The Changing Face of Globalization

20 January 2023

Hi, The Investor’s Podcast Network Community!

Yesterday, we wrote about how renting was now more affordable than owning a home in much of the U.S. due to ballooning mortgage costs.

Today, we got more troubling data on the real estate market broadly: the National Association of Realtors said that existing home sales slid 17.8% in 2022, while Bloomberg reported on a potential $175 billion debt spiral in global commercial real estate 💣

At its annual strategy conference, Goldman Sachs (GS) asked 400 top business leaders whether they expect a recession this year: 57% said “yes” — Happy Friday! 😅

Stocks did zoom higher to wrap up the week, with tech stocks lifting the market, as Alphabet (GOOGL) and Microsoft (MSFT) bounced on news of new cost-cutting measures, while Netflix (NFLX) jumped after trouncing expectations for new subscriber growth.

Here’s the rundown:

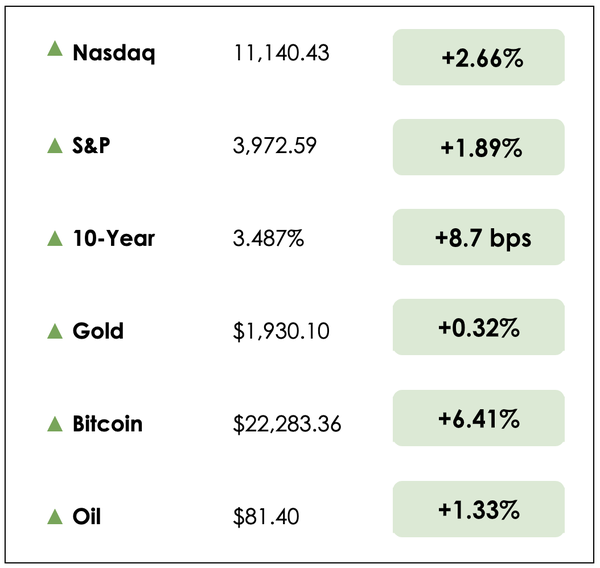

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: the yield curve extends its record inversion, and how New Orleans represents the changing face of globalization, plus our main story on the flawed math that professional investors use in their portfolios.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

😱 Yield Curve Extends Record Inversion (WSJ)

- The long-time bond market recession indicator — yield curve inversion — has never looked so bad, and it keeps getting worse.

- The Treasury yield curve, a reference to the varying interest rate yields offered by U.S. government bonds of differing durations, should normally be upward-sloping to reflect the time value of money and greater risks of lending for longer periods.

- However, the yield on three-month bills is considerably greater than that of 10-year Treasury bonds. In other words, investors earn less for taking on greater risk (lending for ten years versus three months). The inversion, measured by the excess return on three-month bills over 10-year bonds, reached 1.32% today, the highest level ever recorded.

- This topsy-turvy financial reality is, historically, a powerful indicator that all is not well with the economy. The bond market is seemingly telling us that short-term interest rates, as determined by the Fed, are too high, which will cause a recession, forcing future rate cuts in response, hence lower yields on longer-dated bonds.

- According to Federal Reserve data going back to 1982, Treasury yield curve inversions had previously never breached 1%. 1982 was also the last time the Federal Reserve was locked into a major battle with inflation, inducing a recession with rapid rate hikes to cool double-digit increases in price levels.

- While stocks have had a better start to 2023 than in 2022, much of this optimism is based on a so-called ‘soft landing,’ a hope that the Fed can gently cool inflation without plunging the economy into a recession with higher rates. Should the bond market be right, such a rally is likely premature, as markets won’t bottom until a deeper recession arrives.

⛴️ New Orleans Captures the Changing Face of Globalization (NYT)

- The pandemic-era supply chain collapse, alongside a dramatic jump in global tensions, fueled speculation that ‘globalization’ has peaked, that is, the remarkable integration of economies worldwide through extensive trade since World War II.

- In this new world, countries may seek to source more goods and services directly, minimizing reliance on foreign relationships, which are increasingly fragmenting. As a vital gateway between the Mississippi River, the heart of America’s farm belt, and the world’s oceans, the New Orleans port is one of the nation’s busiest for exports, particularly of soy and corn, and it wants to capitalize on these shifting tides.

- Executives at the port are betting on the city assuming a larger role in trade, unveiling a $1.8 billion plan to expand its operations. Rather than entirely dismantling, globalization is, perhaps, evolving, led by galvanized institutions like the Port of New Orleans.

- President of the Federal Reserve Bank of Atlanta, Raphael Bostic, stated “When I hear people say the word ‘globalization,’ what I hear is ‘cost minimization.’ The new globalization isn’t going to have that second part.”

- The U.S. will likely see a boom in its industries over the next decade as production returns onshore and trade with close allies is prioritized (“friendshoring”). However, production outsourcing to countries with lower wages and overhead costs was a considerable factor contributing to the past few decades’ price stability — this new globalization will be fundamentally inflationary as manufacturing returns to countries with higher input costs.

- Port leaders are betting that their expansion will make the city attractive to companies that have realized their supply chains, namely across Asia, are vulnerable. As companies reroute production to closer, still low-wage countries like Mexico, New Orleans will have an opportunity to cement its role in these new and nearby trade flows.

