate Guide to Investing.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy your weekend!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.