Cats & Dogs

Hi, The Investor’s Podcast Network Community!

⚾ Play ball! Happy Opening Day to all the baseball fans out there. For the first time since 1968, all 30 teams will play their first games on the same day (March 30).

It’s a new era for America’s pastime, which has rolled out various rule changes to speed up the pace of play and keep fans engaged. Among them: a pitch timer, limits on defensive shifts, and bigger bases. What do you think?

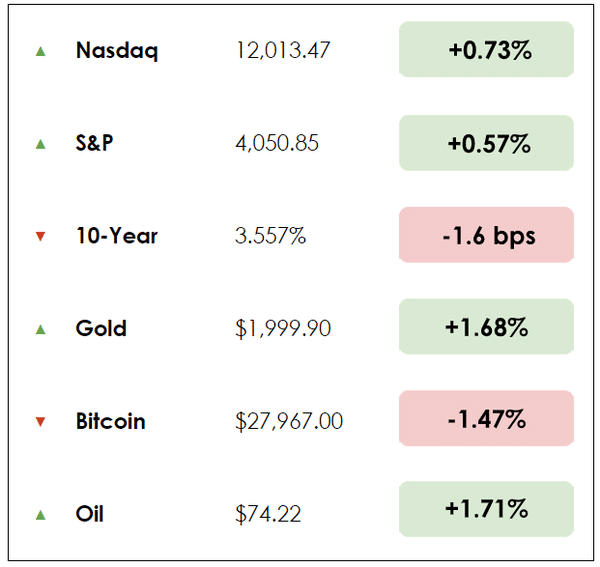

In markets, stocks continue to shrug off the banking woes as the S&P 500 has risen over 5% so far this year. It continues to hold steady, at least for now. The first quarter wraps up Friday.

Here’s the rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- The $3 trillion threat to markets in Japan

- What to know right now about the FDIC

- Plus, our main story on the business of pets

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Real estate investing, made simple.

17% historical returns*

Minimums as low as $5k.

EquityMultiple helps investors easily diversify beyond stocks and bonds, and build wealth through streamlined CRE investing.

*Past performance doesn’t guarantee future results. Visit equitymultiple.com for full disclosures

IN THE NEWS

🇯🇵 A $3 Trillion Threat to Markets Looms in Japan (Bloomberg)

Explained:

Japan’s ultra-low interest rate policies that starved domestic investors of returns pushed a $3.4 trillion flood of money overseas.

What’s happening: Investors are bracing for what happens next, as Japan’s central bank, the Bank of Japan (BOJ), undergoes a momentous leadership change in just over a week that will seemingly bring an inevitable end to a decade of “super-easy money” policies.

- The exodus hastened in 2016 following a move by the BOJ to suppress bond yields, which spawned a mountain of offshore investments worth over two-thirds of the Japanese economy.

However, the new BOJ Governor is expected to accelerate policy tightening later this year, unwinding an epic $3.55 trillion bond-buying program designed to suppress borrowing costs and support Japan’s stagnating economy.

Feeling the pain: Japan’s currency, the yen, has been under tremendous strain from the country’s comparatively low rates and financial outflows, though.

- With inflation starting to finally rear its head in an economy notorious for its lack of growth, the leadership change enables Japan to dismantle its reputation for loose monetary policies.

Why it matters:

The stakes are huge globally: Japanese investors are the largest holders of U.S. Treasury bonds, with other sizable holdings including everything from “Brazilian debt to European power stations to bundles of risky loans stateside.”

An increase in Japan’s borrowing costs from a return to more normal interest rates risks amplifying volatility in bond markets worldwide, which have already been rocked by the Fed’s aggressive hiking campaign to stem inflation.

Looking forward: The head of the BlackRock Investment Institute remarked, “When you control a price and loosen the grip, it can be challenging and messy. We think it’s a big deal what happens next” that is “not being appreciated” by markets.

- And the flow reversal is already underway — Japanese investors sold a record amount of foreign debt last year. One portfolio manager commented: “You’ve already seen the start of that money being repatriated back to Japan.”

🏦 FDIC Directs Deposit Bail Out Costs to Big Banks (Bloomberg)

Explained:

The Federal Deposit Insurance Corp., an institution we’ve written about more recently than we ever expected to, is facing nearly $23 billion in costs related to recent bank failures and its efforts to protect deposits.

