Democratizing AI

Hi, The Investor’s Podcast Network Community!

It’s Friday!

Let the gauntlet of quarterly corporate conference calls, aka “earnings season,” commence 📞

After watching Washington blunder along as one of the NFL’s worst franchises for nearly my entire life, words cannot capture the relief I feel now that the team has sold to new ownership. Being a D.C. sports fan is a difficult burden to carry.

🏷️ A word on valuation: My question is whether the team deserves its $6 billion price tag — the highest ever price paid for a professional sports team…

—Shawn

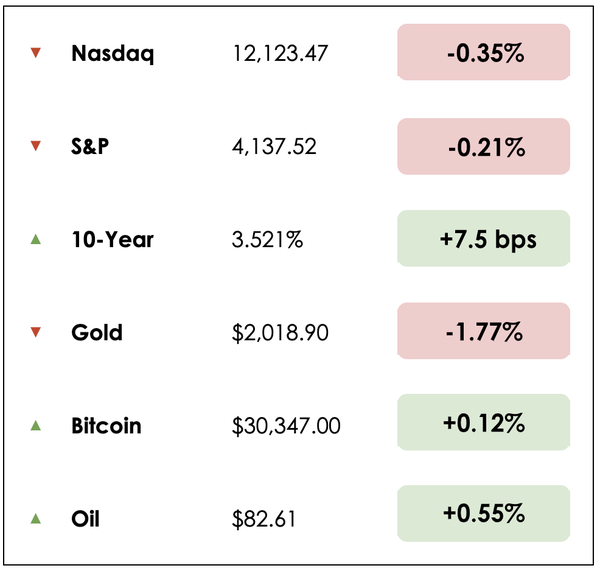

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss in the news:

- Banks kick off earnings season

- Amazon’s bets on artificial intelligence

- Plus, our main story on how the plant-based food market has exploded in recent years

All this, and more, in just 5 minutes to read.

Pop quiz: In which country was the first stock market formed?

Scroll to the end to see the answer.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

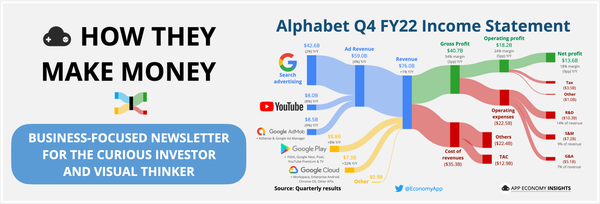

“Have you seen these charts before?

Discover How They Make Money, a business-focused newsletter for the curious investor and visual thinker.

Dive into visual insights on businesses like Google, Apple, and Tesla. Elevate your financial knowledge by learning from Bertrand Seguin, a former financial auditor and corporate strategist.

Subscribe now for concise, data-driven content that respects your time.”

IN THE NEWS

💥 Banks Kick Off Earnings Season With A Bang (WSJ)

Explained:

Four of the biggest U.S. banks, including JPMorgan and Citigroup, reported earnings Friday that easily exceeded expectations, despite the industry turmoil.

- JPMorgan posted a blowout quarter, with profits climbing 52% year-over-year to $12.5 billion, beating expectations by a wide margin. While rising rates hurt many smaller banks, the biggest have made out quite well.

- CEO Jamie Dimon, who helped lead a big-bank plan to backstop First Republic Bank, said the bank had acted as “a pillar of strength in the banking system.” He said the economy remains healthy, but the banking upheaval will likely slow down lending.

Why it matters:

Too big to fail? First-quarter results from the nation’s largest lenders demonstrate why they’re better positioned than smaller rivals to withstand recent challenges.

After depositors raced to pull out their cash from regional banks, they put their money in large institutions such as JPMorgan, the nation’s biggest bank. Its net interest income, what it makes on loans minus what it pays depositors, rose 49% to a record $20.71 billion, as its lending income more than doubled.

- Reports The WSJ: “A glut of deposits has allowed large banks to keep funding costs down while the Fed’s rapid rate increases increased its earning power on lending.”

- Regulators also require them to maintain greater buffers to absorb losses and demonstrate enough liquidity to withstand unexpected economic turmoil.

JPM’s CFO, Jeremy Barnum, told reporters, “it seems to me that the system as a whole is in very good shape. And we’ve had a rough spell in March, but things are looking better now.” This aligns with Warren Buffett’s comments this week: “Nobody is going to lose money on a deposit in a U.S. bank. It’s not going to happen.”

🤖 Amazon Is ‘Democratizing Generative AI’ (AMZN)

Explained

Amid the hubbub of ChatGPT and AI, one tech giant has remained rather quiet. But Amazon’s “best days” are ahead despite “turbulent times,” CEO Andy Jassy wrote in his second annual shareholder letter. And AI is playing a big part in the company’s next chapter.

- Large language models (LLMs) and Generative AI projects will be “transformative” for the company. The two areas are “core to setting Amazon up to invent in every area of our business for many decades to come and where we’re investing heavily,” Jassy wrote.

- “Let’s just say that LLMs and Generative AI are going to be a big deal for customers, our shareholders, and Amazon,” he concluded, without further detail because he “could write an entire letter” on why.

Why it matters:

Amazon benefited greatly from the pandemic, and its share price doubled. But in the last five years, it’s underperformed the S&P 500 since getting cut in half last year.

- Amazon Web Services (AWS), its profit engine, grew 29% in 2022 but “faces short-term headwinds right now as companies are being more cautious in spending.”

