Chinese Yuan vs King Dollar

23 August 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

What do you think of our new time and newsletter length?

Hit reply to this email and let us know!

This morning, S&P Global released its August Global Flash US Composite PMI based on surveys of over 800 representative companies in the manufacturing and services industries.

For its second straight month, the index declined meaningfully, and the decrease in output was the sharpest since early 2020, while employment grew at the slowest pace in 2022 to date for these companies.

On the bright side, the rate of input cost inflation fell for the third month in a row 😅

Survey results in Japan and Europe weren’t any more hopeful either, painting a picture of a global economy that’s sharply contracting.

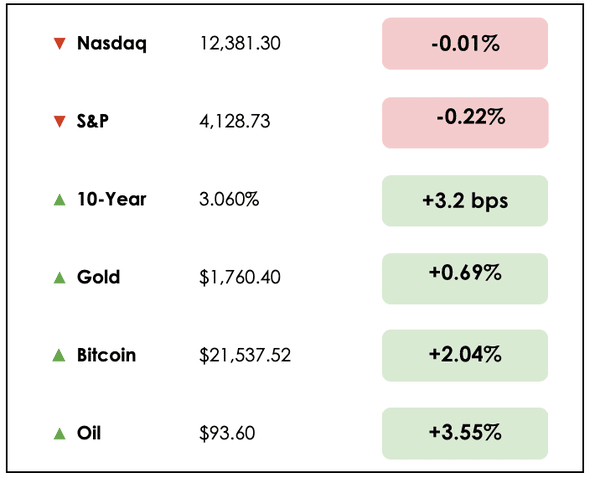

Here’s the market rundown for today:

*All prices as of today’s market close at 4pm EST

Oil prices, and correspondingly energy stocks, bounced following an OPEC+ statement suggesting that they may cut production.

Stocks were mixed generally in anticipation of Fed President, Jerome Powell’s speech on Friday that’s expected to lean hawkish (more aggressive on future rate hikes).

Per a JPMorgan survey, just 38% of investors plan to increase their equity exposure, which marks a record low.

Today, we’ll discuss the euro and dollar hitting parity, Tesla’s stock split, China’s push to make the Yuan a global reserve currency, and two deep-value stock picks in the natural gas space.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

IN THE NEWS

💶 Euro At 20-Year Low (CNBC)

Explained:

- Benchmark gas prices spiked 13% overnight as damage to a key pipeline system running oil from Kazakhstan through Russia and into Europe disrupted supply.

- Russia has already stated it will halt gas supplies to Europe for three months due to an unscheduled “maintenance issue” on its main Nord Stream 1 pipeline.

What to know:

- The euro sank back to below parity with the dollar on the news and recorded a 20-year low, as it was trading at $.9903 against the dollar on Tuesday morning.

- A weaker euro likely will be a headache for the European Central Bank, because it can mean higher prices for imported goods, particularly oil, which is priced in dollars. This complicates the fight against high inflation. They’ve modestly raised interest rates, the typical medicine for inflation, but higher rates can slow economic growth.

🚘 What Does Tesla’s Stock Split Mean For Investors? (WSJ)

Explained:

- Tesla (TSLA) is the latest mega-cap company, joining Amazon (AMZN) and Google (GOOGL) to split their stock to make share prices more accessible to investors in 2022. Investors often interpret a stock split as a sign of confidence by management.

- Tesla announced a 3-for-1 stock split on June 10, and the shares have climbed roughly 25% since that time. Tesla is down 18% for the year amid a broader market downturn.

What to know:

- Tesla will split its stock on August 24, and shareholders will receive an additional two shares for each one they own. For example, someone owning ten shares of Tesla before the split will own 30 shares after, with the share price divided by three.

- The split will not affect Tesla’s market capitalization because the price of each share will reflect the split. The current market value of Tesla topped just over $908 billion as of Monday’s close.

- According to a Bank of America study, stock splits have historically boosted share prices by 25% one year after the move.

China’s Open Bond Market Creates a Big Test For The Yuan (Business Insider)

China’s Open Bond Market Creates a Big Test For The Yuan (Business Insider)

Explained:

- Over the past two decades, China has allowed more traders and central banks to buy into its yuan-denominated bond market, which has elevated the yuan’s status globally.

- After a period of cautious government policy moves, including quotas, lock-up periods, and registration requirements, the worldwide assessment of China’s bonds is more favorable and treated like debt from more advanced countries rather than an emerging market.

What to know:

- The yuan is the fifth most widely used currency in the international payments system. The dollar remains at the top, followed by the euro, British pound, and Japanese yen.

- However, China’s currency has been losing value as central banks hike interest rates worldwide while the People’s Bank of China has been cutting them. As a result, the yuan dropped to its lowest level in three months against the dollar, coinciding with record outflows from China’s bond market. Do you think we are witnessing the Dollar Milkshake Theory unfold? (Hit reply to let us know)

- Beijing may be tempted to restrict capital outflows to halt the capital flight. Minimizing costly episodes of capital flight will be a challenge as the government attempts to steer the yuan towards becoming a more widely adopted international currency.

