Big Mac Index

27 September 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

✉️ By the way, we’re looking for other great newsletters to partner with to grow our community of readers.

If you write a newsletter, know someone who does, or just have some favorites to recommend — Hit reply to this email to let us know!

🚀 In other news, yesterday NASA successfully completed its mission to hit an asteroid ~7 million miles away with a spacecraft, in a test run to see whether we could use such a strategy to protect the earth.

We’ll know in a few months if they actually altered the space rock’s path.

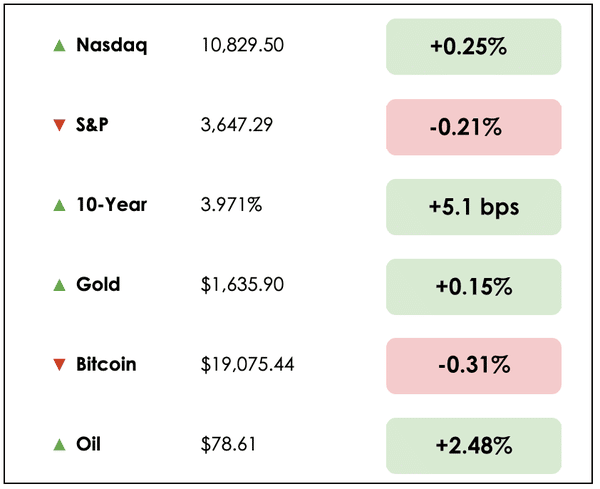

Here’s the market rundown:

*All prices as of market close at 4pm EST

Stocks were mixed today but saw some relief from the harsh selling of late, while geopolitical tensions rose after it was reported that Russia may have used explosives to sabotage the Nordstream 2 gas pipeline.

Today, we’ll discuss using Big Macs as an indication of currency value, a return to normalcy in the lumber markets, China’s moves to feed its massive population, and a breakdown of the ten commandments of investing.

All this, and more, in just 5 minutes to read.

Let’s go! ⬇️

IN THE NEWS

🍔 Big Mac Prices Highlight The Dollar Doom Loop (Bloomberg)

Explained:

- In 1986, the “Big Mac Index” was invented as a lighthearted way to compare currency purchasing power which highlights national living standards and relative currency value.

- With the dollar surging against most world currencies, analysts at Bespoke Invest found that in 53 out 56 countries, local Big Mac prices were higher than in the U.S. after converting from local currency to dollars.

- As measured in burgers, this indicates that the dollar is relatively overvalued.

What to know:

- This is, of course, not a serious measure for comparing purchasing power parity, though it does highlight that despite high inflation domestically in the U.S., Americans’ spending power remains strong globally on a relative basis.

- And the Big Mac, in a way, actually represents a meaningful, “bundle of commodities, labor, real estate, and productive assets” in its prices, according to the analysts.

- With the comparative cost of a burger rising, this is one small glimpse into how currency fluctuations influence the real world.

🪓 Lumber Prices Fall Back To Pre-Covid Levels (WSJ)

Explained:

- Remember the Covid lumber crisis? At one point in 2021, lumber prices hit over $1,600 per 1,000 board feet, but today the commodity trades at closer to $400 which is just above the average between 2015 and 2019.

- Prices soared as many Americans, locked down at home, sank their teeth into ambitious home remodeling projects, while a booming real estate market fueled new construction.

- As the Federal Reserve hikes interest rates to slow the economy, demand for lumber has been particularly sensitive, with one price index for lumber falling 60% since March.

What to know:

- New housing building rates in the U.S. are down 13% from April of this year when residential construction was at its highest level in nearly a decade. And for the ninth straight month, home builder outlooks declined in September.

- Despite two rollercoaster cycles of massive surges and declines in prices over the past two years, it appears that lumber mills and other market participants expect things to remain subdued now.

- One lumber distributor said, “The sexy lumber world is coming to an end, unfortunately.”

🎣 China Targets The Global Fish Supply (NYT)

Explained:

- In a recent New York Times investigation, journalists found that a single country accounts for 80% of the total fishing that occurs in the international waters near Argentina, Ecuador, and Peru, and it’s not South American. It’s China.

- Given the country’s massive population, as its economy has grown and lifted millions out of poverty, so too has grown its people’s appetite for various sources of protein, including fish.

What to know:

- As Chinese fishing boats aggressively deplete fish stocks in international waters, nearby governments are raising red flags.

- One fisherman said, “The industrial fleets are razing the stocks, and we are afraid that in the future there will be no more fishery.”

- It’s also possible that the magnitude of Chinese fishing vessel activity is being concealed, according to some industry experts, as suspicious movement patterns indicate that boats may be turning off their tracking transponders

DIVE DEEPER: PABRAI’S 10 COMMANDMENTS

Moses wasn’t the only one with commandments.

Here at The Investor’s Podcast Network, it’s no surprise that we are big fans of Mohnish Pabrai, and we love watching any interviews of him that are released. One of our recent favorites is one that he did with William Green on Richer, Wiser, Happier.

