Fat Pitch

Hi, The Investor’s Podcast Network Community!

Rates, rates, rates 🎵

Mortgage rates keep rising, hitting levels not seen since their most recent peak in November.

The average rate on the standard 30-year fixed mortgage rose to 6.65%, per a survey released Thursday by Freddie Mac. That’s the highest level since Nov. 10, when it was above 7%. A year ago, pre-bear market, rates were less than 4%.

Are we headed back to 7%?

Here’s the rundown:

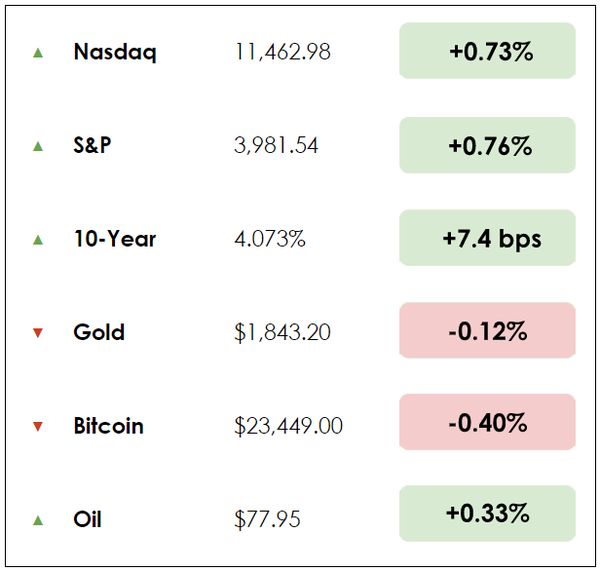

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Elon Musk and Tesla’s investor day

- How China has an edge on the U.S.

- Plus, our main story on investing legend Stanley Druckenmiller

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

🎣 Tesla’s Investor Day Flops (WSJ)

Explained:

- As the old Wall Street adage goes: “buy the rumor, sell the news.” Tesla’s (TSLA) investor day on Wednesday was the latest example of this phenomenon. The event failed to live up to the preceding frenzy, causing Tesla’s stock to drop around 6% Thursday. While Tesla didn’t adhere to corporate norms in setting specific medium-term goals, more noticeable was the lack of any new product announcements.

- Investors hoped to hear about a potential “Model 2” — a cheaper, $25,000 mass-market successor to Tesla’s Model 3 electric vehicle (EV). Instead, the event focused on efficiency gains from the company’s next-generation production platform, though no prototype, illustration, or timeline for what would be produced on said platform was given.

- Following an incredible 75% rally in the first two months of 2023 that added over $300 billion in market cap, Tesla needed to deliver exceptional news to surpass investors’ high hopes. The company delivered plenty of exciting updates but lacked the “cherry on top.”

Why it matters:

- Despite the absence of new products, there’s good reason to believe that Tesla maintains a competitive edge in engineering and manufacturing, something that will be necessary for it to achieve the sort of EV-market-share gains with high profit margins needed to justify its valuation. Impressively, Tesla just built its four millionth vehicle after taking 12 years to produce its first million.

- One innovation it showcased yesterday would reduce the content of costly silicon-carbide chips in its next-generation vehicles by 75%, which rippled through the semiconductor industry and sent the silicon-carbide specialist Wolfspeed’s shares down over 10%.

- Tesla’s focus on greater efficiency and output capacity presumes that demand will follow. This is a judgment we’ll be watching going forward as Tesla fights to maintain its relative dominance over an onslaught of new entrants in the EV space. Consumer loyalty to the company remains an ongoing test.

🔬 China Leads U.S. in Researching Key Technologies (Reuters)

Explained:

- China has a “stunning lead in high-impact research” in 37 out of 44 critical and emerging technologies, according to the Australian Strategic Policy Institute (ASPI), a security think tank, in a study funded by the U.S. State Department.

- Although America was a global leader in researching high-performance computing, quantum computing, small satellites, and vaccines, the study found that in most other areas, U.S. institutions ranked second. In some fields, the world’s top ten research institutions were all based in China.

- The ASPI concluded, “Western democracies are losing the global technological competition, including the race for scientific and research breakthroughs,” urging governments to invest more in research.

Why it matters:

- The study also expressed concerns that China’s research focus on photonic sensors and quantum communication could result in it “going dark” to the surveillance efforts of Western intelligence.

- The ASPI also noted that China’s 2021 breakthrough in hypersonic missiles could’ve been anticipated sooner had governments paid attention to the country’s research efforts: “Over the past five years, China generated 48.49% of the world’s high-impact research papers into advanced aircraft engines, including hypersonics, and it hosts seven of the world’s top ten research institutions.”