WHAT ELSE WE’RE INTO

📺 WATCH: Understanding Joel Greenblatt’s Magic Formula for investing

👂 LISTEN: Getting started in RV park investing, with Matt Whitermore

📖 READ: Crypto lender Genesis files for bankruptcy + a beginner’s guide to Bitcoin mining

“Our whole premise is you construct an investment portfolio based on what you don’t know. You make it so that it performs its best in the extremes…it’s not predicting what you think you know, it’s constructing resilience for what you don’t know.”

Dave Dredge, the chief investment officer of Convex Strategies, made these remarks on the Top Traders Unplugged Podcast, one of our favorites, as he discussed the fundamental mistake asset managers and investors have made en masse in recent decades.

Today’s write-up is a bit longer, but we think it’s an important topic.

What’s that mistake?

It’s falling prey to the illusions of falling interest rates. In fact, the standard 60/40 portfolio (60% stocks, 40% bonds) that has come to dominate financial advisory and wealth management in one form or another is “wrong.”

He argues that the “Sharpe World mathematics” (a tongue-in-cheek reference to status quo calculations in the investment industry, specifically the Sharpe Ratio that divides portfolio returns by price volatility to derive a measure of ‘risk-adjusted performance’) are blinded by an artificially generated negative correlation between stocks and bonds that began under former Fed Chair Alan Greenspan in the mid-1980s.

In simpler words, bonds have been increasingly used to stabilize portfolios and offset stock volatility. A hefty and frequently leveraged allocation to bonds has become dogma for investment advisers, but not as a tool for income as you’d think.

Rather, as a vehicle for managing expected portfolio price deviations.

What to know

Bonds played this role because they have historically had a strong inverse relationship with stock prices, meaning that bonds may limit downside swings in your portfolio, creating a stable ride for wealth compounding.

Add a whole lot of leverage to juice returns, and you might start to believe you can have your cake and eat it, too.

Any time stock prices sold off considerably, the Federal Reserve would intervene by buying bonds, injecting liquidity into the financial system, and implicitly lowering the discount rate for all assets by reducing overnight interest rates.

This support for bonds, and correspondingly stocks, is the playbook policymakers at the Fed have used in response to every crisis since they ‘broke the back’ of inflation in the early 1980s with double-digit interest rates.

A changing reality

In this time, the long-term trend has been clearly downwards for interest rates. In each panic, the Fed lowers rates even further (pushing bond prices higher).

So long as inflation remained tepid, as it largely has since the 1980s, the Fed could continue intervening in crises by simply lowering interest rates via bond purchases of some form.

Of course, this response mechanism broke down in 2020, when rates hit zero — the logical lower bound for yields and the peak in bond prices.

Flawed models

According to Dredge, the investment community has incorrectly evaluated the risks in their portfolio models by extrapolating these correlations, based on Federal Reserve rescue packages and chronic support for asset prices, indefinitely.

The risk profile of owning bonds completely flips when yields are 0% or even negative. Rates cannot naturally stay at these levels or continue falling because there are no reasonable incentives for investors to own them going forward.

They’re essentially getting zero compensation for the time value of money and inflation, and that’s not sustainable, especially as rising inflation reared its head in 2021.

Yet, as Dredge explains, most of the mainstream financial world and the academia that surrounds it clings to their models, derived principally from years’ worth of data corrupted by the Fed’s interventions, even after rates reached their inherent trough (0%).

“The only way you could get savers to hold this stuff (low-yielding bonds) is to dupe them into it through their pension funds, and insurance companies, and banks that bought this stuff on a Sharpe-World mathematic, risk-regulatory, accounting-reporting, annual-return incentive structure that loaded everybody up in the financial fiduciary world with this debt to the disadvantage of the end capital holders.”

Dredge states, “now that we know that, who’s going to own all the bonds?”

Calculating risk

He believes the inability to assess asymmetric risks plagues the entire industry, as reflected by the popularity of the interrelated concepts of normal distributions, the efficient markets hypothesis, modern portfolio theory, Sharpe Ratios, and value-at-risk calculations.

We saw this a few months back when British pension funds nearly became insolvent from rising rates on sovereign bonds.

“The Bank of England can’t let long-dated gilt yields go above 4%, or the entire pension system running on levered versions of Sharpe World optimized portfolios blow up.”

A worrying history

Another related example of egregious risk modeling was, famously, in 2008.

“At exactly the time they (senior tranches of subprimes CDOs) were trading as though they were the closest thing in the world to U.S. Treasuries…A very small change in the correlation of housing prices from what was implied to create that (triple-A credit rating) super senior tranche wiped out all of the capital in the global banking system.”

Takeaways

Dredge believes we’re in a new paradigm where the Fed has had to abandon its commitment to foregone asset price stability to honor its inflation-fighting mandate. He compares the transition to the U.S.’s departure from Afghanistan.

Although it could have prevented the Taliban from taking back the country indefinitely, the costs of such a system outweighed the benefits. In a few weeks, the precedent of two decades-worth of American military intervention was undone.

With interest rates hitting zero and an alarming burst of inflation in the past two years, Dredge thinks the Fed has forged a path that will negate four decades of bond-buying, interest rate-lowering policies.

The takeaway is that the rules that have governed the investing world for most working people’s careers are changing. And the sooner the investment industry realizes this, the better prepared we can all be for the next crisis.

For those who understand this paradigm shift, there’s surely tremendous opportunity.

Dive deeper

We just barely touched on all of the topics covered in this excellent podcast episode, and we’d encourage you to give the full thing a listen here.

Our friends over at Top Traders Unplugged also write a wonderful weekly newsletter for free.

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.