Streaming Wars

09 November 2022

Hi, The Investor’s Podcast Network Community!

Well, just as soon as the major crypto exchange FTX was saved by its rival Binance, which we wrote about yesterday, those hopes were dashed.

Binance tweeted that they are canceling their offer to buy FTX while the firm struggles to meet customer withdrawal requests.

🎥 The story of two crypto billionaires feuding on Twitter, culminating in the complete collapse of one’s empire (Sam Bankman-Fried/FTX), will make for an amazing Netflix documentary.

Can’t wait to watch 🍿

Wall Street was less keen on the financial spillover risks of FTX’s implosion, and both stocks and Bitcoin moved sharply lower.

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Red flags from the “Magic Kingdom” and a big shake-up at Facebook, plus our main story on investing icon Peter Lynch.

All this, and more, in just 5 minutes to read.

Do you want to write for this newsletter? Apply here.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

💻 Streaming Wars Heat Up For Disney’s (FT)

Explained:

- Disney’s (DIS) streaming business added an impressive 14.6 million subscribers, but the growth came at a substantial cost. Operating losses rose by $800 million to $1.5 billion due to higher marketing and content expenses.

- The Magic Kingdom didn’t live up to its promises of being the “happiest place on earth,” at least for investors, after reporting earnings of only 30 cents per share which was almost half of what analysts expected.

Why it matters:

- From Apple (AAPL) and Amazon (AMZN) to Alphabet (GOOGL), Facebook (see below), and now Disney, America’s biggest and most successful brands are getting clobbered this year following disappointing earnings reports amidst rising interest rates. Disney stock fell over 13% during the day, which marked a roughly 44% fall for the year.

- On the bright side for Disney, its CEO reassured investors that the rapidly rising streaming costs were an intentional “strategic decision” while its CFO chimed in to say, “peak losses are now behind us.”

- In the cutthroat streaming world, Disney is using a winner-take-all approach — We’ll see how it pays off for them in the coming years.

🤯 Meta Cuts 11,000 Jobs In Dramatic Restructuring (Reuters)

Explained:

- Meta Platforms Inc (META), also known as Facebook, said today that it would cut 13% of its workforce following its recent poor earnings report that contributed to its 70% year-to-date share price decline.

- The company’s CEO Mark Zuckerberg acknowledged that they had over-hired during the pandemic due to the temporary surge in social media use. He admitted, “I got this wrong, and I take responsibility for that.”

- Any indication that the company will be more disciplined in its spending is welcome news to Wall Street. 2023 expenses are expected to drop by as much as $7 billion due to the layoffs and other discretionary spending cuts.

Why it matters:

- Its stock rallied by over 7% on the news, as investors believe these sorts of cost-cutting initiatives will help return Meta to its past levels of profitability after seeing profits fall due to large bets on the “Metaverse” (virtual reality platforms).

- Investments the Metaverse will still weigh heavily on the company, though, with its Reality Labs unit losing $9.44 billion in just nine months this year.

WHAT ELSE WE’RE INTO

📺 WATCH: What is value investing? Preston Pysh’s series on investing like Warren Buffett.

👂 LISTEN: The best investor you’ve probably never heard of, Clay Finck’s biggest takeaways from studying Nick Sleep.

📖 READ: The FTX and Binance drama explained simply, a Twitter thread by Shaan Puri.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

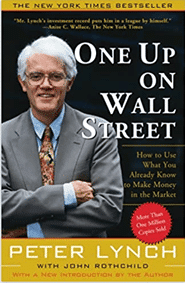

THE MAIN STORY: ONE UP ON WALL STREET

Overview

What advantages over Wall Street do individual investors have?

I (Shawn) recently re-read Peter Lynch’s classic 1989 book, One Up on Wall Street, and I’m here to share some takeaways.

The book itself is a bit simplified and addressed at beginners, but there are nuggets of wisdom beneficial to all investors.

Let’s go through it.

Who is he?

Lynch was born in 1944, and he’s most famous for managing the Magellan Fund, which generated a stunning 29.2% annual return over twenty years.

