One Up On Dalal Street

02 December 2022

Hi, The Investor’s Podcast Network Community!

💪 Despite the headlines about mass layoffs in the tech sector, employers added 263,000 jobs last month.

For those who did get laid off, the median unemployment duration is 8.4 weeks, well shorter than the average of 9.4 weeks pre-pandemic.

The strong job report today once again shows that the labor market doesn’t want to cooperate with the Fed’s efforts to cool the economy.

Stocks weren’t happy about it 😑

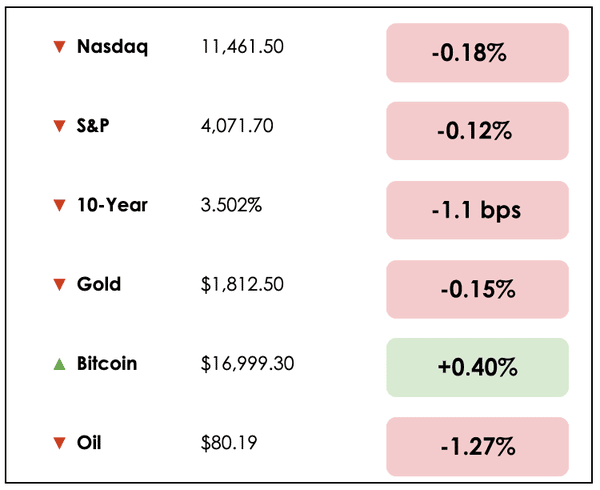

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: A price cap on Russian oil, and the growing controversy with BlackRock, plus our main story on the second-greatest investor of all time.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🛢️ Oil Price Cap Looks Set To Keep Russian Gas Flowing (Bloomberg)

Explained:

- The G7, an informal group of the world’s most advanced economies, plans to impose a price cap on Russian oil above current prices, which are roughly $50 per barrel for Russia’s signature Urals grade oil.

- The cap will likely be set at $60 a barrel, with the hope of preventing excess profits on oil sales from being funneled back into Russia’s war machine.

- America and its close allies have mostly stopped importing Russian oil, though they hope the move will target other buyers such as China, India, and Turkey. If countries buy Russian gas above the cap, they won’t be able to access European insurance and shipping.

Why it matters:

- A price cap at this level will allow most buyers and sellers to continue business as usual, which may convey a sense of action without necessarily changing the status quo and risk pushing oil prices higher globally.

- Some point out, though, that Russian oil may trade at such a discount globally because of price cap threats alone.

- The move is still a gamble since Russia has threatened to cut off oil sales to any country that tries to employ a price cap system against it.

🌊 Florida To Pull Funds From BlackRock In Growing ESG Backlash (FT)

Explained:

- Florida will replace the world’s large asset manager, BlackRock (BLK), in overseeing its $2 billion in state Treasury funds due to concerns that the company has “openly stated they’ve got other goals than producing returns.”

- This comes as backlash mounts among Republican state leaders, who see BlackRock’s climate change initiatives and other sustainable investing goals at odds with maximizing investment performance.

- At least 19 Republican-leaning states have now taken action to mitigate the use of environmental factors in investing and efforts to boycott oil and gas companies.

Why it matters:

- While Florida’s funds are a drop in the bucket for BlackRock, which manages over $8 trillion, the move marks a dramatic pivot in a world where public and private investments are becoming increasingly politicized.

- BlackRock’s CEO, Larry Fink, has been outspoken about wanting to use his company’s substantial influence over markets to push for social change and reduce carbon emissions.

- The tensions have sparked debate over the purpose of financial markets generally and whether public investment funds should optimize for purely financial returns or incorporate socially-beneficial factors as well.

- Unsurprisingly, there’s considerable disagreement over what socially-good initiatives should be prioritized while raising red flags about BlackRock’s growing influence as their assets under management rise.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

WHAT ELSE WE’RE INTO

📺 WATCH: How to negotiate like the FBI, with Weronika Pycek

👂 LISTEN: Developing short-term rental cabins, with Alex Jarbo on Real Estate 101

📖 READ: How Ray Dalio views the world economy, a thread by Clay Finck

THE MAIN STORY: INDIA’S WARREN BUFFETT

The World’s Second-Best Investor

Can you imagine starting with about $420 in capital in 1985 and amassing a fortune worth $5.8 billion by 2022?

Well, that’s exactly what Rakesh Jhunjhunwala accomplished, starting off trading stocks on the Bombay Stock Exchange on Dalal Steet in India.

If you run the numbers, that’s roughly a 65% compound annual return, making him the world’s second-best investor ever based on available data. Nosing just ahead of him is Jim Simons, who generated 66% annualized returns during his career.

The Big Bull

Over time, as he honed his skills at making long-term investments in outstanding companies, Jhunjhunwala became known unofficially as India’s Warren Buffett. He was also called the “Big Bull” for his outspoken and relentlessly optimistic view of India’s economy.

He began actively trading in college and went on to run his own stock trading firm, RARE Enterprises.

Jhunjhunwala loved to look under the hood of companies and do deep fundamental research. As he once stated, “A balance sheet is like a bikini, it shows more, but it hides what is vital. I learned to read a balance sheet, and then I got fascinated with stocks.”

Sadly, Jhunjhunwala passed away this year at 62 due to prolonged health complications.

It’s hard to imagine what he would have accomplished if he had the same long runway that Buffett has enjoyed.

We’ll unfortunately never know, but we can glean some key lessons from the Big Bull’s success.

Look for companies with a competitive edge

Like Buffett, Jhunjhunwala sought to find companies with a competitive edge whose success would be hard, if not impossible, to replicate. His philosophy was “buy right and sit tight.”

He preferred to search for small-cap stocks and wanted to establish a position before the stock was on most investors’ radar.

You don’t have to be right all the time

One of the common myths about investing legends is that they’re right most of the time. If we look at the Big Bull’s track record, he was wrong many times, particularly during the dot-com bubble.

Despite being wrong so often, he was successful because he could consistently identify stocks with 10-50 times upside potential.

He also would scale up his position in these winning stocks, which allowed him to further compound his money. These 10-50 baggers more than made up for his losses.

Trading vs. investing

Jhunjhunwala viewed himself as a trader in the first ten years of his career, but he sought to build up enough capital to later become a long-term investor in undervalued companies.

Early on, he took very concentrated positions in high-conviction trades. As he built up his capital, wealth preservation became much more important to him.

Still, he felt actively trading kept him sharp and in touch with the markets, and it was something he loved to do.

Rakesh’s success came from combining two opposing strategies (short-term trading and long-term investing) and juicing his returns with borrowed cash.

He would assert, “I am always 130% invested,” which shows the role that leverage played on his returns (Not something we would particularly recommend).

Don’t blindly follow famous investors’ picks

Jhunjhunwala cautions against following rumors or even the trades of legendary investors. He urged folks to do their own research, rely on their own thinking, and develop conviction in their trades independently of pundits or famous investors.

Advice for Beginners

Investing is a full-time job that requires continuous monitoring. Jhunjhunwala suggests beginners should take their time and make informed decisions before investing. He recommends spending as much time researching a stock as you would your first home.

He often recommended books by Victor Sperandeo, also known as Trader Vic. He suggested always starting with a small position because mistakes are bound to happen, and the markets can be merciless.

Wrapping up

While he was arguably one of the best investors of all time, the Big Bull had an interesting relationship with money.

He said, “It’s a means to an end, but it cannot be an end in itself. Money is freedom because it means I don’t have to do what I don’t like.”

In the end, Rakesh Jhunjhunwala loved to trade and invest and found remarkable success in doing it.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.