Material Risk

11 October 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

🗽 The oldest bank in the United States, founded by Alexander Hamilton, has received regulatory approval to custody and transfer digital assets like Bitcoin on behalf of customers.

Fund managers can now use the historic and systemically important Bank of New York Mellon (BK) to manage their holdings, rather than relying on crypto fintech firms.

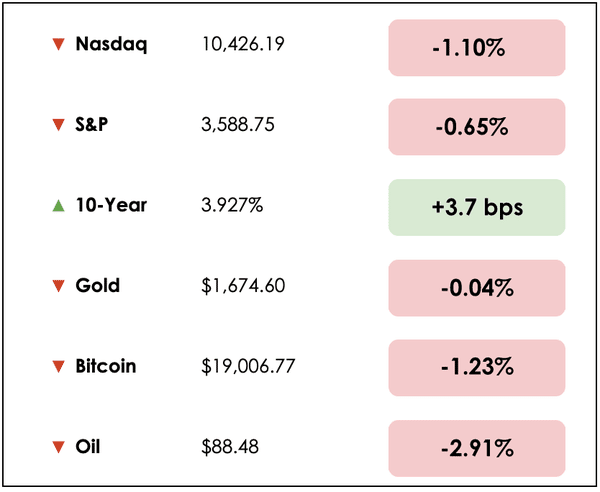

😪 Once again, the market rundown is ugly:

*All prices as of market close at 4pm EST

Today, we’ll discuss the absence of major buyers from U.S. Treasury bond markets, “material risk” in the U.K.’s financial system, why now is the best time for Americans to travel, and a deep dive into how the rich invest.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

IN THE NEWS

🏃♂️ U.S. Treasury Buyers Are in Retreat (Bloomberg)

Explained:

- The largest players in the $23.7 trillion U.S. Treasuries market are staying on the sidelines as demand for bonds craters.

- Typical buyers such as Japanese pension funds, life insurers, foreign governments, and US commercial banks are all pulling back from their Treasury purchases en masse. Even the Federal Reserve increased the pace it plans to offload its Treasuries from its balance sheet to $60 billion a month.

- If a few of these sources of demand were bailing, it would be less cause for concern, but for every one of the typical buyers to pull back is alarming.

What to know:

- The Bloomberg U.S. Treasury Total Return Index has lost about 13% this year, almost four times as much as in 2009, the worst full-year result since its 1973 inception.

- Credit Suisse Group AG’s Zoltan Pozsar said, “since the year 2000, there has always been a big central bank on the margin buying a lot of Treasuries.” Now “we’re basically expecting the private sector to step in instead of the public sector, in a period where inflation is as uncertain as it has ever been.”

- Peter Boockvar, chief investment officer at Bleakley Financial Group, said it’s dangerous to assume that the U.S. Treasury will “ultimately find buyers to take the place of the Fed, foreigners, and the banks.”

- More pain may be in store until consistent, new sources of demand emerge for Treasuries. Until then, it’s bad news for American taxpayers, who will likely have to foot the bill for higher borrowing costs.

💵 Strong Dollar Goes Far for American Travelers (WSJ)

Explained:

- American travelers are being offered a once-in-generation opportunity to benefit from the strong dollar overseas. It may be the time to take that international adventure you’ve been dreaming about for years.

- The euro, Japanese Yen, and British pound have all fallen to multi-decade lows against the dollar. For U.S. travelers, even those used to a shoestring budget, this means a license to spend where their dollars are going further.

What to know:

- “Right now is the best time we’ve probably had in 25 years to travel most destinations internationally, including Europe and Japan,” said Angela Hughes, owner of Trips and Ships Luxury Travel.

- Travel experts say U.S. travelers can get a breather from domestic inflation, as the dollar’s strength has helped offset rising costs in other countries. Time to become a digital nomad?

🆘 Bank of England Expands Bond Market Rescue Plan (Reuters)

Explained:

- The U.S. Treasury isn’t the only government facing bond market woes. The Bank of England extended support for the second day in a row, the latest attempt to contain a serious bond market sell-off threatening U.K. financial stability.

- Citing “material risk” to the health of pension firms, the central bank said today it would add inflation-linked government bonds to its program of bond purchases after an attempt Monday to ease concerns failed to calm the markets.

What to know:

- Markets witnessed “a further significant repricing of U.K. government debt,” according to the Bank of England.

- This may be an understatement as long-term inflation-linked gilts (the equivalent of a U.S. Treasury) maturing in 2073 have declined 78.6% since being issued in November 2021. In the same period, the famously volatile asset, Bitcoin, is down just 67%.

- A drawdown of this magnitude on inflation-proofed sovereign debt is truly mind-blowing. With good reason, investors in British government debt are worried about what will happen to the bond market after most of the Bank of England’s emergency support measures end.

DIVE DEEPER: HOW DO THE RICH INVEST?

It’s no secret that the rich invest differently than the average person does, often for the simple reason that they have more options available to them.

High-net-worth individuals may find it easier to participate in large private deals, such as in commercial real estate, or they may be able to invest in hedge funds and private equity funds that typically have considerable investment minimums ranging from a few tens of thousands of dollars to millions.

Breaking it down

The technical term to participate in these exclusive investment funds is to be “accredited.”

What that means, in the eyes of the Securities and Exchange Commission (SEC), is that accredited investors qualify to invest in financial assets that aren’t registered with them, and therefore, have less oversight.

This essentially means that you either have a significant amount of wealth or income, proven experience in professional finance, or both, such that it’s “safe” for you to participate in investment strategies that are less regulated by the government.