FEATURED SPONSOR

Enjoy the ups and downs of roller coasters, but not when it comes to your money? Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

DIVE DEEPER: BETTING ON NATURAL GAS STOCKS

In our hunt for value stocks, we stumbled across some research by investor Andrew Walker, who runs the excellent Yet Another Value Blog.

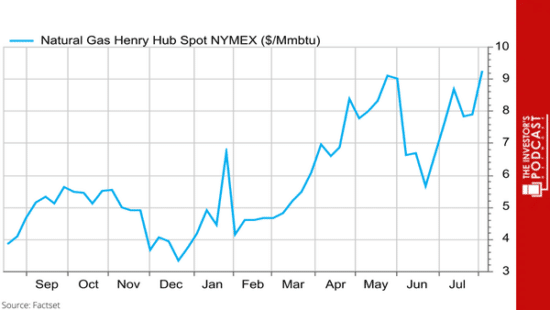

Walker believes that there may be a lot of opportunities in the energy space, specifically in the natural gas industry, and we’ve been thinking the same thing for a while now.

Breaking it down

He says that, in light of current geopolitical unrest and underinvestment in fossil fuels throughout the developed world, we’ve entered a period where energy prices will be structurally higher for the foreseeable future.

Natural gas, in particular, is quite important for powering electric grids and heating homes, so demand is unlikely to falter anytime soon. With an energy crisis in Europe sending natural gas prices parabolic, it’s clear that there’s a dire shortage of it.

Despite high energy prices being a boon for their earnings, many energy-related companies trade at a discount to the earnings that they’re expected to generate at current prices.

Walker explains that this can mean two things: either investors are expressing tremendous skepticism towards continued elevated energy prices, or they don’t trust the management teams at these companies to create shareholder value with their new bountiful cash flows.

This sort of excess pessimism tends to create excellent value opportunities. In his analysis, Walker highlights two domestic natural gas producer stocks: CNX Resources Corp (CNX) and Diversified Energy (DEC), which trades in London.

Why domestic producers when prices are highest in Europe?

Well, the U.S. is the largest natural gas producer in the world, and it’s making sizable infrastructure investments to build export terminals. In the intermediate term, that’ll enable companies to capture higher demand and prices in Europe through shipping liquefied natural gas (LNG).

Natural gas is a regional market, and pipelines are typically the primary means of transporting it. Exporting LNG across the ocean is expensive and difficult, but with European prices trading seven times higher than in the U.S., the incentives are in place to do this.

Domestic producers trade at a discount currently, in part, due to natural gas prices being higher in Europe.

Yet, as more domestic supply is sent to Europe to offset diminishing Russian flows, prices in the U.S. will likely rise.

This comes as inventories tighten to meet U.S. demand, assuming there aren’t any large new investments in the space which is politically unpopular and difficult given the world’s emphasis on transitioning to green energy.

Perhaps, most important to his logic behind focusing on U.S. natural gas producers is that they’re “really cheap.”

For example, EQT Corporation (EQT) is expected to generate 140% of its market capitalization in free cash flow in the next five years…that’s pretty remarkable, to say the least.

Why CNX and DEC?

DEC’s dividend yield is north of 10%, and CNX trades at less than 5x their 2022 free cash flow projections, says Walker.

Even better, though, is that he believes both companies are excellent at financial engineering in terms of effectively hedging commodity prices rather than being just a pure bet on the price of natural gas.

DEC, for example, expects to have 80% of next year’s production hedged, and CNX follows a similar strategy.

This hedging minimizes downside should prices crash while normalizing cash flows during periods of surging prices. Because their near-term production isn’t fully hedged, this leaves ample room to capture upside profits should natural gas prices remain elevated, which is what Walker expects.

Due to operational leverage, as their margins expand, profits grow at an even greater rate.

He explains further that many peer companies are much more reckless in managing their cash flows and remain far less hedged.

This exposes them more to any downside movements in natural gas prices.

In relative terms, the market has reacted quite harshly, to CNX & DEC not generating short-term profits as high as their peers, which is why he believes investors are overly discounting the soundness of their businesses.

In terms of returning profits to shareholders, CNX has done so primarily via large share repurchases, while DEC has focused on its dividends. In tandem, it’s a powerful combination.

Wrap up

For context, we are not directly invested in these stocks, nor would we recommend that you invest in them without doing your own research and considering your own specific financial circumstances.

To read Walker’s full analysis, check it out here, and don’t miss our podcast with him from earlier this year.

To analyze value stocks like these, why not use our TIP Finance tool (for free) which is custom built for this purpose?

Let us know – Do these stocks interest you?

Are you looking at opportunities in the natural gas space?

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.