125-Bagger

Hi, The Investor’s Podcast Network Community!

Higher borrowing costs are again squeezing affordability. A mortgage rate increase from 6.4% to 7.4% would have the same effect on affordability as a 10% increase in home prices.

By some measures, this is the least-affordable market for homebuyers since the ’80s 🤯

What do you think — are rates impacting your homebuying or selling decisions?

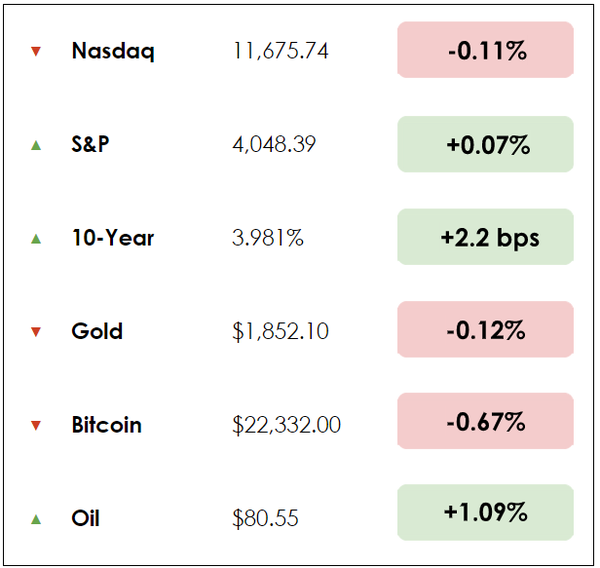

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- How Citadel printed money in 2022, thanks to the weather

- Companies respond to Fed’s “higher-for-longer” rate policy

- Plus, our main story on a stock posting 30%+ gains

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

History of positive returns ✔️

Inflation-hedging potential ✔️

Resistance to market volatility ✔️

Land has helped investors preserve wealth for generations, and AcreTrader makes it easy to diversify with farm and timberland assets online — Find out how.

IN THE NEWS

⛈️ How One Hedge Fund Profited From the Weather (FT)

Explained:

- In 2018, Ken Griffin’s hedge fund, Citadel, recruited a team of 20 scientists whose weather forecasts are often more accurate than most meteorological offices. It was a seemingly bizarre move.

- However, early insights into weather patterns enabled Citadel to generate a record 38.2% return last year, earning a $16 billion profit and displacing Ray Dalio’s Bridgewater as the most successful hedge fund ever. But even by hedge fund standards, Citadel is secretive. It’s clear, though, that the firm benefited from rising energy and commodity prices.

- One investment advisor commented, “Citadel’s institutional energy trading and commodities operation was surely a big benefit to their eye-popping year.” Yet many of Citadel’s rivals have much less exposure to commodity prices, likely because unexpected swings in supply and demand can move prices wildly.

- That is, if you don’t have the power of weather forecasting at your fingertips.

Why it matters:

- In gas markets, predicting supply, which largely flows through established pipes, is typically more straightforward. But forecasting demand is much harder and influenced by weather. A hot summer or frigid winter can cause surges in air conditioning or heating, boosting demand for commodities like natural gas to power those systems.

- This is where Citadel has a key advantage, feeding its traders real-time information from its London-based weather team using supercomputers to forecast the impact of seasonal trends down to thunderstorms. In a chaotic European energy market last year, this data has proven essential for nimbly trading gas and power prices.

- Financial markets are cutthroat, and the lengths investors will go to get an advantage may seem almost unbelievable. This is all par for the course in a hedge fund industry with billions on the line — Citadel charged its clients $12 billion in fees and expenses last year.

💲 Companies are Borrowing Again (WSJ)

Explained:

- After over a decade of unusually low-interest rates on debt that bottomed during the pandemic, rapid rate hikes last year pushed many companies to the sidelines of debt markets. However, with the initial shock wearing off, companies are increasingly looking to lock in fundraising efforts, especially as the Fed doubles down on its commitment to keep rates “higher for longer.”

- For riskier companies with speculative-grade (aka “junk bond”) credit ratings, like Caesars Entertainment (CZR) and American Airlines (AAL), financing needs outweigh concerns that capital comes at a considerably higher interest cost. More junk bonds were issued this January and February than in the entire second half of 2022.

- It’s not just firms with shaky finances hurrying to issue bonds: Axios reports that the investment grade bond market, for more stable companies, saw an explosion in debt issuance last month that tallied $147 billion, crushing estimates in the $90-to-100 billion range.

Why it matters:

- U.S. Bank’s head of investment grade bond trading remarked that companies wanted to “get a lot of their issuance out of the way, for fear that they could run into higher rates if they were to delay issuance.” Painfully, the corporate world is adjusting to a new paradigm where the ultra-low rates of the 2010s and pandemic era may soon become a distant memory.