That was more than enough to secure his place in the Wall Street hall of fame, and he not only considerably beat the market’s performance, but he did so with remarkable consistency.

After a summer job caddying at a golf course as a kid, Lynch frequently heard golfers discuss opportunities to make money in the stock market, and his interest was piqued.

Soon enough, he had saved enough money to buy his first stock, and after quickly (and luckily) making a profit, he realized this was a game he wanted to master.

What to know

While he certainly came to do this, his book emphasizes that anyone can be an investor. Plenty of people have achieved spectacular returns without a business degree over the years.

Despite market crashes, recessions and depressions, wars, and everything else, the U.S. stock market has proven remarkably resilient.

Tips

He’s also quite adamant about the risks that stock pickers face.

Although, he does have a few tips to help.

Reject the notion that you can predict the future. It’s among the greatest traps that new (and old) investors fall into.

While the stock market and the general economy move hand in hand sometimes, it’s not possible to make accurate predictions consistently, given the huge complexities underlying these two areas.

If you presume to do this, you’ve already lost. And further, anyone who claims to be able to make these predictions, is, at best, engaging in pseudoscience and is, at worst, a charlatan.

What’s there to do then?

Lynch says that the average investor should focus only on profitable companies that aren’t overpriced.

To find these, we ought to be vigilant and mindful of the successful products we see all around us.

Perhaps we find a new product of superior quality while shopping, or maybe our friends are all purchasing a new popular subscription package.

Paying attention to these sorts of things can tip us off that a company is likely to soon report excellent earnings, which Wall Street analysts may not be aware of until the actual quarterly earnings report comes out.

Hold your horses

But don’t jump the gun here. He compares buying stocks without doing any fundamental research to playing poker without even looking at the cards.

According to Lynch, aspiring stock pickers must find businesses with catalysts for growth that are largely being dismissed.

This ties into the thinking that you can earn an edge just by observing the businesses and products that are successful in your own life.

And there may be truth to it.

Suppose you overhear your children or younger cousins talking about some new video game or toy they must have. Or maybe you uncover a social media platform that’s just become popular with their generation.

You could have stumbled onto a profitable trend before markets have caught on.

Bonus points if the business is standard and boring, making it even more likely to be overlooked by others.

Unanticipated growth

The possibilities for catalysts are nearly endless. Maybe, instead, it’s a new software that your company is making everyone transition to using, or your mechanic who mentions a new brand of superior tires, that offers the inspiration.

The point is that you’ve uncovered increasing demand for a company’s products, so it’s time to investigate further.

The next step would be determining which company produces this trendy product and whether they’re publicly traded.

If the company is massive and does tens of billions of dollars in sales, well, a new product that unexpectedly adds $100 million to its revenues doesn’t move the needle much.

But if it’ a core product/service, and the stock is languishing while you get tipped off to how successful they really are, you may have found a “ten-bagger,” as Lynch refers to them. That is an investment that increases tenfold from its current prices.

Takeaways

It’s fair to say that Lynch’s teaching here are elementary or only relevant in a pre-internet era.

I’d argue that finding an unloved company with a major growth catalyst is easier said than done, and I think Lynch would agree, but his insights are still useful.

Plenty of “micro-cap” stocks just aren’t meaningfully covered by Wall Street because they’re too small.

And it’s also true that just by being a consumer in the global economy, you could find excellent and increasingly popular products/services that won’t hit professional investors’ radar until the stocks are larger or until their financial statements for the next quarter come out.

I don’t necessarily employ Lynch’s framework literally. Still, I do find it helpful as a reminder that those stock prices flashing on my phone or computer are linked to companies with operations in the real world.

And being observant about the brands I interact with while being curious enough to dig into their fundamentals, at a minimum, provides a great opportunity to learn about different types of businesses.

Dive Deeper

To see my full video review of the book, you can find it here. Or you can listen to Preston and Stig’s (throwback) podcast on the book from 2017.

Or just buy it for yourself.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.