Au Contraire

10 October 2022

Hi, The Investor’s Podcast Network Community!

Hope everyone had a great weekend and welcome back to We Study Markets!

We had some fantastic responses to our recent reader survey and wanted to thank everyone that took the time to let us know how we can continue to improve the newsletter.

If you haven’t already, please take 30 seconds and fill out this survey to tell us what topics you’d like to hear more about — Don’t pass up your chance to shape We Study Markets!

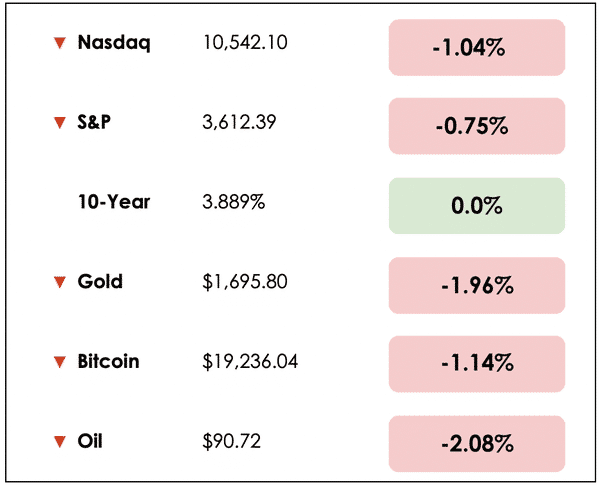

U.S. stocks fell Monday as investors continue to be concerned about potential Federal Reserve rate hikes, further escalation in Ukraine, and China trade policy.

Earnings season for the 3rd quarter starts in earnest this week, and the big banks all will weigh in with their numbers on Friday 🏦

U.S. bond markets were closed due to Columbus Day and Indigenous Peoples’ Day.

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss aggressive trade restrictions against China, the inflationary impact on 3rd quarter profit margins, PayPal’s misinformation scandal, and how to take a contrarian approach to investing.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

IN THE NEWS

⛔ U.S. Slams China With More Sweeping Tech Restrictions (Bloomberg)

Explained:

- The U.S. Commerce Department on Friday revealed new regulations that may hinder the Chinese economy’s ability to develop everything from semiconductors and supercomputers to surveillance systems and advanced weapons.

- The aim is to target the sale of semiconductors and chip-making equipment to Chinese customers from the U.S., and the moves are seen as the most aggressive yet from the Biden administration in blocking rivaling Chinese tech capabilities.

What to know:

- Some Chinese officials spent the weekend demanding retaliation from the government and warning of “economic war” between the two countries.

- Dan Wang, an analyst at Gavekal Dragonomics wrote: “The rules are a directional signal about U.S. policy on China: a very hawkish consensus is now cemented in place.”

- Relations between the U.S. and China continue to decline, and the consequences from this economic escalation will surely be quite significant, with China’s Foreign Ministry spokesperson saying the measures will “deal a blow to global industrial and supply chains and world economic recovery.”

📉 Inflation Is Expected To Squeeze 3rd Quarter Profits (WSJ)

Explained:

- While many large U.S. businesses have succeeded in raising prices in response to inflationary pressures, others like Olive Garden and LongHorn Steakhouse operator Darden Restaurants Inc. (DRI) say that inflationary costs are rising faster than their price hikes.

- Corporate profit margins hit historically elevated levels in recent quarters fueled by robust consumer demand, but expectations for many of the upcoming third-quarter results are increasingly pessimistic.

- JPMorgan’s (JPM) chief U.S. economist said, “It might be a tough quarter for margins…I wouldn’t expect a big margin squeeze, but I think it’s going to be tough to expand margins from here.”

What to know:

- Excluding the energy sector, Refinitiv analysts believe this next round of earnings data will yield a 2.6% decline in profits from the same period in 2020.

- Darden has sought to keep its price increases subdued, only raising by 7.5% over the last two years, in contrast to a 14% increase at full-service restaurants broadly.

- The company is hoping that margin pressure will lessen as commodity prices continue to moderate and productivity measures like simplifying menus and production processes take effect.

🤨 PayPal Says Policy To Fine Customers For ‘Misinformation’ Was An Error (Reuters)

Explained:

- After a public outcry that sent PayPal’s (PYPL) stock down 6% following an announcement that the company would fine users for spreading misinformation in a policy update, company officials are now saying that “this language was never intended to be inserted in our policy.”

- The company apologized for the confusion, as a number of media outlets reported that PayPal’s policy update enabled them to limit services for any users that engaged in “sending, posting, or publication of any messages, content, or materials” promoting misinformation.

What to know:

- PayPal’s former president David Marcus denounced the company’s move initially in saying that it “goes against everything I believe in.”

- The clarification likely comes as welcome news to both investors and users of the service.

- Marcus continued on by saying, “A private company now gets to decide to take your money if you say something they disagree with. Insanity.”

WHAT ELSE WE’RE INTO

📺 Watch: Why microcaps have the best year-to-date performance. We Study Billionaires interviews Ian Cassel for the answer.

👂 Listen: Clay Finck, who will be taking over as a host of We Study Billionaires, interviews The Investor’s Podcast co-founder Stig Brodersen, about the company’s early days.

📖 Read: Farnam Street’s Brain Food with Annie Duke on the art of quitting.

DIVE DEEPER: CONTRARIAN INVESTING WITH DAVID DREMAN

We all have a favorite investing book that made a lasting impact on us and turned us on to the challenging pursuit of investing.

