The Wooden Way

Hi, The Investor’s Podcast Network Community!

It was another day in which all of Wall Street was tuned into the Federal Reserve.

Jerome Powell and Co. raised interest rates another quarter-point Wednesday afternoon. Same old, same old, as Powell reiterated that the labor market is still too tight and inflation is still too high 😬

The Fed did signal banking-system turmoil might end its rate-rise campaign sooner than seemed likely two weeks ago. Markets fell sharply into the close following Powell’s remarks.

More on the latest rate hike below.

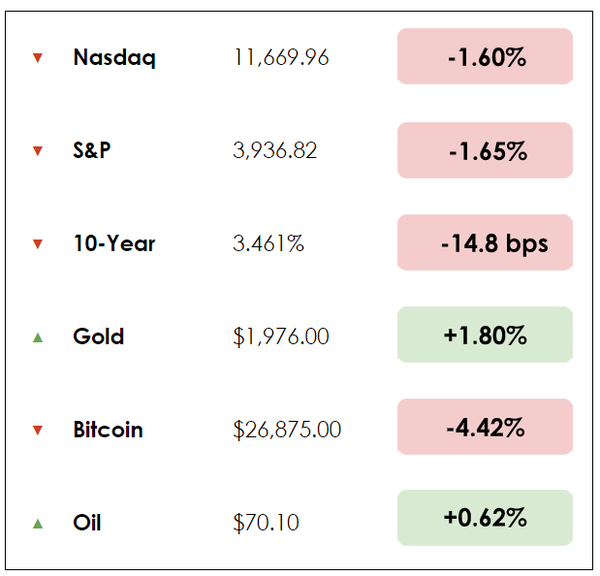

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Making sense of the Fed’s latest move

- Apple and Microsoft become havens as FAANG loses allure

- Plus, our main story on John Wooden’s enduring lessons

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

Real estate investing, made simple.

17% historical returns*

Minimums as low as $5k.

EquityMultiple helps investors easily diversify beyond stocks and bonds, and build wealth through streamlined CRE investing.

*Past performance doesn’t guarantee future results. Visit equitymultiple.com for full disclosures

IN THE NEWS

🏧 Fed Raises Rates Amid Banking Turmoil (NYT)

Explained:

- The Federal Reserve raised interest rates by a quarter-point, the ninth increase in a year, as it balances the long-running fight against inflation with the tumult in the banking industry.

- Fed chair Jerome Powell said the Fed is undergoing “a thorough review” of the banking system and will try to prevent future bank collapses. Powell noted the Fed considered pausing interest-rate hikes at this meeting but went ahead with a quarter-point hike primarily because inflation remains far too high.

- Other takeaways from Powell include: wage growth has shown signs of easing; inflation is still “well above” the long-run goal of 2% and must come down; and the Fed is focused on potential credit tightening and what it might mean.

Why it matters:

- Asked about the possibility of unemployment spiraling upward due to rate increases, Powell said recessions are difficult to model and lowering inflation is his top priority, despite the risk. Long economic expansions with low interest rates are “very good for people,” he said. “It’s just a place that we should try to get back to.”

- Powell made an interesting nod toward the role of social media in the speed of the deposit flight from Silicon Valley Bank, noting that the bank run was different from what the Fed had previously seen. He suggests the Fed must update regulations and supervision to keep pace.

- On inflation, Powell is focused on robust activity in the services sector, noting there has been little to no cooling in industries like healthcare and hospitality despite declining prices of goods and housing. “That’s something that will have to come through softening demand,” he said, as well as in labor markets.

💻 Apple, Microsoft Dominate (WSJ)

Explained:

- The combined weighting of Apple and Microsoft in the S&P 500 has risen to the highest level on record as the FAANG trade fizzles out. FAANG is an acronym referring to Facebook, Amazon, Apple, Netflix, and Google.

- As we mentioned yesterday, Apple and Microsoft’s combined weighting in the S&P 500 has risen to 13.3%, the highest level on record, while the influence of other big technology stocks has waned. Not since IBM and AT&T in 1978 have two stocks made up a greater share of the benchmark. It ends a run in which investors flocked to shares of Meta, Amazon, Apple, Netflix, and Alphabet.

- At its peak in August 2020, the “FAANG” stocks made up about 25% of the S&P 500. The big tech firms began to diverge over worries about inflation and the Federal Reserve’s need to raise interest rates, dimming the allure of some growth stocks. There were plenty of company-specific issues for Netflix and Meta, too.