- The company doubled its 25-year fulfillment center footprint in two years, when the consumer side of its business grew by 77% in annual revenue between 2019 and 2022, there’s been “a lot of optimization needed” to bring costs down.

Jassy is still making continued bets on healthcare and satellite internet, which he says could pay off in the same way AWS has. It’s a bold statement, but Amazon knows it must keep innovating to stay ahead of the pack.

MORE HEADLINES

⛽ Russian oil exports bounce back to pre-war levels

💰 Hedge funds aren’t managing to beat the market

🎭 Broadway’s iconic ‘Phantom’ tickets sell for $4,000

The inception of the vegan food market

Who doesn’t love a great burger? It’s probably a rhetorical question. A good ol’ hamburger is one of America’s most famous comfort foods worldwide.

Although originally, a burger consisted of ground beef grilled and placed between two halves of a bun, preferably with two deep-fried strips of bacon and some veggies if you ask us, today, you don’t need to be a meat lover to fall in love with burgers.

The most recent data analyzed by the Plant-Based Foods Association (PBFA) shows that U.S. retail sales of plant-based foods continue to grow.

Though “Veganism” originated in 1944, the concept traces back to ancient Indian and eastern Mediterranean societies.

Since hitting $4.8 billion in 2018, sales have jumped 46%, bringing the total plant-based U.S. market value to an all-time high of $7.4 billion in 2021, outpacing the growth of the overall food industry.

According to research conducted by PBFA, nearly half (48%) of all restaurants currently offer plant-based alternatives, representing a 62% increase since 2012. Finding plant-based alternatives to meat, dairy, eggs, or confectionery in restaurant menus across the U.S. is becoming easier.

PBFA analyzed data from operators across various segments, including on-site, quick service, fast casual, fine-dining, and more, to shed light on how plant-based foods have been adopted within the food service industry.

The data shows that plant-based companies are focusing on restaurants because these are often where consumers experience new food trends for the first time.

Driving factors

There are many reasons for the vegan market’s significant growth, which derives from how today’s consumer approaches well-being, health, and the environment.

- Living healthier by eating less meat – consumers became more aware of how food influences their health and well-being

- Rising awareness of animal cruelty – consumers have access to various news reports painting more color around the frequently poor quality of farming conditions

- High cost of meat – due to inflation and higher costs of meat production, the cost of a restaurant dish has risen by 7.9% in just three months. This has forced some restaurants to remove comparatively expensive meat dishes from their menus

- Environmental-consciousness – consumers are increasingly mindful of climate change and the impact meat production has on it

- “Vegan” is not reserved for foodies – It has gone beyond the dining experience, exploding in industries like fashion. The fashion designer Stella McCartney has introduced a fashion line where 91% of pieces are made from responsible, traceable, and organic materials, free from leather, feathers, fur, and exotic skins

Investors know

There’s an increasing demand for plant-based food, and many entrepreneurs, investors, and pop culture icons have spotted the opportunity.

One of the believers is the billionaire investor Mark Cuban. He’s known for selling Broadcast.com for $5.7 billion to Yahoo, and he’s one of the main “sharks” in the Shark Tank show.

He’s noticed the growth potential of plant-based food, which reflects in his numerous investments in vegan products and companies like Wild Earth, Unreal Deli, or Everything Legendary. The last one carries plant-based burgers, which Mark Cuban became crazy about.

Cuban says, “It’s going to keep on growing quickly. People realize that eating plant-based is better for their own health, for the environment, and it now tastes great!”

While there are plenty of public companies with vegan products in their portfolio, there are relatively few pure-play vegan businesses. Beyond Meat was the first vegan IPO, listing on the Nasdaq in 2019. Oatly was another purely vegan stock chosen to list in 2021 on the Nasdaq.

Neither has performed particularly well, though: Oatly is down 89% since its IPO, and Beyond Meat is down 65% in the past year.

Nevertheless, there are more examples of vegan business ideas that attracted passionate investors from pop culture, including:

- Actress Natalie Portman invested in vegan whole-cut meats

- Robert Downey Jr., aka the Ironman putting money into vegan whole-cut bacon

- Snoop Dogg, who financed plant-based pork rinds

- Bill Gates investing in a startup making stretchy vegan cheese from soybeans

By the numbers

Here are some notable insights about the U.S. vegan market and American consumers’ preferences and habits:

What are vegan alternatives?

Plant-based meat like tofu bacon, dairy made of nuts, confectionery consisting of agar, fruits, and syrups, and beverages like almond milk, soy milk, or coconut milk.

Who loves plant-based?

Almost one-third of the population (28%) has a high affinity for plant-based, primarily among Gen Z and Millenials, which skews toward women.

What are the fastest-growing vegan alternatives you can find in U.S. restaurants?

- Plant-based cheese has grown 110% in four years

- On restaurant beverage menus, almond milk is the top-offered alternative milk and has grown 41% over the past four years

- Over the past year, more plant-based analog varieties took off, like plant-based egg marking 52% growth, or plant-based seafood marking 57% growth

Dive deeper

Readers, what do you think of vegan alternatives? (Hit reply to let us know).

To learn more about the vegan market, check out the PBFA research here.

TRIVIA ANSWER

The first stock market was formed in the Netherlands in 1611, and the Dutch East India Company was the first publicly traded company.

SEE YOU NEXT TIME!

Help us improve! Leave comments/suggestions/feedback anonymously here.

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.