Jay-Z’s Empire

09 February 2023

Hi, The Investor’s Podcast Network Community!

Fun fact: The Beatles made their first appearance on TV 59 years ago today, drawing 73 million viewers. That’s equivalent to about 128 million today, 30% more than the Super Bowl 🎸

🤦 In the tech world, Alphabet made a $100 billion mistake yesterday in showcasing its ChatGPT rival Bard. The AI chatbot flubbed an answer, and investors weren’t happy about it, promptly sending the stock 7% lower after the presentation, only to keep falling today.

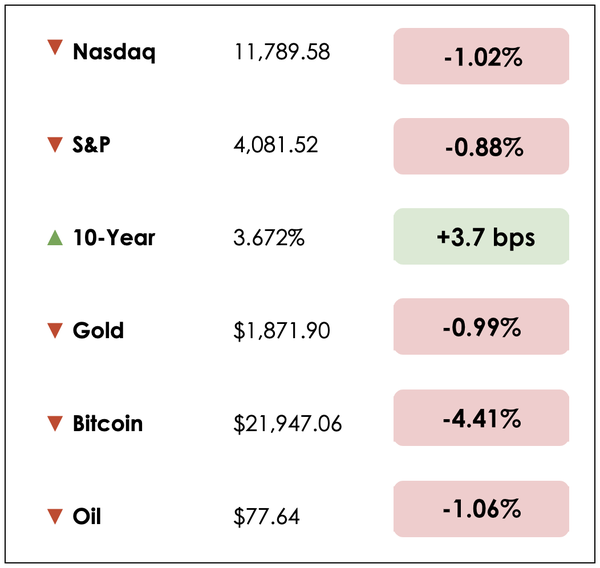

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Bob Iger’s plan to save Disney

- Are we facing mass layoffs or a hiring boom?

- Plus, our main story on how one man built a music and business empire

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

History of positive returns ✔️

Inflation-hedging potential ✔️

Resistance to market volatility ✔️

Land has helped investors preserve wealth for generations, and AcreTrader makes it easy to diversify with farm and timberland assets online — Find out how.

IN THE NEWS

🎢 How Iger Plans to Fix Disney (NYT)

Explained:

- After beating on the top and bottom lines, Disney (DIS) plans to lay off 7,000 people, 4% of its workforce, and cut $5.5 billion in costs. CEO Bob Iger announced a restructuring that would put content production and streaming under one roof, undoing a reorganization led by Bob Chapek, Iger’s ousted successor/predecessor.

- Challenges linger for the iconic global brand. Its streaming operations are a major source of red ink, and Iger is under pressure to get those into profitability. (They’ve lost nearly $10 billion since Disney+ debuted in 2019.)

- Iger said the company needs to be “more discerning” about its decisions and what it says “yes” to. Iger noted that Disney would make fewer shows and concentrate on core franchises like Star Wars and Marvel. In short: More focus. “We’re simply going to have to get more selective,” Iger said.

Why it matters:

- On Disney’s earnings call Wednesday, Iger said: “We must return creativity to the center of the company, increase accountability, improve results and ensure the quality of our content and experiences.” On the top of the list is Disney’s streaming strategy and making the business profitable, Iger said Thursday. He called streaming “the future.”

- ESPN and its streaming offshoot will become a stand-alone unit for the first time, a move that was instantly interpreted as making the sports behemoth easier to spin off or sell, should Disney decide to pursue such action.

- The organizational changes, which will go into effect immediately, were designed with astonishing speed; Mr. Iger returned to the company only in late November. And despite a weakening economy, Disney’s domestic theme parks delivered a fat $2.1 billion in operating profit, a 36% increase from a year earlier.

💼 Mass Layoffs or Hiring Boom? (WSJ)

Explained:

- What’s really happening? Interest rates have climbed, reports of layoffs headline newspapers, yet the recent jobs report shows an incredibly reliant labor market and economy. To understand the full picture, we must look beyond the headlines.

- Driving the jobs boom are large but often overlooked sectors of the economy. While technology isn’t hiring, restaurants, hospitals, nursing homes and child-care centers are staffing up as they enter the last stage of the pandemic recovery.

- With the effects of the pandemic diminishing, many executives and business owners in services industries told the WSJ they are finding it easier to recruit and fill jobs.

Why it matters:

- That inflation is falling rather sharply, combined with a strong labor market and relatively good earnings, has onlookers less convinced of a recession in 2023. Goldman Sachs economists reduced their odds that the U.S. will enter a recession in the next 12 months to 25%, from 35%, citing the strength of the labor market.