What to know: While banks typically pay into its insurance fund, the agency is considering directing a higher-than-normal share of costs to the country’s biggest banks.

- The “special assessment” aims to firm up the FDIC’s $128 billion deposit protection fund while mostly sparing smaller banks, hoping to avoid further weakening already vulnerable institutions. The assessment intends to speed up refilling the FDIC’s coffers.

Political pressures: Details are mostly pending, but leaning more on big banks is seen as the most politically palatable solution. Banks pay into the FDIC’s insurance fund quarterly, but the fees vary widely, determined by a bank’s size and confidential regulatory rating.

Why it matters:

For officials in Washington, ensuring that the public doesn’t see the costs incurred by the government in response to 2023’s bank failures as being similar to the controversial measures taken in 2008 is critically important.

Focusing on optics: Senator John Boozman of Arkansas argued, “I’m concerned that Arkansans will have to subsidize Silicon Valley Bank and Signature Banks deposits, and maybe others that come forward.”

- In response, the FDIC’s Chairman responded, “We have the discretion to tailor that assessment to the institutions that most directly benefited.”

- The big banks, who don’t face the same bank run concerns because they’ve been designated ‘too big to fail’ and even benefited from attracting depositors fleeing failed banks, will have to pay up for those privileges.

Not cheap: In 2009, the FDIC sought to raise $5.5 billion with a special assessment, which JPMorgan said extracted $675 million from its second-quarter earnings. The financial impact this time around will likely be even greater.

Introduction

“Money can buy you a fine dog, but only love can make him wag his tail.” – Kinky Friedman

In the U.S., about 180 million households own a pet. Many of us love our furry friends and consider them a focal point of the family. For others, they’re a necessity. Pets help people with disabilities, ailments, and anxiety.

Americans are more than willing to treat their pets, whether it’s buying premium food, treats, grooming, medical care, or even Halloween costumes; Americans spent nearly half a billion dollars on pet customers in 2021, up 18% from 2020.

There’s no shortage of business opportunities in the space, from pet sitting to pet healthcare to food and treats. There’s increasing demand for pet food, insurance, veterinary care, and grooming services. And industry executives have said for years that their business resists economic cycles; people love their pets.

A growing industry

The industry has seen a major lift as households adopted pets during the pandemic.

Its market size is estimated to be over $100 billion in the United States alone. According to the American Pet Products Association (APPA), the pet industry has grown steadily over the past few decades.

Total spending on pets in the U.S. has increased from $17 billion in 1994 to $103.6 billion in 2020. Growth factors include:

- Humanization of pets: Pets are now viewed as members of the family, and as such, people are willing to spend more money on their pets to ensure their health and happiness.

- Increase in pet ownership: The number of households owning pets has been consistently increasing over the years, leading to a larger customer base for the pet industry.

- Advances in pet healthcare: Veterinary care and pet healthcare products have improved over the years, leading to longer life spans and increased demand for products and services.

- Increase in disposable income: As people’s disposable incomes grew during the pandemic, they were willing to spend on pets.

- Growth of e-commerce: The rise of online shopping has made buying pet products and services easier, leading to increased sales in the industry.

Major players in the space

Companies include pet food manufacturers to pet supply retailers to vet clinics. A few that stand out:

Mars Petcare: A subsidiary of the Mars Corporation, Mars Petcare is one of the largest pet food manufacturers in the world, producing brands such as Pedigree, Whiskas, and Royal Canin.

Nestle Purina Petcare: Another major player in the pet food industry, Nestle Purina Petcare produces popular brands such as Purina ONE, Friskies, and Fancy Feast.

Chewy: An online retailer of pet food, supplies, and medications, Chewy.com was acquired by PetSmart in 2017 and has since become one of the largest e-commerce sites in the pet industry.

Petco: A retail chain that sells pet food, supplies, and services, Petco has over 1,500 stores across the U.S.

Banfield Pet Hospital: A veterinary clinic chain owned by Mars Petcare, Banfield Pet Hospital has over 1,000 locations across the United States and offers veterinary services for dogs and cats.

Zoetis: A leading animal health company, Zoetis produces medications and vaccines for pets and livestock.

Rover: With Rover’s mobile app, pet owners can book daycare, pet sitting, and dog walking services with a few clicks. Rover receives 20% of the transaction.

Dive deeper

In the coming months, we’ll dive deeper into one of the leading pet-industry companies. Which is your favorite? Which would you like to read about? We’d love to hear from you.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.