Loan Forgiveness

10 January 2023

Hi, The Investor’s Podcast Network Community!

Another day, another round of prominent corporate layoffs. This time, it’s the digital asset exchange Coinbase (COIN), letting go of nearly 1,000 employees — 20% of staff — amidst other cost-cutting measures ✂️

And despite political pressure to use the Fed’s economic influence to spawn social change and protect the climate, Fed chairman Jerome Powell reiterated the central bank’s commitment to focusing on inflation and unemployment, saying we “will not be a climate policymaker.”

🌏 Elsewhere, 2023 could be a strong year for stocks globally relative to the U.S.

On a 50-trading-day basis, international stocks are outperforming their American peers at a rate not seen in over a decade. This is largely attributable to a 26% bounce in Chinese equities in the last three months.

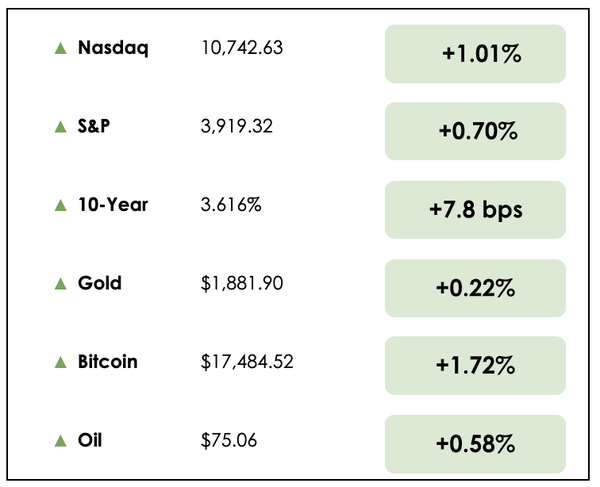

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: A new plan for student loan forgiveness and the World Bank’s troubling forecasts for economic growth, plus our main story on determining when the stock market may near a bottom.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

History of positive returns ✔️

Inflation-hedging potential ✔️

Resistance to market volatility ✔️

Land has helped investors preserve wealth for generations, and AcreTrader makes it easy to diversify with farm and timberland assets online — Find out how.

IN THE NEWS

🎓 More Student Loan Forgiveness (WSJ)

- The Biden Administration released a detailed plan on Tuesday that would make it easier for student-loan holders to wipe out their debts using income-driven repayment plans.

- The plan is seen as a key step in revamping the $1.6 trillion federal loan program that has left millions with substantial debts. At the same time, the Supreme Court is preparing to review President Biden’s broader student loan forgiveness plans next month which would cancel up to $20,000 in debt for many borrowers.

- If enacted, the proposed changes would provide qualifying borrowers with more-generous options that could leave them debt-free sooner while paying off only a fraction of their total loan balances.

- “We are, for the first time, creating a student-loan safety net in this country,” said Education Department Under Secretary James Kvaal.

- The Biden Administration noted the plan would lead to “increased costs of the student loan programs to the taxpayers in the form of transfers to borrowers who would pay less on their loans.” Opponents of debt relief have criticized the agreement as unfair to taxpayers who didn’t take out loans or paid them off in full.

- A fact sheet released Tuesday indicated that the Department of Education estimates 85% of community-college borrowers would be debt free within ten years of entering repayment.

🏦 World Bank Lowers Growth Forecast (WSJ)

- The World Bank has drastically lowered its growth forecast for the global economy this year as persistently high inflation has elevated the risk of a worldwide recession.

- The bank expects global growth to slow to 1.7% in 2023, down from an estimate of 3% growth in June. It would be the third-weakest pace of global growth in three decades. Only the 2009 and 2020 downturns would be worse, according to the World Bank.

- The forecast growth rate narrowly keeps the global economy out of a recession as inflation cools but remains elevated. Rising interest rates, Russia’s invasion of Ukraine, and pandemic-related disruptions in China all stress the global economy.

- “Global growth has slowed to the extent that the global economy is perilously close to falling into recession,” the World Bank said in its latest report on global economic prospects.

- Some economists project the U.S. and parts of Europe will slip into a recession for a portion of 2023. A global recession, defined as a “contraction in annual global per capita income,” is more rare because China and emerging markets usually grow faster than more developed countries. In other words, the world is often considered in a recession when economic growth falls behind population growth.

- The World Bank also called on global central banks to be alert to the risk that aggressively tightening monetary policy to fight inflation could have substantial consequences. The report called for discussions between central bankers to “help mitigate risks associated with financial stability and avoid an excessive global economic slowdown in the pursuit of inflation objectives.”

RECOMMENDED READING: THE CREATOR LETTERS

Each Sunday, Jay Yang writes The Creator Letters, where he shares one actionable tip with you to help you grow your one-person business.

With his help, you can master the written art of persuasion.

Get started on growing your business and improving your marketing skills.

THE MAIN STORY: WHEN WILL THE STOCK MARKET BOTTOM?

Overview

Rebecca Hotsko, host of the Millennial Investing podcast, spoke with Lance Roberts to discuss what’s ahead for the markets in 2023 and why a Fed pivot is not a sign that the pain is over for the stock market, rather that it is just the beginning.

Today, we welcomed Rebecca back by popular demand as a guest writer to share her thoughts on the topic.

She writes the following.

Breaking it down

Despite markets eagerly awaiting a Fed pivot as a positive sign that this bear market is over, Lance explains that when the Fed pivots, this is not the time when you want to go all in on buying stocks. Rather, it’s when you want to be out of them.

Why?

Historically, stock market bottoms happen later in the Fed easing cycle, not at the beginning of it.

History shows that a stock market bottom usually happens when the yield curve has un-inverted and turns positive (as measured by the spread between the 2-year and 10-year bonds), around 140 bps.

Currently, the yield curve is still deeply inverted to the highest levels in 40 years, around -60 bps.

This newsletter received such great feedback, we decided to write an entire article just on the stock market bottoming. Read the full piece here.

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.