Bailouts

14 November 2022

Hi, The Investor’s Podcast Network Community!

Berkshire Hathaway’s (BRK.B) 13F dropped today, meaning we have new insights into Warren Buffet’s latest moves 🧠

In the third quarter, the Oracle of Omaha bought $9 billion worth of stock with a couple of new bets.

This included 60 million shares of Taiwan Semiconductor Manufacturing (TSMC), 5.8 million shares of the building materials manufacturer Louisiana-Pacific (LPX), and over 400,000 shares of Jefferies Financial (JEF), all while expanding his position in several oil companies 🛢️

(FYI, you can see his full portfolio with our TIP Finance tool.)

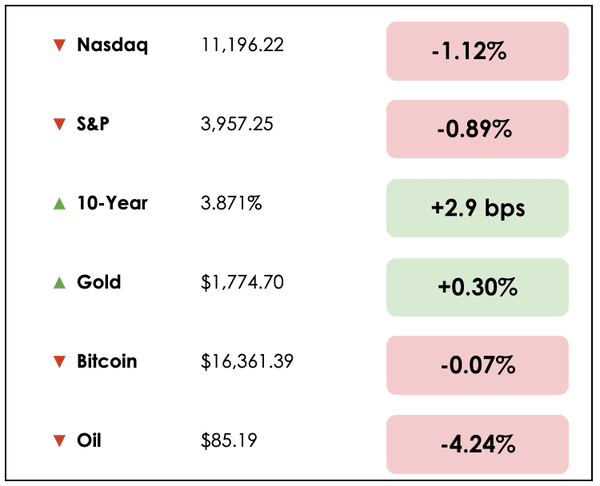

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: One firm’s plan to bailout the crypto industry and China’s latest moves to fend off a financial crisis, plus our main story on the secret sauce underpinning businesses like Amazon, Walmart, and Costco.

All this, and more, in just 5 minutes to read.

Do you want to write for this newsletter? Apply here.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

💰 Binance Pledges To Create Crypto Industry Recovery Fund (Reuters)

Explained:

- While the digital asset space navigates financial contagion after the collapse of the large exchange FTX (formerly best known for owning the naming rights to the Miami Heat’s arena), one CEO, Changpeng Zhao of Binance, plans to launch a fund that will offer needed capital to companies in crisis.

- CZ, as he’s known, tweeted that the fund will help “reduce the further cascading negative effects of FTX.”

- Given the fraud committed at FTX, the CEO also emphasized that more regulation was necessary to protect customers interacting with crypto-related businesses.

Why it matters:

- Following FTX’s epic demise, firms like Binance are left picking up the pieces of an industry that must rebuild trust with the public and regulators. This is particularly ironic since FTX’s CEO was the former face of lobbying efforts to D.C.

- While Binance appears to be a “winner” from this debacle, it can’t allow the entire industry to crumble, hence the bailout fund it plans to start. This is doubly ironic because FTX was famous for bailing out companies like BlockFi that were hurt by the Three Arrow’s Capital blow-up earlier this year.

- Unlike when financial firms began collapsing in 2008, the Federal Reserve isn’t coming to bail out companies hurt by FTX. The pain, then, won’t end until big investors step in to re-capitalize struggling crypto firms themselves, and maybe Binance will lead the way on this front.

📄 China Announces Property Market Rescue Plan (Bloomberg)

Explained:

- In China’s slow-motion real estate crisis, the government just released a 16-point plan to hopefully turn things around. Chinese property builders saw their stocks soar on the news as reduced restrictions and more access to liquidity prompted hopes that the worst could be avoided.

- However, China’s $2.4 trillion new-home market remains fragile as defaults have surged. And developers in the country still face a mountain of looming debt maturities, estimated to be at least $292 billion worth of borrowings coming due through 2023.

Why it matters:

- A director at one Beijing-based investment bank indicated that if liquidity continues to deteriorate for property developers as debt maturities peak, “This will very likely trigger systemic financial risk.”

- The plan comes just as China’s Xi Jinping and U.S. President Joe Biden are set to meet for the first time in person since the pandemic began and as health authorities issued new measures to reign in harsh Covid restrictions.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

WHAT ELSE WE’RE INTO

📺 WATCH: The Way to Wealth by Benjamin Franklin, a book review of the Founding Father’s financial advice from Shawn O’Malley

👂 LISTEN: How to create a recession-proof financial plan with Dave Alison, on the Millennial Investing podcast

📖 READ: The inspiring and depressing insights from data on how we spend our time, a thread by Sahil Bloom

THE MAIN STORY: THE GREATEST INVESTOR YOU’VE NEVER HEARD OF

Overview

Nick Sleep of Nomad Investment Partnership has said, “The trick, it seems to us, if one is to be a successful long-term investor, is to recognize the sources of enduring business success, get in early, and own enough to make a difference.”

What are the ingredients of enduring business success?

