Cash Pile

08 December 2022

Hi, The Investor’s Podcast Network Community!

🛢️ Fitting with the narrative that energy companies would rather return capital to shareholders than invest in new projects, Exxon Mobil (XOM) announced plans to expand its share buyback program through 2024 with $50 billion of spending.

Elsewhere, the Federal Trade Commission is suing Microsoft (MSFT) to block its acquisition of Activision Blizzard (ATVI).

They hope to prevent Microsoft from consolidating power in the gaming industry to employ anti-competitive practices.

Expect a drawn-out battle in court 🏛️

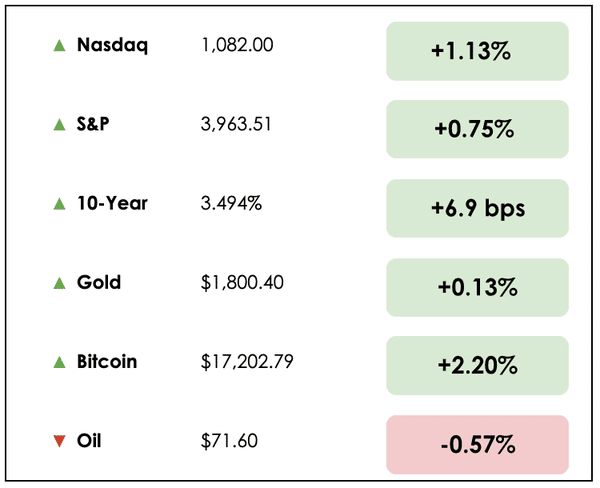

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: U.S. allies join the effort to block China’s advanced tech capabilities, and Americans drain down their savings at a record pace, plus our main story on whether passive investing caused a bubble in financial markets.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🙅 U.S. Pushes Allies To Assist With China Tech Ban (Bloomberg)

Explained:

- Dutch officials are reportedly planning new restrictions on exports of important chipmaking equipment to China, aligning with U.S. efforts to strangle Beijing’s access to high-end technology.

- Negotiations are still ongoing, but a deal is expected as soon as next month. Outside of the U.S., the Netherlands and Japan are the world’s leading suppliers of machinery and know-how for building advanced semiconductor chips.

- Export limits will likely focus on equipment related to the most advanced generation of chips. For Dutch firm ASML Holdings NV (ASML), a major player in the global semiconductor supply chain, sales to China accounted for roughly 15% of its revenue last year.

Why it matters:

- Because the components used in ASML’s machinery are often sourced from the U.S., Washington has some leverage in enforcing its plan to thwart China from using advanced chips for military and artificial intelligence purposes.

- Dutch officials also voiced concerns over national security and China, highlighting their willingness to assist American efforts.

- The U.S. is hoping to systematically handicap China’s tech sector and military, and as more of its allies involved in the semiconductor supply chain collaborate on doing this, the more difficult it will be for China to remain competitive. Read our past piece on the ongoing “Chip War” to learn more.

💸 Americans’ Pandemic-Era Cash Pile Is Shrinking (Axios)

Explained:

- Although Americans’ real incomes are stagnating or declining due to inflation, consumers are still spending at an impressive pace.

- From Covid-era stimulus checks to boosted unemployment benefits and less money spent on travel and leisure services from 2020 through 2021, many built a nice savings cushion that they’re now spending down.

- The personal saving rate, the share of disposable income left over after spending, dropped to its second-lowest level in 60 years to 2.3%.

Why it matters:

- One concern is that while this spending is keeping the economy relatively strong, it’s not sustainable. If these savings dry up just as the Fed’s continued rate hiking endeavors compound across the economy, the result could be a double-whammy stunting growth next year.

- JPMorgan’s (JPM) CEO predicts that nearly $1.5 trillion in accumulated savings will be exhausted by the middle of next year.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

THE MAIN STORY: ARE WE IN A PASSIVE INVESTING BUBBLE?

Overview

The finance industry has structurally changed over the past few decades with a major tilt towards democratization.

