Age of AI

Hi, The Investor’s Podcast Network Community!

Is Deutsche Bank next to fall? 😮

Fear of a European banking crisis drove a selloff in Deutsche’s share price Friday. It thrusts one of Europe’s most important lenders into the center of concerns about the health of global financial system (more below.)

The S&P 500 didn’t bat an eye, however, closing higher on Friday. It’s been flat over the last month amid all the chaos in the banking sector.

🏀 In lighter news, the Sweet 16 and Elite Eight continue this weekend. By Sunday night, only four teams will remain in the NCAA Tournament.

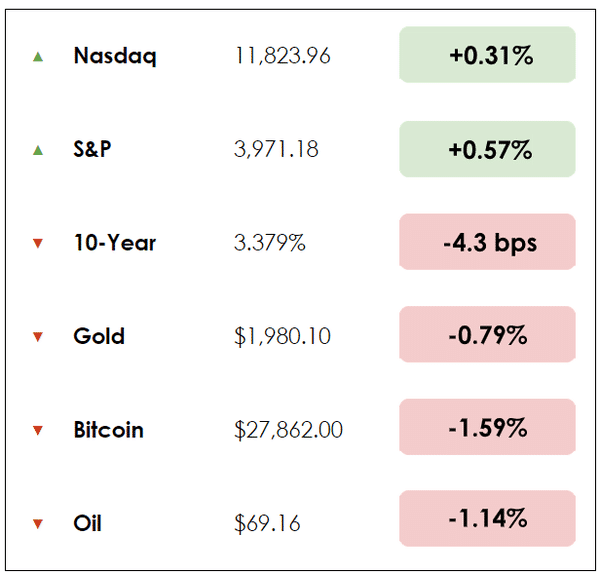

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Why all eyes are on Deutsche Bank

- What’s going on with capital markets

- Plus, our main story on Bill Gates’ compelling essay about AI

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

Simple setup for new Bitcoiners ✅

Advanced features for Bitcoin veterans ✅

The Bitcoin wallet for your every need ✅

Blockstream Jade is the only hardware wallet designed for your whole Bitcoin journey. Visit store.blockstream.com and use coupon code: ‘Fundamentals’ to get 10% off your Blockstream Jade.

IN THE NEWS

👀 All Eyes on Deutsche Bank (Bloomberg)

Explained:

- We’re as tired of writing about banks as you probably are reading about them, but the saga continues on. Following Credit Suisse’s demise last Sunday, Deutsche Bank has become the latest focus of investors’ attention.

- The bank’s stock dropped as much as 15% Friday after announcing debt repurchase plans. Repurchasing debt is typically a sign of financial strength, which is why Citigroup analysts called the selloff “irrational.” More troubling was a surge in the bank’s credit default swaps, indicating a higher cost to hedge against the bank failing. In plain English: it’s not just stock traders concerned about the bank.

- Rational or not, the sharp decline undermines hope that the Swiss government’s coordinated rescue of Credit Suisse, via an acquisition by UBS, hasn’t sufficiently restored stability to anxious markets.

Why it matters:

- The head of Germany’s banking regulator emphasized this week that European banks weren’t directly at risk, though there was danger of a “contagion via psychology in markets.” One analyst commented “It’s a clear case of the market selling first and asking questions later.”

- An analyst from Autonomous Research suggested that fears stem from the bank’s substantial exposure to U.S. commercial real estate and its large derivatives book. However, both are “well known” and “not very scary.”

- Deutsche Bank, which has recently emerged from a four-year turnaround plan involving thousands of job cuts, faces a sensitive challenge where it must restore confidence without doing anything too unusual that might trigger further concerns. Germany’s Chancellor tried reassuring the public, saying, “Deutsche Bank has fundamentally modernized and reorganized its business model and is a very profitable bank. There’s no need to worry.”

💭 Companies Big and Small Lose Access to Credit (WSJ)

Explained:

- Capital markets have been on edge for weeks following the collapse of Silicon Valley Bank, and the uncertainty has caused companies to be cautious about new corporate debt financings. From March 10th through March 17th, no firms with investment-grade credit ratings sold new bonds, the first time that has happened in March since 2013.

- March is usually a busy period for companies to secure financing since it falls before the blackout period between the end of the first quarter and the kickoff of earnings season. But wild swings in the Treasury market, which underpins debt markets globally, alongside hesitation from investors generally, have kept companies sidelined.

- For the month, companies with the highest credit ratings and the most capacity to borrow have only sold about $60 billion worth of bonds, compared with March’s five-year average of $179 billion.