- The 10-year Treasury bond yield, a benchmark for much corporate borrowing, is hovering around 4% after rising from near zero in 2020. Except for the period after the 2008 financial crisis and for a few years following World War II, 10-year yields below 3% is a historic anomaly since the 1800s.

- Where interest rates settle after the Fed finishes hiking remains to be seen, but if it’s anywhere close to historical norms, companies are right to try and borrow as much now before rates rise even further.

WHAT ELSE WE’RE INTO

📺 WATCH: Patrick Collison’s manifesto on reading

👂 LISTEN: The best capital allocator you’ve never heard of

📖 READ: The luckier you are, the nicer you should be (Housel)

What if I told you there was a company with the following characteristics:

- High margins

- Low leverage

- High return on invested capital

- Historical stock returns of 30%+

- One of the best capital allocators at the helm

Would you be interested?

Enter Mark Leonard and Constellation Software.

Our colleague, Clay Finck, just released a podcast covering Constellation Software, which piqued our interest to dive in further.

The story

Constellation Software was founded in 1995 and focuses on acquiring small to midsize vertical market software (VMS) companies.”

This is a highly profitable endeavor as these businesses tend to have high margins, strong moats, recurring and sticky revenues, strong pricing power, and deep customer relationships.

Constellation IPO’d in 2006 and has acquired more than 600 businesses globally.

Constellation’s decentralized structure enables it to operate as a holding company, acquiring software companies and allowing them to operate independently. The acquired companies retain their existing management teams, and Constellation provides the necessary resources to support their growth, including capital, technology, and expertise.

This approach has proven successful as the acquired companies operate efficiently, maintain their market position, and generate sustainable profits. With each business Constellation purchases, they intend to hold it forever.

Track record

Constellation has a proven track record of growth, with its revenue and earnings per share increasing consistently over the past decade. Over the past ten years, revenue grew from $891 million in 2012 to $6.1 billion, with gross margins being nearly 90%.

Constellation’s growth is fueled by its acquisition strategy. Their average acquisition has been around $5 million, but due to their ever-growing profits, they have begun to perform acquisitions as large as $700 million.

The management team is conservative in its acquisition strategy and strictly adheres to internal hurdle rates.

Constellation Software’s stock has been one of the best-performing companies on the Toronto Stock Exchange, with an average annual return of 34.8% over the past ten years vs. the S&P 500’s average return of 10.2%.

Mark Leonard

Mark Leonard is one of the most interesting founders we’ve studied. He keeps a low profile despite his estimated net worth of $2 billion. There are few public photos of him and no interviews. Leonard unquestionably has been an essential figure in Constellation’s rise.

Leonard’s letters to shareholders provide valuable insights into the company’s culture, acquisition strategy, and prospects. His writings focus on the long-term outlook, emphasizing the importance of acquiring high-quality businesses, retaining their management teams, and fostering a culture of innovation and entrepreneurship.

His focus on creating value for shareholders and maintaining a high level of transparency in communication has earned him praise from investors.

Like us here at The Investors Podcast Network, Mark Leonard is an avid learner. He has been ruthless in studying other holding companies and great investors such as Warren Buffett and Charlie Munger. And like Buffett, Leonard has continued to under-promise and overdeliver.

Culture

The company’s decentralized structure allows the acquired businesses to maintain their unique cultures while Constellation provides the necessary resources to support their growth.

This has created a diverse and innovative environment where employees are encouraged to take risks, develop new products, and create value for customers.

The company’s culture also emphasizes accountability and responsibility. Each acquired business is responsible for its operations, and its success or failure hinges on the decisions made by its management team.

This approach fosters a sense of ownership among the employees, as they’re responsible for the growth and profitability of their businesses.

The company also provides employees with training, development, and career advancement opportunities, creating a culture of continuous learning and improvement.

Constellation has built a reputation as a holding company to whose founders would be more than happy to sell their business when ready.

Conclusion

Constellation Software has been one of the best-performing stocks over the past decade. Can that continue?

Constellation’s success has attracted many companies trying to replicate their business model, but that hasn’t stopped Constellation from continuing to succeed in its decentralized acquisition strategy.

As its business continues to grow, the company will need to keep finding new ways to redeploy capital outside of the small to midsize VMS market.

If Constellation is able to continue to fend off competition in finding the best deals and create synergies within its ecosystem, it could reach new heights.

Dive Deeper

To learn more about the brilliance of Mark Leonard and Constellation Software, be sure to check out Clay Finck’s recent episode doing a deep dive into the company. You can tune in here.

What do you think of Constellation Software and Mark Leonard? Let us know by replying to this email.

(Full Disclosure: Clay has ownership in shares of Constellation Software.)

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.