Hard Work, Talent, or Luck?

16 November 2022

Hi, The Investor’s Podcast Network Community!

Welcome back, We Study Markets readers 📖

📈 The S&P 500 fell after a report showed retail sales posted the biggest increase in eight months in October, indicating the economy can withstand additional Fed rate hikes.

👊 The FTX contagion has hit the Winklevoss twins through a liquidity squeeze at their lending partner, Genesis.

Genesis suspended redemptions and new loan originations at its lending business after the company faced withdrawal requests that exceeded current liquidity.

🤕 To say it’s getting ugly in the “crypto” world may be an understatement.

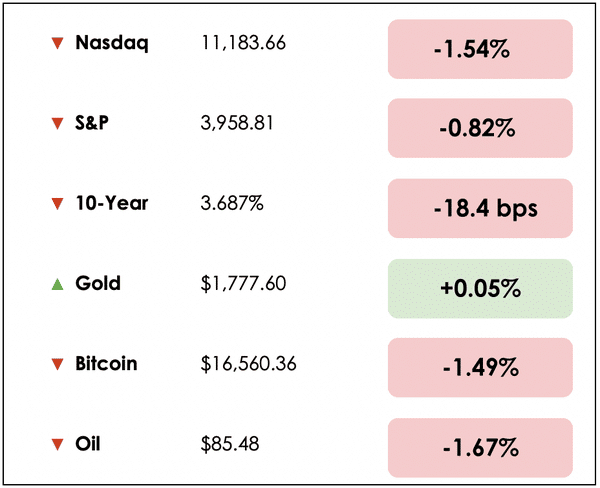

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: How Americans are increasingly tapping into their home equity and one company’s warnings of a slower holiday season, plus our main story discussing if positive results are due primarily to hard work, talent, or luck.

All this, and more, in just 5 minutes to read.

Do you want to write for this newsletter? Apply here.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🏠 Americans Tap Into Home Equity (WSJ)

Explained:

- More people are tapping into their home equity as high-interest rates are driving up the cost of borrowing money. Americans took out $66 billion in home-equity lines of credit (HELOCs), a 40% increase from a year ago.

- A HELOC allows homeowners to borrow against the value of their home and works like a credit card, but since the home serves as collateral, the rates are much more favorable.

- The average HELOC rate is 7.7%, according to Bankrate.com, compared with the average credit card rate of 19.04%.

Why it matters:

- Access to money a HELOC provides is appealing to borrowers during a time of economic uncertainty and rising fears of unemployment.

- According to financial planners, lenders tend to tighten credit standards during a downturn, so it may be wise to apply for a HELOC now if you’re worried about needing funds later.

- Big banks such as JPMorgan Chase (JPM) and Wells Fargo (WFC) haven’t resumed issuing new HELOCs after halting them during the pandemic. Borrowers are increasingly turning to credit unions and community banks to meet their borrowing needs via HELOCs.

🛍️ Target Warns of Soft Holiday Sales (Reuters)

Explained:

- Target’s (TGT) profit fell by nearly 50% in the third quarter as consumers pulled back on discretionary spending, and the company cleared through unwanted inventory. A surprise drop in holiday quarter sales was blamed on surging inflation and “dramatic changes” in consumer spending.

- Shares of the big box retailer fell by over 12% on Wednesday, even as they announced a cost-cutting plan to save $2 to $3 billion over three years.

- Layoffs or a hiring freeze are not part of the current cost reduction plan.

Why it matters:

- It is the second time Target has misjudged consumer demand this year as company executives claimed shopping behaviors have been increasingly affected by inflation, rising interest rates, and economic uncertainty.

- Target executives said consumers were rapidly giving up discretionary purchases such as clothing, home furnishings, and electronics in favor of household essentials.

- Retailers face an uncertain holiday season, and many expect the challenging environment to linger into 2023.

THE MAIN STORY: HARD WORK, TALENT, OR LUCK?

Overview

How do we know if we are good at investing? Or anything, for that matter?

Are positive results attributable to hard work, talent, or luck?

To explore this further, we turned to a long-time friend of The Investor’s Podcast Network, David Stein.

He hosts the excellent Money for the Rest of Us podcast, and in a recent episode, he provides a helpful analysis.

Let’s dig in.

What to know

Stein begins by discussing a report that showed that just eight of the world’s richest billionaires held the equivalent total wealth of approximately 3.6 billion people.

He explains that wealth follows a power law distribution, also known as a Pareto distribution.

This type of distribution is where the 80/20 rule originates. For example, businesses may find that 20% of their customers generate 80% of their revenue.

Looking at the data

One piece of research sought to address the role of randomness in success and failure, though, by using wealth as a proxy for success.

And the results, unsurprisingly, are deeply asymmetric and uneven since just a few can command such great wealth.

Could this concentration be simply due to an exponential difference in hard work, determination, ability, or grit?

Stein asks whether this could happen because “some people are just incredibly more talented or intelligent or hard-working?”

He points out that human capability tends to be normally distributed, instead of following a power law. Meaning most people have an IQ around 100, but no one has a 1,000 IQ that’s an order of magnitude greater than everyone else. Yet, wealth distributions (a proxy for success) can differ by several orders of magnitude.

In other words, we all have the same 24 hours in a day, so no one has a million times more hours than anyone else, though they can be a million times more successful.

How it relates to investing

Investors, of course, also benefit from luck. Sometimes our stock picks or allocation strategies will perform well but not for reasons that have anything to do with our initial thesis.

This makes determining our own and others’ skill levels messy. Look no further than last year’s bull market — How many felt like geniuses while Fed policies pushed all asset prices higher only to see their performance flipped upside down this year?

In one study on whether returns for various funds were the result of skill or luck, the researchers went through every investment decision made by a group of investors over time. They tracked whether it was good or bad and how it impacted performance in either direction.

You may be surprised to learn that only 18% of the investment firms studied demonstrated advantageous skill rather than luck.

And these skilled investors were only right about 55% of the time, but as Stein emphasizes, when they were right, the value they created far exceeded what was lost when they were wrong.

He notes that most investors, even the pros, probably benefit significantly from luck while also destroying more value than they create with their decisions over time.

Takeaways

Stein suggests that we recognize how luck and randomness have been factors in our lives while also seeking to minimize their negative effects on our investments.

We can use put options, for example, as an insurance policy that hedges our portfolios from unexpected downside. But we should also be prepared for good fortune by having the extra resources, like cash, ready and the necessary skills/education to pounce on positive opportunities.

You could think of this as a margin of safety for your life and portfolio.

To some extent, success comes from where preparation and hard work meet opportunity (random luck).

Dive deeper

You can listen to the full podcast here, or our most recent interview with him on We Study Billionaires.

If you like David Stein’s thinking, we recommend his weekly newsletter. If you sign up, you’ll also get his free investing checklist: Become a better investor here.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.