Buffett’s Money Moves

15 February 2023

Hi, The Investor’s Podcast Network Community!

🏡 The company that enables you to temporarily live in other people’s homes, Airbnb, saw its stock soar today. Jokes aside, the company crushed things last quarter, reporting its first annual profit, with last quarter’s earnings coming in at $0.48 per share. That easily beat projections of $0.26.

And for Berkshire Hathaway watchers, new 13F filings revealed insights into Warren Buffett’s company. The conglomerate actually sold more shares than it bought in the 4th quarter of 2022.

Berkshire did surprise investors with a sudden reversal, cutting its position in Taiwan Semiconductor Manufacturing by 86%.

More on that below👇

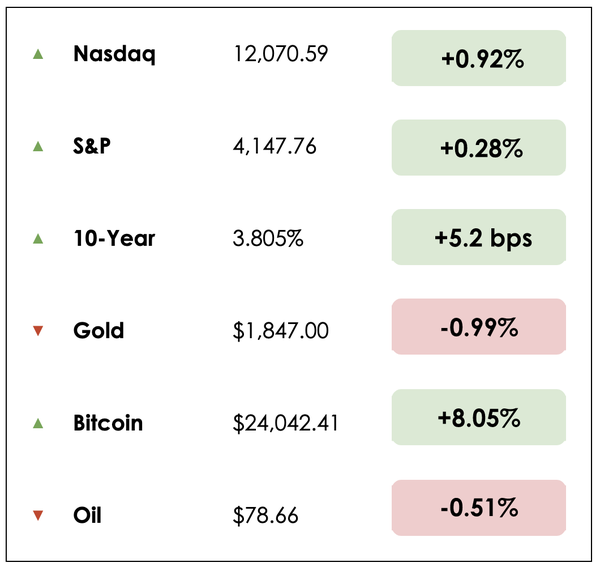

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Buffett’s latest money moves

- The growing network of EV superchargers

- Plus, our main story on the earthquake that prompted the creation of the Federal Reserve

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

💵 Buffett’s Latest Money Moves (WSJ)

Explained:

- Warren Buffett’s Berkshire Hathaway didn’t open any new positions in the last quarter, per its 13F filing, the form that institutional investors managing more than $100 million are required to file to the SEC.

- Berkshire added slightly to its positions in Apple, Louisiana-Pacific, and Paramount Global in the final three months of the year while trimming positions in eight companies, including U.S. Bancorp and Taiwan Semiconductor Manufacturing. Apple still makes up nearly 40% of Berkshire’s holdings.

- Perhaps most notably, the company reduced its position in chip maker Taiwan Semiconductor Manufacturing by 51.8 million shares, or roughly 86%, a notable move considering Berkshire only began investing in the company during the third quarter of 2022. Typically, Buffett likes to buy and hold quality businesses for much longer periods.

Why it matters:

- Many investors view Berkshire’s 13F as a way to get a sense of how Buffett, his deputies, and his right-hand man, Charlie Munger, are approaching the markets.

- Berkshire trimmed its stake in several financial companies and Chevron, though the oil giant remains one of its top five holdings, following Apple and Bank of America.

- After scaling back its stock purchases in 2020 and 2021, Berkshire dramatically ramped up its spending in the stock market last year as many share prices fell. This aligns with Buffett’s approach of generally buying during fearful or turbulent periods.

- Berkshire spent $66 billion buying stocks in the first nine months of 2022, more than 13 times its spending over the same period in 2021. Investors see the pickup in activity as Berkshire taking advantage of the tumult across markets in 2022, following a relatively quiet 2021 in which the company largely stuck to repurchasing its own shares.

🚗 The World of Superchargers (WSJ)

Explained:

- Tesla (TSLA) will open part of its proprietary Supercharger network to other kinds of vehicles for the first time, the White House said Wednesday. The move qualifies the company for a share of billions of federal dollars on offer to build a national network of EV chargers.

- Tesla plans to open at least 3,500 new and existing 250-kilowatt chargers to drivers of all EVs by the end of next year. Fast chargers can repower cars in 30 minutes, but those available to any kind of EV are in short supply across U.S. highways. More charging stations nationwide will be key to boosting EV adoption as auto makers convert their fleets to electric over the next decade.

- Tesla’s current network is 17,700 fast chargers at more than 1,650 locations, but they aren’t available to other types of vehicles in the U.S. The White House says Tesla will triple its Supercharger network.

Why it matters:

- The chargers were part of a broader White House announcement that included details on the phase-in of a domestic-manufacturing requirement for chargers amid a larger push by the Biden administration to boost clean-energy manufacturing.

- The federal government has already begun to release $5 billion in funding for highway chargers to states. It will soon release the first $700 million of $2.5 billion planned for discretionary grants that would install chargers at places like schools, stores, and apartments.

- Said Ali Zaidi, the White House national climate adviser: “This is not pie in the sky. It’s literally steel in the ground. We’re seeing the Biden climate vision on wheels.”

