Buffett’s Outlook

Hi, The Investor’s Podcast Network Community!

What’s interesting about 2023 is that, more than usual, the economic outlook fits into multiple narratives.

Last Friday’s strong jobs report highlighted a growing labor force with more jobs but decelerating wage growth — sounds like a dream “soft landing” for the Fed 💭

However, credit conditions are tightening quickly while business optimism surveys are deteriorating, pointing to a recession.

Today, we got a cooler-than-expected inflation number for March, showing a 5% year-over-year Consumer Price Index rise (compared to 6% in February) and just a 0.1% uptick from last month.

🤔 You could either interpret the above as signs of a slowing economy heading into recession or that, when combined with other data, the Fed is threading the needle with rate hikes, cooling inflation without smothering the economy. Pick your narrative.

At 5% inflation, though, the Fed is still painfully far from its 2% target.

Here’s the rundown:

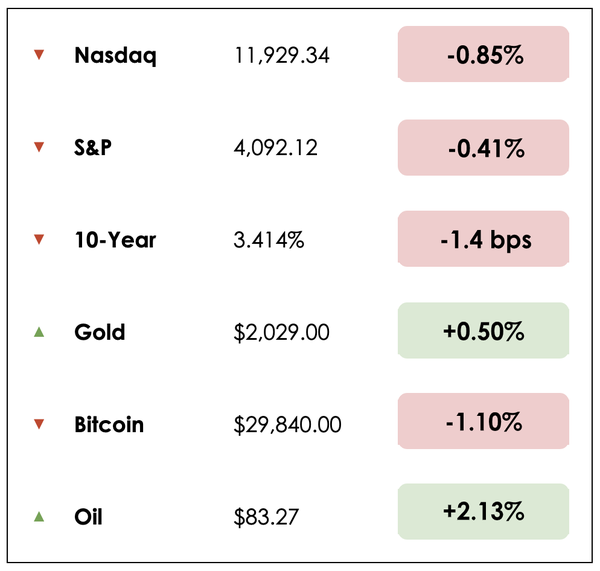

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Buffett’s latest outlook on markets

- An update on the EV expansion

- Plus, our main story on how to save public transportation

All this, and more, in just 5 minutes to read.

Trivia question — What was the first totally electronic stock exchange?

Read to the end of the newsletter to find the answer!

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Real estate investing, made simple.

17% historical returns*

Minimums as low as $5k.

EquityMultiple helps investors easily diversify beyond stocks and bonds, and build wealth through streamlined CRE investing.

*Past performance doesn’t guarantee future results. Visit equitymultiple.com for full disclosures

IN THE NEWS

💸 Buffett’s Latest Outlook (CNBC)

Explained:

In a three-hour CNBC special Wednesday, Warren Buffett weighed in on the banking crisis, Berkshire Hathaway, cryptocurrency, and the economy. Here are the highlights.

- Buffett believes there could be more bank failures to come. But depositors shouldn’t be worried. “We’re not over bank failures, but depositors haven’t had a crisis,” he said. “Banks go bust. But depositors aren’t going to be hurt.”

- Buffett added: “Nobody is going to lose money on a deposit in a U.S. bank. It’s not going to happen… you don’t need to turn a dumb decision by managers into panicking the whole citizenry of the United States about something they don’t need to be panicked about.”

Elsewhere, Buffett said crypto is the result of “an explosion of gambling.” He added: “I’ve seen people do stupid things all my life. I empathize with that. People like to play the lottery…the gambling urge is so strong.”

Why it matters:

Buffett hosts his annual Berkshire Hathaway Annual Meeting in less than a month, and his comments Wednesday were another window into how he sees markets and investment opportunities.

On the economy, he said, “it’s a tougher world,” though he never pays attention to economic forecasts or market predictions.

- “I’ve been running Berkshire for 58 years, and I’ve never found economic forecasts of any use to the company. All we have to do is keep running every business as well as we can. If I depended my life on economic forecasts, I don’t think we’d make any money.”

- Buffett also said he was “confounded” by the opportunity to buy into five Japanese trading houses two years ago, something we discussed yesterday. Berkshire plans to hold the investments for 10 to 20 years.

“I was confounded by the fact that we could buy into these companies,” Buffett said. They had, in effect, “an earnings yield of maybe 14% or something like that, but dividends would grow.”

🚗 EV Expansion? (FT)

Explained:

U.S. environmental regulators on Wednesday proposed tough new emissions limits that would force carmakers to make 67% of their American models electric by 2032, a bold move the Environmental Protection Agency’s (EPA) administrator Michael Regan called “the most ambitious pollution standards ever for cars and trucks.”

- This would significantly increase electric vehicles (EVs) share of the new vehicle market, which stood at only about 7 percent in 2022.

- The proposed rule would limit tailpipe emissions across all the vehicles in a carmaker’s fleet, forcing companies to make more battery-powered vehicles to meet the new standard.

Why it matters:

The proposal would also curb air pollution, boosting the U.S.’s chance of achieving its Paris Agreement pledge to lower emissions by 50-52% below 2005 levels by 2030.

- General Motors, Ford, and Stellantis have pledged to make between 40-50% of their U.S. sales electric by 2030, and they have invested billions of dollars in developing new models and building factories.

- Tesla remains the market leader by a wide margin, though most car manufacturers still face the challenge that producing EVs costs more than gas-powered equivalents.

