Changing The Rules

14 December 2022

Hi, The Investor’s Podcast Network Community!

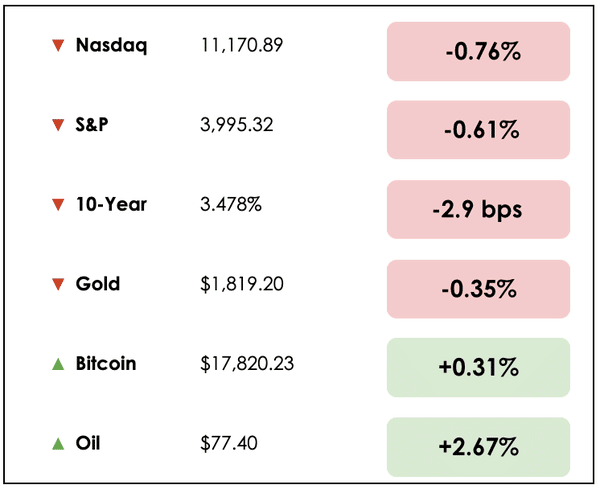

We expected a big news week, and we got one. The Federal Reserve unveiled its plan to raise rates by 0.5%, which came as no surprise, though stocks promptly reversed their gains on the day 📉

Why?

Well, the central bank’s statement was almost unchanged from last month.

🦅 For eagle-eyed Wall Street traders who obsess over every word the Fed publishes, the absence of language tweaks might indicate a continued aggressive stance in confronting inflation rather than a true softening.

Combine this with Fed officials’ revised expectations for 2023 interest rates to reach 5.1%, as opposed to the 4.8% levels anticipated by markets, and you get a stock market selloff.

Here’s the rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: An update on this week’s fusion energy breakthrough, and new rules for how stock trading will function, plus our main story on having bulletproof personal finances.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🔋 Fusion Industry Suddenly White-Hot (WSJ)

Explained:

- On Monday, we introduced you to a breakthrough in research on nuclear fusion, a potential source of clean, virtually limitless energy. Already, investors are flocking to the technology’s long-term clean energy potential. And we heard recently from the Department of Energy, which confirmed the accomplishment after review.

- The lab breakthrough announced this week could be a game-changer: The Fusion Industry Association said fusion-energy companies have raised more than $5 billion in private funding, roughly doubling the amount from 2021.

- Big names are backing fusion research, from Google parent Alphabet (GOOGL) to Chevron Corp. (CVX). Companies working in the space have “received a flurry of new investor inquiries this week.”

Why it matters:

- One expert, Dennis Whyte, said: “We have an emerging, possible new energy industry based on fusion.” Whyte is a director at MIT and founder of a fusion-energy startup that raised $1.8 billion last year from investors, including Bill Gates.

- Expectations should be tempered, of course, given that commercialization of the process is probably decades away. But real progress is being made both in labs and in financial backing.

- One consultant in the fusion space called this week’s news “the event of the century” that could change the entire fusion power landscape.

😬 SEC Rule Could Squeeze Middlemen (WSJ)

Explained:

- U.S. regulators are set to propose big changes to stock market rules, notably in altering the relationships between brokerages and investors’ orders to buy or sell securities, the high-speed traders who often handle those orders, and stock exchanges.

- Under the new rule, brokers would send many small-investor stock orders into auctions. The auctions would apply to “marketable orders,” for orders less than $200,000 in size by investors who place fewer than 40 trades a day.

- The proposals were prompted by last year’s frenzied trading in GameStop (GME). The rule could take effect by the middle of 2023.

Why it matters:

- The rule would be the biggest change to U.S. stock-market operations since the mid-2000s, with the intention of giving smaller investors better prices on trades.

- If most of the Securities and Exchange Commission’s (SEC) five commissioners vote to issue the proposals, they’ll then be open to public comment until at least March 31st. Economists estimated that more competition in filling stock orders could save individual investors $1.5 billion a year.