Why it matters:

- Apple and Microsoft have emerged as havens in the stock market turmoil, bringing their weightings in the S&P 500 to about 7% and 6%, respectively. The stocks have gained around 27% and 14% in 2023 after suffering losses last year.

- Said one strategist: “It’s just been monumental. There’s just more comfort with the way Apple and Microsoft are viewed as opposed to going out and buying any tech name out there.”

- Further, investors have piled into Apple and Microsoft to hide from the banking crisis amid hopes the Fed is nearing the end of its campaign to raise interest rates. These two profitable, stable firms with well-entrenched moats represent the best of a group of companies already known for their high quality.

WHAT ELSE WE’RE INTO

📺 WATCH: The magic of compounding, the Templeton way

👂 LISTEN: Buffett and Munger’s principles and mental models

📖 READ: All together now, Morgan Housel’s latest blog post

The first lesson was always how to tie your shoes.

Here was John Wooden, head men’s basketball coach at UCLA, welcoming some of the better college players in the country to the first practice of every season with instructions on how to put on their socks and shoes correctly.

“First, put your socks, slowly with care, over your toes,” he’d begin. He didn’t want his players getting blisters, but he also wanted them to recognize that mundane, everyday tasks are opportunities for careful, intentional living.

This is the core of the John Wooden way.

The essence

No college basketball coach has ever dominated the sport like legendary UCLA coach John Wooden. His teams reached unprecedented heights in the 1960s and ’70s. They accomplished a run of 10 NCAA championships in 12 seasons and an 88-game winning streak — records that stand to this day.

He was only paid $32,500 a year. He drove a 15-year-old Ford Taurus. He asked everyone questions and listened intently when people listened. He gave away all but one of his 10 championship rings but kept a bronze medallion he won for academic-athletic achievement as a student at Purdue.

“Success is peace of mind,” he said.

Your masterpiece

In sports, there’s a common mantra to win at all costs. In business, some organizations seek to profit at all costs. While those approaches might work for some, Wooden wanted his players to focus on the process.

He never mentioned the word “win” to his players. His attitude: If you improve and maximize your potential, you’ve succeeded. That was his definition of success; where you get peace of mind because you know in your heart, mind, and soul that you’ve reached your full potential.

Wooden recognized that keeping winning off his players’ minds would focus them on getting to a game, the hour-to-hour, day-by-day practices, and tiny improvements would make winning a byproduct. In other words, winning was simply a lagging indicator of an impeccable process.

“Make each day your masterpiece,” he said.

When Wooden was a high school English teacher in South Bend, Indiana, during the 1930s, he grew disenchanted when he saw how much the parents fixated on their children’s grades.

Wooden believed this was foolhardy thinking. For a student who was not particularly gifted in a certain subject, a B should be considered a fine grade. For another with more natural ability but did not work as hard, a B should be deemed less than satisfactory.

“The best competition I have is against myself to become better,” he said.

Focus and patience

Wooden didn’t spend much time on scouting reports or evaluating opponents. He wanted his team to focus on themselves to keep it simple. The business analogy would be a company less focused on emulating competitors or fearing them, but rather a company that tries to innovate every day and be the best company it can be.

Once the game began, he didn’t want his players looking over to the bench for instructions from him. He rarely called time-outs. As their coach—their teacher—he believed his work was mostly done during practices. The games would be their final exams.

If a star player was two minutes late to the team bus for a road game, the player didn’t get to play that day.

He was at UCLA for 16 years before they won their first national title, a lesson in patience. Today, some coaches are fired for one year of underperformance. Today, some people expect instant results. But Wooden knew greatness takes time.

Memorable quotes

Wooden quotes hang in corporate boardrooms and pro sports locker rooms. Here are a few of the best:

- A player who makes a team great is much more valuable than a great player.

- A strong leader accepts blame and gives credit. A weak leader gives blame and accepts the credit.

- If you are afraid to fail, you will never do the things you are capable of doing.

- Things turn out best for those who make the best of the way things turn out.

- Promise to give so much time to improving yourself that you have no time to criticize others

- Promise yourself to make all your friends know there is something in them that is special and that you value

- Be true to yourself. Make each day a masterpiece. Help others. Drink deeply from good books. Make friendship a fine art. Build a shelter against a rainy day.

Dive deeper

Check out Seth Davis’s superb biography on Wooden here.

Here is Wooden’s Ted Talk on the difference between winning and succeeding.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.