We discussed Pabrai’s thoughts on buying Apex Spawners last week, and we wanted to share something equally valuable that we came across in our further research of the famed investor’s principles.

In October 2018, Pabrai gave a talk to business students at Boston College called The Ten Commandments of Investment Management.

This was the first time that he discussed his money management principles to ensure capital protection and growth. However, he noted that most investment managers violate these commandments regularly.

These commandments are useful not only for professional money managers but also for anyone managing their own investment portfolio.

Likewise, knowing the commandments is useful if you need some guidelines to select a good money manager, now or in the future.

Let’s go through them.

Pabrai’s Ten Commandments

- Commandment 1: Thou shall not skim off the top — Pabrai feels that the traditional fee structure in wealth and asset management yields the wrong incentives. Most money managers take some percentage of fees as a fixed cost, and hedge funds typically take 1-2% off the top plus an additional performance fee.

He highlighted that the Buffett partnership, though, took no fees off the top.

Buffett, instead, took 25% of the returns once a 6% hurdle rate was attained. On an additional note, investment managers should first practice with their own money ideally and establish a solid track record before managing other people’s capital.

- Commandment 2: Thou shall not have an investment team — According to Pabrai, investment management is not a team sport. Rather, it’s designed to be an individual pursuit.

Investment decisions just don’t work well under the debate of extensive committees, according to Pabrai.

He argues that you do not even need many stocks in a portfolio. In a single year, you have plenty of time to individually research stocks and find a handful that fit your investment criteria.

Pabrai also says research and investment analysis is the fun part of the job (we agree with him), which a good investment manager will not want to delegate away to others.

- Commandment 3: Thou shall accept being wrong at least 40% of the time — This commandment can be attributed to John Templeton. Pabrai notes that investing is a very inexact science, and trying to determine the future of businesses is an extremely difficult art.

He claims that, at a minimum, four out of ten times we will fail to predict a company’s future accurately. So, it must be accepted that even the highest conviction ideas may not pan out.

Investing, then, is an exercise in ego management.

- Commandment 4: Thou shall look for stocks with a hidden P/E of 1 — The seasoned investor says it is wise to look for stocks based on future earnings or hidden earnings that are currently trading at a 1x multiple. He states, “when you can buy at this valuation, good things tend to happen. Looking for the hidden PE is a really good exercise.”

For example, Pabrai says that when he bought Fiat Chrysler, it was trading at less than $5 a share, and the company had forecast that by 2018 it would be earning about $5 a share.

In 2016, it spun off Ferrari, and including that it exceeded its forecasted earnings numbers. The P/E (price to earnings) of 1 materialized, and the investment increased by 7-8 times.

- Commandment 5: Thou shall never use Excel — Pabrai says the use of Excel should be avoided in making investment decisions.

He claims, “the investment process is simple, and you should not take the help of an Excel sheet to figure out if something is a great investment. If you cannot figure it out in your head, it can’t be a great investment.”

- Commandment 6: Thou shall always have a rope to climb out of the deepest well — Our take on this commandment stresses the importance of asset allocation. Never invest your entire portfolio in one asset class.

The market will have wild gyrations, and you’ll experience periods where performance is great and other times when (perhaps now) you question your investment choices.

Diversifying our investments broadly across different asset classes will allow for sound sleep even during deep market corrections. Being able to weather these storms psychologically is also part of having a long rope to help us climb out of the deepest of wells.

- Commandment 7: Thou shall be singularly focused —Pabrai stresses the importance of having an investment plan, adhering strictly to it, and not being lured away by the latest investment craze.

Only focus on the company and tune out macro news. The key is to buy good businesses at a fraction of their liquidation value or a small fraction of future earnings. Doing this is part of Pabrai’s “Heads I win. Tails I don’t lose too much” philosophy.

- Commandment 8: Thou shall never short a stock — Pabrai makes a great point in discussing shorting a stock (selling a stock first, buying it back later, and pocketing the difference if the price falls).

The maximum return shorting is 100%. However, the maximum downside is unlimited. According to him, this is a bad risk/reward trade and should be avoided.

- Commandment 9: Thou shall not be leveraged — You do not want leverage in your life. As Pabrai says, “to finish first, you need to first finish.

“Pabrai stressed the importance of not blowing up. If you compound at a stellar rate for many years, and then take on excessive risks that destroy your portfolio returns, then in total you’ve actually failed to compound at all.

The key is to spend less than you earn and put your savings into a compounding machine, thus meaning that we must take great care to be conservative in our investment management.

- Commandment 10: Thou shall be a shameless cloner — Pabrai says cloning is good for your health. Many great investors, and their high conviction ideas, are easily accessible for you to copy.

You can check out TIP Finance to see how many great super investors manage their investments — Try it out!

The bottom line:

Just as Moses gave humanity the 10 Commandments to live a good life, Pabrai has given us these commandments to follow for investment success.

Tell us readers — What’s your favorite commandment here?

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.