WHAT ELSE WE’RE INTO

📺 WATCH: Why China is losing the microchip war.

👂 LISTEN: The art of transforming communities with real estate developer Eric Weatherholtz.

📖 READ: U.S. military confirms that it used AI to fly a fighter jet.

Overview

In his book, A History of the United States in Five Crashes, Scott Nations explains that most crises are precipitated by an initial (perhaps seemingly unrelated) shock that ignites brewing underlying vulnerabilities.

Consider the Covid-19 pandemic as an external shock. While not directly related to financial markets, its disruptive nature had many huge, easily identifiable impacts.

We’re all familiar with these recent analyses.

Let’s instead jump back in time with Jamie Catherwood, writer of Investor Amnesia, to the Panic of 1907 to learn about another shock that moved markets.

Back in the day

On the morning of April 18th, 1906, an 8.3 magnitude earthquake tore through San Francisco. Despite lasting less than a minute, the quake caused fires that persisted over four days, decimating much of the city.

Busted water pipes left firefighters powerless to tame the inferno’s hellish blaze. Ultimately, Catherwood tells us that over 490 city blocks, some 25,000 buildings, were destroyed, forcing between 55 and 73% of the city’s population into homelessness while killing nearly 3,000 people.

News traveled slower back then, but markets reacted promptly to the catastrophe: Stocks on the New York Stock Exchange collapsed 12%. One newspaper reported, “Some insisted on selling out of their stocks no matter what price they brought.”

Ripple effects

The financial fallout proved more systemically troubling. See, Britain’s fire insurance industry broadly insured San Francisco’s home, and the natural disaster promised unprecedented claims.

The historians Kerry Odell and Marc Weidenmier provide more context: “Endowed with an excellent natural harbor and easy coastal and river access to the agricultural and natural resource riches of the west, San Francisco had developed strong economic ties to other countries, particularly to Britain.”

They continued, “A sizable number of London banks had offices in that city. At the same time, other British financial institutions sought to expand their business in the area. Prominent among those were the British fire insurance companies.”

By 1900, British companies in San Francisco issued at least half of all fire insurance policies. Although the earthquake was a regional tragedy, the complex interlinking of the economy and financial system spawned an international crisis.

Gold shortage

The insurance payments were more than just balance sheet losses; they resulted in unprecedented gold outflows from London. When all was said and done, 14% of the country’s national gold reserves had been transported west to settle insurance claims.

The ripple effects kept mounting. With the gold exodus pushing the Bank of England’s reserve ratio to a 16-year-low, it was forced to raise interest rates to protect its remaining reserves. Over two months, the British central bank raised rates by 250 basis points, which one newspaper called a “bombshell in the market.”

Like today, when rates dramatically jump, that can inflict much pain. The move marked a swift end to reckless financial speculation, cutting off many American firms’ access to credit. This caused the U.S. stock market to sell off amidst a subsequent drain of American gold reserves and liquidity.

Spreading contagion

During this time, investment ‘trusts’ played a big role in the shadow banking system, providing financial services and taking deposits despite being less regulated than banks.

These trusts were also excluded from the New York Clearing House (NYCH). Catherwood says, “In other words, investment trusts couldn’t access the one institution able to throw them a lifeline in times of crisis.”

A failed attempt to corner the copper market spurred a “run” on New York’s second-largest trust, the Knickerbocker Trust. Due to its already low ratio of cash reserves to deposits from the earthquake-imposed financial stresses, the trust had to close its doors to withdrawal requests, spooking the public and causing a run on other trusts.

Credit markets froze as trust evaporated, which had significant costs for the American economy. The financing crunch hit small borrowers the hardest and resulted in a nationwide decline in industrial production.

Historical perspective

The ordeal, now known as the Panic of 1907, was America’s most brutal recession until the Great Depression just over two decades later. The Dow Jones Industrial Average dropped almost 40% in 1907, marking the last straw for regulators.

The panic directly led to the creation of the Federal Reserve, notes Catherwood, as the U.S. government sought ways to reduce the fragility of their markets and the frequent panics caused by gold shortages or external shocks.

He says further that “History isn’t a road map, but a compass,” meaning that “Reading all the financial history in the world will not enable you to predict everything that will unfold in financial markets…However, history acts as an invaluable compass for steering investors in the right direction in challenging times. By recognizing the patterns that repeat themselves over the course of centuries, we can better position ourselves for whatever lies ahead.”

Well said.

Takeaways

Our world is deeply unknowable yet surprisingly comparable to past eras. I (Shawn) would argue that we’re still learning about the financial fallout of our most recent exogenous shocks, the Covid-19 pandemic and Russia’s invasion of Ukraine.

The wisest among us will look to their historical compasses for guidance in these uncertain times. I know one thing for sure: The ripple effects will continue to prove deeper and stranger than anyone can anticipate.

Dive deeper

Check out Catherwood’s full write-up on the almost unbelievable story of how an earthquake moved markets.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.