- Additionally, the study found that China was likely to emerge with a monopoly in ten crucial fields, including synthetic biology (where it produces one-third of all research), 5G, and nano manufacturing. The findings come as the U.S. and its allies are reacting more harshly to Chinese gains across many key industries, seeing the country increasingly as a peer adversary.

By late 1999, as internet stocks were flying, Stanley Druckenmiller was up 42% for the year. In January 2000, he (correctly) sensed it was a bubble. He sold his technology stocks. But two young analysts working for him kept small amounts of tech in the fund, making nearly 10% per day.

Feeling FOMO, Druckenmiller initiated a $6 billion long position in tech. Then the bubble burst. He said he lost more than $2 billion, bringing the fund’s return to -18%.

Druckenmiller became an emotional “mess” and traveled to Africa with his family. To disconnect, he didn’t watch TV or read newspapers. He had to recharge.

When he returned, in 2000, as oil, interest rates, and the USD moved higher, he put substantial amounts of the fund’s stake in treasuries, generating 40% returns in Q4 2000. He avoided catastrophe and didn’t let one mistake lead to another.

His mental break in Africa to recalibrate, reflect, and recharge helped him regain his mojo.

One big game

That story is one of many investing successes for Druckenmiller, who was running more than $20 billion at his peak. He’s not very public, and he doesn’t often conduct interviews, but his track record of 30% annual returns as a fund manager is remarkable.

The investor, hedge fund manager and philanthropist is the former chairman and president of Duquesne Capital, which he founded in 1981. He closed the fund in August 2010 because of the “heavy personal costs” associated with competing in the markets over 30 years.

After beginning his career as a stock analyst at Pittsburgh National Bank, the Pittsburgh native founded his own firm.

Then, in 1988, legend George Soros hired him to work at the Quantum Fund. In 1992, he realized a billion-dollar gain by shorting the British pound, making him a household name on Wall Street.

But unlike Warren Buffett and many other value investors, he focuses heavily on central bankers.

“The major thing that we look at is liquidity. Contrary to what a lot of the financial press have stated, looking at the great bull markets of this century, the best investments for stocks is a very dull, slow economy that the Federal Reserve is trying to get going.”

Now 69 and worth about $6 billion, he’s spending most of his time on his family office and philanthropy. He’s given large gifts over the years, including $100 million to NYU’s Langone Medical Center to help start a neuroscience center.

“I’ve always loved to play games, and face it, investing is one big game,” he has said. “You need to be decisive, open-minded, flexible, and competitive.”

Focus investing

In Jack Schwager’s book The New Market Wizards, Druckenmiller said he used to write thorough papers covering every aspect of a stock or industry. He recalls presenting a paper to a research director, who said his work was “useless. What makes the stock go up and down?”

That comment changed how he conducted stock analysis. He focused on only the factors highly correlated to a stock’s price movement rather than looking at all the fundamentals.

“Frankly, even today, many analysts still don’t know what makes their particular stocks go up and down,” he said. “Most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.”

To be clear, Druckenmiller analyzes earnings, but it’s not always his central approach. He also advocates focus investing, like Buffett. He believes most money managers and individuals are too diversified simply because they feel they need to play different sectors.

He makes a critical distinction: Diversification doesn’t necessarily equate to lower risk, just as less volatility doesn’t necessarily mean less risk.

He says concentrated investors pay more attention to their positions and evaluate them regularly.

“Put all your eggs in one basket,” he has said, “and then watch the basket very carefully.”

Takeaways

Other lessons from Druckenmiller:

- He’s made many mistakes, but none were catastrophic.

- He believes the potential of Bitcoin is high, especially as insurance against widespread central bank fallout. If he were younger, he thinks he’d dive into Bitcoin and blockchain more aggressively. He has said he would be “very surprised if Blockchain isn’t a major force in our economy in five years, 10 years from now.”

- New investors flooding the market in 2020 and 2021 gave people like him great opportunities to short. He’s made high returns in bear markets with careful shorting and risk management.

- Druckenmiller has a bearish bias because he made a lot of money being bearish early in his career. But great investors make most of their money being long.

- He enjoys trying to predict how the world will look in the future.

- He’s seen people with much higher IQs than him do poorly in stocks because they weren’t passionate or didn’t have the right temperament.

- Last year, he navigated the bear market by not doing much. “I’m pretty much taking a break,” he said. “I’m waiting for a fat pitch.”

Four years ago, our Stig Brodersen and Preston Psych studied Stanley Druckenmiller in a fascinating podcast episode here.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.