Today, we’d like to focus on so-called “passive investing.”

If you’re unsure what that means, just think about the recurring contributions to index funds you may make in a retirement or regular brokerage account.

Historical context

Stock investing used to require substantial commissions just to execute a trade. And mutual funds were the main way to broadly invest in the markets despite their often high management fees and exclusionary investment minimums, where you might have to have, say, $5000 to be allowed to invest in the fund.

All that has changed.

For most, you can trade as much as you want with even just a few dollars to spare without incurring commission costs, and flexible exchange-traded funds (ETFs) are increasingly displacing the mutual funds of old.

Enabled by technology and with Vanguard leading the charge in offering diversified funds with almost zero fees, it’s never been easier and more advantageous for anyone, anywhere, to own shares in leading companies.

What to know

This has unleashed a tidal wave of capital from individual investors, often into either ETFs or mutual funds, which have accumulated roughly $11 trillion worth of passive funds.

This trend has empowered millions to save for their future by embracing stock investing while saving them collectively billions of dollars in fees to Wall Street firms. Most of these changes are objectively good.

Of course, there are trade-offs for everything.

The trade-offs

Today, with most following the conventional wisdom to invest for the long-term and doing so in diversified index funds via automatic daily, weekly, or monthly contributions, asset managers who offer those funds like Vanguard and BlackRock have accumulated trillions of dollars in assets under management.

These asset managers who custody your shares are the ones who vote on internal matters at companies on your behalf.

That dynamic has become quite controversial as society wrestles with how corporations should respond to the climate crisis, wealth inequality, workers’ rights, etc.

This gives them, and the index providers like S&P Dow Jones, tremendous power to direct society’s aggregate capital into companies by determining, for example, who gets included in the famed benchmark S&P 500 index.

Waving a red flag

Mike Green, chief strategist of Simplify Asset Management, has become known for his warnings about the rise of passive investing.

He’s argued that all this money blindly flowing into the market, buying set groups of stocks, distorts the actual purpose of equity markets.

On top of this, he worries that the stock market has become a “public good.”

Meaning, as pension funds, endowments, and individuals stake their financial well-being in global equity markets, particularly in the U.S., these markets’ purpose as a vehicle for capital allocation becomes corrupted.

People have been promised that if they hold their money in stocks for several decades, they’ll earn 7-10% per year. The irony is that as more people pile into markets and bid prices higher, expected future returns fall.

There’s now a pressure, if not obligation, for stock funds to deliver those returns. Otherwise, we face a reality where many people are unable to meet their retirement obligations.

Are markets serving their purpose?

Green believes markets were never intended to serve this role as a guarantor of society’s financial health.

He states, “Markets are ultimately not about funding someone else’s retirement but instead about allocating capital efficiently within an economy and creating the signals that encourage investment in better companies.”

Michael Burry, known for his bets against the housing market during the 2008 financial crisis and featured in the Big Short, has called the passive investing boom “an impending crisis.”

The thinking is that inflows into passive funds, which set a record last year, have boosted stock prices irrationally by offering almost constant buying demand.

The flip side

Others don’t agree.

Senior ETF analyst at Bloomberg, Eric Balchunas, in a recent interview on Millennial Investing, conceded that “as passive grows more and owns more shares of companies, it’s possible stocks could be more volatile” because there are fewer shares available for active investors to bet on or against stocks with.

However, he asserts that the bubble people warn of has more to do with the Fed than passive investing’s effects.

Since stock prices are determined at the margin, active investors are still primarily settling whether companies are over or undervalued.

He emphasizes that when companies miss earnings estimates, their stocks still go down, meaning fundamentals haven’t been totally forsaken.

“Just take my word for it. I don’t think ETFs are ruining fundamentals.”

At least not yet.

Dive deeper

Which side of the debate do you fall on? (Hit reply to let us know).

You can listen to the full interview with Balchunas here to learn more about why he’s not worried about a passive investing bubble.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.