- Apparently, the SEC reflected on 2021’s many controversies and wants to ensure a more level playing field. “Today’s markets are not as fair and competitive as possible for individual investors,” SEC Chair Gary Gensler said.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

WHAT ELSE WE’RE INTO

📺 WATCH: The Senate Banking Committee’s hearing on the collapse of crypto exchange FTX.

👂 LISTEN: If an NFL player can invest in real estate, so can you — With Devon Kennard.

📖 READ: U.S. Lawmakers unveil bipartisan plan to ban TikTok, per CNBC.

THE MAIN STORY: MASTERING YOUR MONEY

Overview

We love discussing investment ideas and strategies but mastering your personal finances is 10X more important than picking the right stocks.

Without a sound financial plan, how can you possibly hope to allocate your money accordingly to reach retirement and lifestyle goals?

I (Patrick) admittedly have selfish intentions for this article. I was listening to a podcast that joked that waiting to do your New Year’s goals at the beginning of the year is for losers.

So I decided to jump to it.

I like to set goals and intentions for the new year in three areas: wealth, health, and love.

I decided to focus on wealth first. Not that it’s the most important, but it’s the area that needs the most attention in my life lately.

Fortunately, I came across an excellent Twitter thread by Brian Stoffel. His guide for making my personal finances bulletproof was exactly what I needed, and I hope it’s useful for you, too, as you plan for 2023.

Let’s dive in.

- Get organized — The first step to money mastery is to get a clear picture of where you are. To make good decisions, you’ll need to gather accurate information about the variables that matter. We recommend the personal budgeting app Personal Capital to gather your data.

- Insurance — It’s not the sexiest of topics, but ensuring you have adequate insurance (health, home, auto, life, and disability) will prevent a potentially catastrophic loss. Over a long enough time frame, you’ll need insurance.

- Align your spending — Money, ideally, is a tool for joy. As Ramit Sethi says, “Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.”

- Starter emergency fund — Save up one month’s expenses and have it stashed safely away for inevitable, unplanned expenses. Once you have one month saved for emergencies, start working on a multi-month emergency fund.

- High-interest debt — Next, Stoffel recommends paying off high-interest debt, which is a financial time bomb, as quickly as possible. That includes any non-mortgage debt higher than 7%.

- Get the match — If your employer has a matching 401(k) plan, maximize contributions to capture that to the fullest extent possible. It’s essentially free money.

- Open an HSA — If you’re eligible, opening a Health Savings Account is a prudent move that is triple tax-advantaged. Whatever you put in (up to the IRS limits) reduces your taxes immediately. All growth on your investments is tax-free, and the distributions are also tax-free for qualified medical expenses.

- IRA — Open an Individual Retirement Account and put money towards retirement with tax advantages and the ability to invest where you want. You can utilize a Traditional or Roth IRA and contribute up to $6,500 annually. Withdrawals without penalty begin at 59 1/2.

- Education — College is expensive, and saving in tax-advantaged education accounts can help if you have kids. There are three popular options: Uniform Gift to Minors Act, 529 plans, and Coverdell Education Savings Accounts.

- Debt-free — Stoffel recommends ultimately eliminating ALL debt, including your mortgage. This goes against traditional financial planning, but he says being completely debt-free offers unmatched benefits.

- Build wealth — Consistently saving and investing at least 10% of your income throughout a lifetime will compound for an enjoyable retirement. Stoffel says wealth isn’t the same as being rich. For him, it’s doing what you want, when you want, how you want, for as long as you want.

Takeaway

Some of these items will take longer than others. You can sit down and analyze your spending in an evening. Depending on your goals, building wealth may last a lifetime.

Regardless, your future self will thank you for taking the time to implement this plan to make your finances anti-fragile.

Dive Deeper

Check out the Personal Finance Starter Pack, which are some of our top money management podcast episodes, curated by Robert Leonard.

A MESSAGE FROM SEEKING ALPHA

Seeking Alpha is having a New Year’s sale!

For just $39, you can get Seeking Alpha Premium access (normally $239).

With Seeking Alpha, you can take control of your financial future — use our link here for a special 83% discount.

Don’t miss this flash sale!

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.