To answer this, we turned to a fantastic article by Thomas Chua about Nick Sleep, in which he discusses one of Sleep’s key concepts for lasting investment success — Scaled Economics Shared (SES).

The Greatest Investor You’ve Never Heard Of

If you studied the early years of Nick Sleep’s career, you likely wouldn’t have pegged him to become a future investing legend featured alongside icons such as Charlie Munger, Joel Greenblatt, and Mohnish Pabrai in William Green’s book Richer, Wiser, Happier.

Nick dreamt of becoming a landscape architect and worked in the field before getting laid off. He found the work boring and uninspiring.

At loose ends, he read a book called Investment Trusts Explained to see if, perhaps, the investing business was for him. Spoiler alert: It was.

The book inspired him to enter the investment industry and, later, he teamed up with Qais Zakaria to form Nomad Investment Partnership. Over 13 years, the fund returned 921.1% versus 116.9% for the MSCI World Index and 149% for the S&P 500.

Someone with the foresight to put $1 million with Nick and Zak would have watched their investment soar to $10.21 million.

But Nick and Zak shut the fund down in 2014, returned the money to their investors, and became involved in philanthropic pursuits.

What it is

As Chua writes, one of the most powerful compounding tools is Scaled Economics Shared, a term coined by Sleep and his partner that defined their stock-picking approach.

The SES strategy creates a perpetual growth machine where a company benefitting from economies of scale chooses to lower its prices and improve its offerings to customers to win market share over the long term.

As SES businesses grow larger, it becomes harder for competitors to offer as much value to customers. Ultimately, the strategy creates a flywheel effect that becomes unstoppable. Examples include Amazon (AMZN), Walmart (WMT), and Costco (COST).

Sharing scale doesn’t always have to result in reduced prices, though. It can also include improving the customer experience via increased selection and convenience.

Amazon and Costco, two of the best SES businesses, comprised roughly two-thirds of Nomad’s portfolio. They discovered early on that companies utilizing Scaled Economics Shared increased their chances of compounding effectively for many years.

Breaking down SES

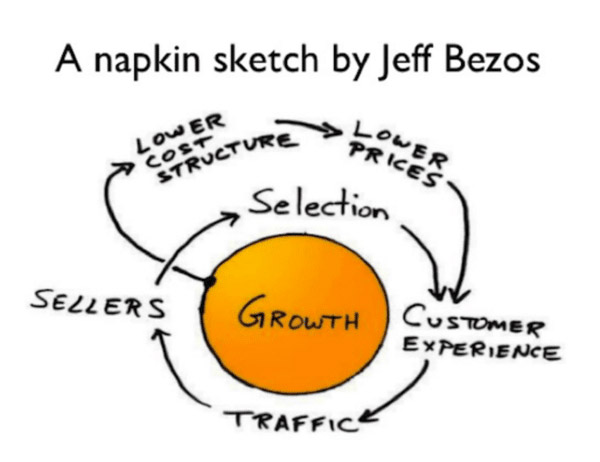

If you look closely at the napkin sketch above by Jeff Bezos, you’ll notice there is no arrow pointing outwards titled “take profits.”

It’s, instead, a closed loop. Profits are plowed back into the business to create lower cost structures, lower prices, and an enhanced customer experience which engenders lifetime loyalty.

As Jeff Bezos said in his 2015 letter to shareholders, “We want Prime to be such a good value, you’d be irresponsible not to be a member.”

The Amazon founder clearly understands sharing scale advantages with customers.

Takeaways

Chua explains that SES businesses delay gratification while giving their customers instant gratification. SES businesses reinvest their scaled benefits into improving the value proposition for the customer, even if the financial return isn’t immediate or guaranteed.

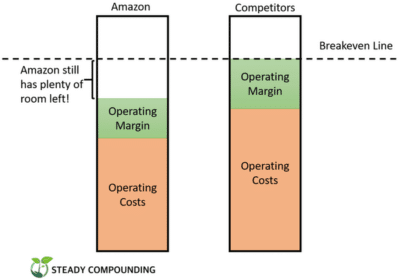

Amazon executed Scaled Economics Shared so well that its operating costs and operating margins are significantly less than competitors.

This means that, even if Amazon’s competitors were to price their products at break-even, they still couldn’t match Amazon’s profitability. In other words, Amazon can completely price its competitors out of the market while remaining profitable.

As Chua writes, “it’s hard to find a business model with a greater margin of safety than this.”

This is the power of Scaled Economics Shared, and Sleep’s deep understanding of it fueled his remarkable returns.

Dive Deeper

Check out an in-depth review of Nick Sleep from Clay Finck on the We Study Billionaires podcast.

For more Thomas Chua, he’s the founder of Steady Compounding, a newsletter that breaks down important business and investment concepts, and timeless lessons from super investors such as Warren Buffett, Mohnish Pabrai, Peter Lynch, and many more.

You can click here to sign up and grab a free copy of his Warren Buffett investing checklist.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.