Why it matters:

- Riskier corporations that borrow by issuing so-called high-yield bonds are having an even tougher time raising funds. These more vulnerable firms have raised just $5 billion vs. the five-year average of $24 billion for March.

- And the ripple effects extend down to mom-and-pop companies, as many regional banks tighten lending standards to small businesses. The banking crisis in recent weeks has spurred a pullback in lending, making it harder for companies of all sizes to access credit.

- For the Fed, which is hoping to tighten financial conditions, the slowdown in financing activity is welcome news. Fed Chairman Powell explained, “It’s possible that (bank stress) will contribute to significant tightening in credit conditions over time, and in principle that means monetary policy will have less work to do.”

WHAT ELSE WE’RE INTO

📺 WATCH: Bill Ackman on what he’s learned from Warren Buffett

👂 LISTEN: The surprising opportunities in commercial real estate

📖 READ: The need to read, by Paul Graham

THE AGE OF AI IS HERE

“The development of AI is as fundamental as the creation of the microprocessor, the personal computer, the Internet, and the mobile phone.

It will change the way people work, learn, travel, get health care, and communicate with each other. Entire industries will orient around it. Businesses will distinguish themselves by how well they use it.”

Introduction

Bill Gates is often early. Very early. In 2022, Bill Gates challenged the OpenAI team to train an AI that could pass an Advanced Placement (AP) Biology exam – roughly equivalent to an A-level exam – with the strict rule that the AI could not be specifically trained to answer biology questions.

A few months later, they revealed the results – a near-perfect score, he said, missing only one mark out of 50.

After the exam, Gates said he asked the AI to write a response to a father with a sick child.

“It wrote a thoughtful answer that was probably better than most of us in the room would have given,” he wrote. “I knew I had just seen the most important advance in technology since the graphical user interface (GUI).”

In a recent blog post, Gates recounted these examples while saying there will be AI that does “everything that a human brain can,” adding: “Entire industries will orient around it.”

Welcome to the age of AI.

The big picture

Gates believes artificial intelligence is the most revolutionary technology he has seen in decades, on par with computers, cell phones, and the internet.

The future is uncertain, but it’s worth examining Gates’ views, given he was early to the personal-computer revolution when he founded Microsoft in 1975, decades before nearly every American household had a computer. He was also early about the danger of viruses: He was outspoken about the risks of a pandemic years before Covid-19 rocked global markets and healthcare systems.

Gates wrote in his blog post that the AI revolution will mean everyone will have their own “white collar” personal assistant.

“The development of AI is as fundamental as the creation of the microprocessor, the personal computer, the Internet, and the mobile phone,” he wrote. “Businesses will distinguish themselves by how well they use it.”

Gates added: “Superintelligent AIs are in our future,” he wrote, adding that he believes people will see AI on par with the capabilities of a human brain 10 to 100 years from now.

“Once developers can generalize a learning algorithm and run it at the speed of a computer — an accomplishment that could be a decade away or a century away — we’ll have an incredibly powerful AGI [artificial general intelligence].

“It will be able to do everything that a human brain can, but without any practical limits on the size of its memory or the speed at which it operates. This will be a profound change.”

Key takeaways from Gates

Artificial intelligence generally refers to a computer’s ability to learn from large amounts of data and subsequently mimic human responses.

Other notable takeaways from Gates:

- “The rise of AI will free people up to do things that software never will—teaching, caring for patients, and supporting the elderly, for example.”

- He said he believed AI could also help scientists develop vaccines, teach students math and replace jobs in task-oriented fields such as sales and accounting. He suggested that one day AI could go through a person’s email inbox and schedule their meetings.

- In the workforce, Gates says AI will help people write emails, monitor schedules, take notes, and reorient their days to be more productive on more creativity-demanding tasks.

- “We should keep in mind that we’re only at the beginning of what AI can accomplish,” he wrote. “Whatever limitations it has today will be gone before we know it.” He said he believed AI should be properly regulated. Elon Musk, another tech entrepreneur, has suggested creating a regulatory body to help guide AI development.

- AI could have helpful use cases in health care and reduce global inequality, noting that AI systems could accelerate medical research and potentially create tools to mitigate diseases like AIDS, TB, and malaria.

- He also said generative AI tools will help diagnose cancers and other medical needs.

- While AI will inevitably misdiagnose some humans, Gates points out that humans “make mistakes too.”

- Gates said. “AI-driven improvements will be especially important for poor countries, where the vast majority of under-5 deaths happen,” he wrote. “Many people in those countries never get to see a doctor, and AIs will help the health workers they do see be more productive.”

Gates added: “I’m lucky to have been involved with the PC revolution and the Internet revolution. I’m just as excited about this moment.”

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.