For some, it may have been One Up on Wall Street. The Intelligent Investor may have greatly influenced others. For me (Patrick), it was a book given to me in high school by my uncle called Contrarian Investment Strategy by David Dreman.

The Backstory

David Dreman is arguably one of the founding fathers of contrarian investing, and his methodology, when it comes to stock selection, generally opposes or rejects popular market opinion.

He has deeply studied the psychological underpinnings of the stock market and its impact on valuation levels. Dreman sees markets as driven by emotions that often push prices too far in either direction from their intrinsic or “fair” value.

He runs Dreman Value Management and says, “we stand apart, not merely for the sake of being different, but because the popular thing to do is often not the smart thing to do.” He believes that markets are not perfectly efficient and that behavioral psychology plays a considerable role in stock price movements.

What is it?

Contrarian investors seek to understand and profit from the market’s emotional misjudgments by going against the crowd. They’ll do this by seeking out-of-favor stocks and avoiding high-flying “vogue” stocks driven up by market euphoria. Eventually, the market rediscovers out-of-favor stocks and lets the high fliers fall back to earth.

Dreman feels that the best approach to beating the market is to follow the principles of contrarian investing. For over 30 years, he has advocated his strategies in books and as a financial columnist for Forbes.

In 1980, he wrote Contrarian Investment Strategy — The Psychology of Stock Market Success. I’m not sure why the book clicked for me, but it made intuitive sense to buy stocks that had been beaten down in price that most investors were shunning.

What they’re saying

Michael Mauboussin, a Columbia University adjunct finance professor, said, “if you distinguish the great investors from the average investors, it’s not because their cost of capital calculation is more accurate. It almost always has to do with the fact that they’re able to make good decisions and be correctly contrarian in adversity.” He goes on to say, “being contrarian for the sake of being contrarian is a bad idea.”

Said another way, choosing unpopular stocks to invest in doesn’t ensure you’ll make money. However, using solid, fundamental analysis as part of your decision-making process can help you be “correctly” contrarian.

The Problem

The main problem, as Dreman sees it, is that investors tend to get in their own way by overreacting to market news. This tendency is something that the contrarian investor can take advantage of and profit from.

For example, investors often overprice “hot” stocks and consistently underprice those that trigger doom and gloom media attention due to price dips.

Dreman says that popular stocks with stretched valuations have a long way to fall if they don’t meet expectations and little room to climb in the event they meet or exceed expectations.

The trouble is human beings are often poor forecasters, especially in a rapidly expanding, complex, multinational business environment. Even a 1-cent miss in an earnings forecast can sometimes result in a popular stock dropping 20% or more.

The opposite is true for out-of-favor stocks, which can have a lot of headroom and less downside risk since they’ve already been beaten down in price.

Say No to the Herd

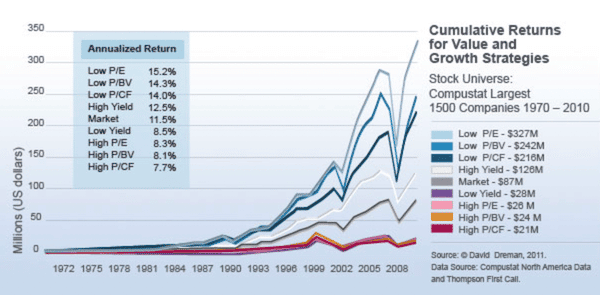

By going against the herd mentality, Dreman argues, the smart contrarian investor has the chance to beat the market by focusing on stocks that are priced in the lowest 20% of the market in relation to such fundamentals as price/earnings, price/cash flow, price/book, and price/dividend ratios.

Dreman says the contrarian investor can’t just go bottom-feeding on price-based measures alone. To ensure that a company is fundamentally and financially sound, he also looks at metrics such as return on equity, profit margins, and debt-to-equity ratios in his analysis.

Below is a chart from Dreman’s website showing the cumulative returns using both value and growth investment strategies from 1970-2010:

The Strategy

Dreman Value Management’s basic investment strategy is to buy financially strong companies paying above-average dividends but are currently out of favor. Over time, their studies indicate that there will be a resurgence of earning power in a great majority of cases followed by renewed enthusiasm and higher market prices.

Dreman believes the best way to identify undervalued stocks is through a low price-to-earnings approach to stock valuation. Although the low P/E method has an outstanding statistical record, it is rarely followed by investment advisors or investment committees of large banks or insurance companies.

Why?

The answer lies in behavioral finance. There are simply too many forces in the contemporary money management environment, including peer pressures, client pressures, career pressures, and psychological forces, resulting in following the prevailing trends and fashions.

The failure to adhere to proven and disciplined investment philosophies is one of the main reasons for so many management firms’ lackluster records. Countless studies on low P/E investing suggest that the cost to their clients in terms of “investment opportunities foregone” has been enormous.

By combining a deep understanding of behavioral finance with a low P/E approach to stock selection, Dreman claims may provide the best way to beat the market over time. This contrarian value philosophy leads to a highly disciplined approach to investing that avoids style drift and offers downside protection.

Takeaways

It takes strong conviction to stick with Dreman’s investment philosophy, especially in years when beaten-down value stocks continue to stay out of favor. The method can generate great returns, but there will also likely be years of underperformance.

However, investors who maintain a contrarian mindset and appreciate the tenets of value investing would be well-served by looking at the Dreman-inspired model and learning from it.

Go Further

There is much more to David Dreman’s contrarian investment strategy. Check out NASDAQ’s article here to learn more about the metrics he uses to select high-quality contrarian stocks.

You can also use TIP Finance to help you screen for stocks that meet Dreman’s criteria.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.