- Roadblocks remain, including access to enough charging stations on America’s roads and supply for the lithium batteries EVs require.

MORE HEADLINES

📨 Inflation hits the mailbox: stamp prices are rising, again

😅 Fed expects the banking crisis to tilt economy into recession later this year, minutes show

👎 AI can do a lot of things, but beating the market isn’t one of them

Brewing crisis

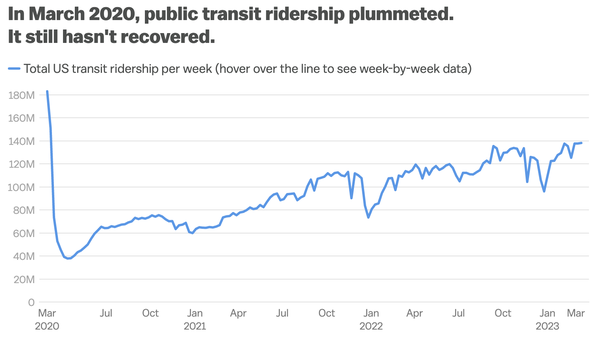

America’s largest transportation systems face a pandemic-induced crisis: below-average ridership and reduced revenues for transportation agencies.

Without new funding injections, many of our largest transit networks will have to dramatically curtail service, which could spark a feedback loop that turns away more passengers, further worsening the financial hole.

During the pandemic, the number of subway and bus riders dropped considerably, and usage has yet to return to pre-pandemic norms.

A death spiral for these public services wouldn’t only hurt frequent riders but could also hinder many cities’ goals for revitalizing downtowns and minimizing greenhouse gas emissions.

Turning to an expert

David Zipper, a Harvard Business School alum and visiting fellow at Harvard’s Center for State and Local Government, argues, “Transit leaders must offer a full-throated defense of their essential role in American life. They must then secure new and reliable revenue streams from state and regional sources.”

In other words, Zipper suggests that local governments should willingly subsidize public transit more to ensure that its often unseen positive externalities remain intact.

In a country as sprawling as the U.S., though, where most people don’t ride the bus or train, convincing folks about the value of public transportation is often easier said than done, particularly when money is on the line.

Pro-transit arguments

But a few points tend to resonate, such as the potential to cut back highway congestion, reduce auto emissions, and boost productivity by making cities more navigable.

After growing up in the D.C. metro area, I (Shawn) can attest to the terrible social and economic costs imposed by chronic rush hour-like traffic during most hours of the day. Few would argue that a 45-minute commute by car (or more!) to travel six miles is a good use of anyone’s precious time.

Public transit offers a viable solution with an important caveat: transit services must offer quick, frequent, and reliable trips. Otherwise, folks will default to what they know best — clogging up the roads with their cars.

It’s a chicken and egg problem.

You need well-funded, robust transportation networks to attract riders at scale, but to attain said levels of reliability, lots of revenue is needed to support operations, renovations, and expansions. To generate the necessary revenues, extensive ridership is needed, but that’s absent because existing services aren’t reliable enough.

As mentioned, the pandemic only magnified this problem.

Driving culture emerges

Funny enough, mass transportation’s heyday in the U.S. was almost a century ago, when privately run street cars dominated urban America and subway lines in cities like Boston and New York flourished.

As Zipper details, the rapid rise of automobiles prompted many regular passengers to opt for life in the suburbs. That “declining ridership eroded transit companies’ finances, leading to deteriorating service that drove away still more riders.”

And policies like the 1956 Federal-Aid Highway Act spurred the modern interstate highway system’s invaluable development, yet this accelerated suburbanization and the strain on urban centers.

By 1960, about 12% of Americans’ work commutes relied on public transit, falling to 5% more recently.

Shaky finances

Transit agencies in metro areas have long earned much of their revenues from passenger fares. For example, New York City’s MTA recouped over half of its operating expenses from farebox revenue in 2019.

These fare revenues enable large transit systems to offer more service, making them more appealing to those who might otherwise use a car. According to one study from the nonprofit TransitCenter, “The two most important factors driving satisfaction with transit are service frequency and travel time.”

In March 2020, nationwide ridership dropped 80%. Smaller metros, like Austin, Texas, where only 11% of its operating budget comes from fares, could better endure the hardship, while bigger cities, often more reliant on fares, couldn’t without cutting back on service offerings.

And ridership rates were slow to recover as remote work became more normalized.

Congress threw transit agencies a lifeline in 2020, providing packages totaling $69 billion, which funded big agencies’ operating expenses. Unfortunately, that Federal money is running out, and as mentioned, the public hasn’t embraced mass transit again.

Final thoughts

As a fake headline from The Onion 23 years ago puts it, “98% of U.S. Commuters Favor Public Transportation for Others.” Everyone likes the idea of transit clearing up roads for them to drive on more easily.

Still, Zipper thinks we’re near an inflection point. He endorses deprioritizing expensive capital projects, like vehicle purchases and rail expansions, to direct money toward maintenance and hiring that could make existing services more convenient.

He concludes, “The focus must be on providing high-quality service that reinforces transit systems as assets worthy of investment. The alternative — widening budget deficits and deteriorating service — would be a tragedy for some of America’s greatest cities.

What do you think?

Turning to an expert

For the full picture, well beyond what we can capture in this newsletter, check out Zipper’s article.

The trivia answer from the top of the newsletter is: the Nasdaq (in 1971).

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!