- But it’s too early to celebrate a soft landing and much work remains. The jobs report was “certainly strong—stronger than anyone I know expected,” Federal Reserve Chair Jerome Powell said Tuesday. “It kind of shows you why we think [reducing inflation] will be a process that takes a significant period of time.”

An unexpected friendship

Nearly 13 years ago, two unlikely partners sat across from each other at Omaha, Nebraska’s Hollywood Diner.

Chatting over strawberry malts, Warren Buffett, a regular at the diner, sat across from an out-of-town visitor: Shawn Carter.

If that name doesn’t ring a bell, the rap icon, record producer, and founder of the entertainment and talent conglomerate Roc Nation is better known as Jay-Z.

But what was an elderly billionaire value investor doing with a music icon at a homely diner in America’s heartland?

Talking business, of course.

Speaking of the artist 40 years his junior, Buffet later said: “Jay is teaching in a lot bigger classroom than I’ll ever be in. For a young person growing up, he’s the guy to learn from.”

Building an empire

After solidifying himself as one of hip-hop’s most defining figures, Jay-Z had his own plans to acquire a ten-figure fortune like his new-found friend Warren Buffett.

Less than a decade later, there were no doubts that Jay-Z had built a multi-billion dollar empire, the first hip-hop artist to do so.

His kingdom touches everything from real estate in the Hamptons, sports bars, the “Uber for private jets” in JetSmart, an over $600 million luxury champagne brand, and high-end art, to early stakes in Uber, Oatly, and SpaceX, and, obviously, the music industry.

The early days

But Jay-Z began with humble origins, growing up in Brooklyn’s notorious Marcy housing project and dealing drugs before becoming a musician.

Reflecting on his career, Jay-Z recalled in 2010 that he had a “genius” move that powered his success. “In the beginning, we went to every single label, and every single label shut their door on us…The genius thing that we did was we didn’t give up. We used that ‘what do they know’ approach.”

He started his own label, Roc-A-Fella Records, which released his debut album, Reasonable Doubt, in 1996. Since then, he’s amassed 28 Grammys and 14 No. 1 albums.

“We started selling our own CDs and built our own buzz. Then, the record companies came back to us.”

His commitment to working for himself has defined his swagger.

When Def Jam, a record company that has worked with Justin Bieber and Kanye West, offered Jay-Z a deal, he replied, “I own the company I rap for.”

A business tycoon

But his ambitions extended beyond just recording and producing great music. After buying and revamping a Norwegian streaming service in 2015 for $56 million, he sold it to Jack Dorsey’s fintech company Square (now called Block) in a $300 million deal.

Jay’s music catalog alone is worth an estimated $200 million. And that doesn’t even account for his wife Beyoncé’s assets who carries a $500 million net worth.

His larger-than-life persona would have defined pop culture for generations had he only stuck to music. Still, his range of entrepreneurial successes has come to represent much more: how an inner-city boy could climb the ladder and establish himself as a multi-faceted business tycoon, regardless of the odds stacked against him at every turn.

But it’s not just about the money for him. Jay says his brands are an extension of himself: “They’re close to me. It’s not like running (General Motors) where there’s no emotional attachment.”

Self-made success

Everything he has today he built himself, making his story all the more impressive and meaningful. Like any good value investor, Jay finds opportunities within his circle of competence, and despite caring deeply about his endeavors, he’s not afraid to move “on to the next one.”

Evidently, he’s built an impressively diversified portfolio while compounding his wealth at an incredible rate. Yet, he remains an ambassador for other African-American stars as CEO of Roc Nation, representing talent in both music and sports, including Rihanna and NBA star Kevin Durant.

An advocate for others

In this regard, many see him as a champion of artistic freedom, working to free and encourage others to ditch the exploitative contracts that have defined the music industry for decades. In one recent example of his efforts, Jay-Z led a list of music industry titans to support a proposed New York State law that would block prosecutors from using song lyrics in criminal prosecutions.

Another rapper supporting the law remarked, “Criminal cases should be tried on factual evidence, not the creative expression of an artist…”

For many, Jay-Z is an inspiration, not just for his rebellious lyrics; rather, he embodies the first truly self-made hip-hop business empire.

Dive deeper

Read JAY-Z: Made in America for more, and if you’re curious, you can listen to his latest album here (explicit content warning).

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.