There’s no process to objectively become an accredited investor, and the SEC will not anoint you as one, as it’s the investment firm’s responsibility to determine that you are indeed accredited to participate.

So what might an accredited investor look like then?

The SEC sets these guidelines:

- An individual income greater than $200,000, or a joint income with their spouse greater than $300,000

- A personal or joint net worth with their spouse in excess of $1 million (not including personal residences)

- Professional licenses in finance for passing the Series 7, Series 65, or Series 82 exams

The perk of being accredited is that you can participate in investments and strategies not easily available to the majority of people.

For example, mutual funds are broadly open to the public and they’re also heavily regulated.

On the other hand, hedge funds are primarily available to accredited investors, and they have fewer regulations than investment products intended for the general public, but this gives hedge fund managers far more discretion over how they can invest their fund’s capital.

What to know

One reason that certain investments require accreditation is that the strategies are illiquid. This means that the investments need to be locked up for periods of time to be executed properly.

Think about venture capital for reference.

If you invest in a venture capital (VC) fund that seeks to find the next hot tech company, it may be several years (if ever) before the fund receives its investment back, since it can’t just sell the investment in a secondary market like with other stocks.

The VC fund, generally speaking, has to wait for the young companies that it invests in to either be bought out by another company or reach enough size such that they can list on a stock exchange and become publicly traded (IPO).

The takeaway here is that the strategies used by funds requiring accreditation status are risker, at least in the SEC’s eyes, but more importantly, there’s often a significant time and capital component, where these funds will demand sizable sums of money from investors and then wait years for their bets to unfold.

Rationale

Practically speaking, these sorts of investments only made sense for the wealthy historically, because no one else could afford to lock up large amounts of their capital in one strategy with the uncertain promise of being paid back many months or years later.

While regular ol’ stock investing can be long-term in nature, we also know that you can sell out and get (some of) your money back at any time if you need to.

As we highlighted with venture capital, an industry that’s known for accredited investor limitations, there’s really no way to get your money back sooner, and only those with enough excess cash to comfortably participate have had the stomach for these strategies.

Accredited investors, then, have more flexibility than the average investor, but they also tend to have different goals. Rather than trying to aggressively build wealth, these people are probably trying to preserve it.

High-net-worth portfolios

Let’s see what an accredited investor portfolio may actually look like.

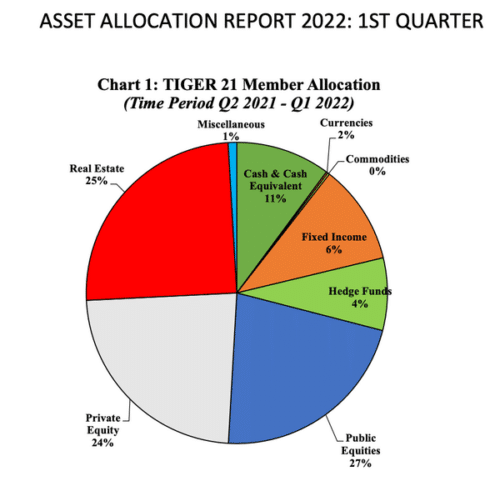

For this, we turned to Tiger 21, a peer group of wealthy entrepreneurs, investors, and executives. Twice a year, the organization publishes a breakdown of its members’ average portfolio construction.

To become a member, you need to have at least $20 million in investable assets readily available.

Here’s what their member portfolios look like in aggregate (from earlier this year):

Comparing allocations

With public equities at a decent bit less than 1/3 of the allocation, you may be surprised to hear that this reflects the largest percentage allocation that these assets have held in their member portfolios since 2009.

What’s more striking to consider is that, according to the wealth tracking service Personal Capital, the average American investor in their 20s, 30s, 40s, 50s, and 60s holds 50% or more of their liquid financial assets in either U.S. or international stocks.

And even the average person in their 70s or older holds at least 40% in public equities.

While this data isn’t necessarily representative of the entire population, since it’s derived from studying their users’ accounts, it’s probably a decent indicator of how many people, who actively and meaningfully are able to save for their future, allocate their assets in the United States.

Alternative assets

The other striking difference that comes between the “rich portfolio” and the “average person portfolio”, is, as we’ve discussed, high-net-worth investors’ huge exposures to private equity, hedge funds, and real estate.

For Tiger 21’s members, these three groups capture approximately 53% of their total assets.

Per Personal Capital, so-called “alternative assets” (a broad term typically including private equity, hedge funds, real estate, commodities, etc.) account for less than 4% of users’ assets in all age ranges.

An accurate explanation for why richer investors prefer alternative assets, to the plain vanilla stocks and bonds that most of us hold in our investments, is beyond the scope of today’s letter.

Though to explain briefly, opportunities for high returns in these spaces are believed to be greater, since they’re less regulated and correspondingly have less competition. There’s also a hope that they provide diversification benefits.

Accreditation requirements artificially restrict the pool of potential investors, and thus, in some sense work to ensure higher returns for those who can participate.

Again, this is pretty simplified, and the private equity space, for example, has become so saturated with new funds over the past few years, there are meaningful questions as to whether this asset class can continue to provide the sort of remarkable returns that it once did.

Takeaway

The point, though, is that for better or worse, and for sometimes legitimate reasons (wealth preservation versus wealth creation), high-net-worth portfolios tend to look quite different than they do for most Americans who overwhelmingly hold their wealth (outside of personal residences) in publicly-traded stocks and bonds.

But we also cannot pretend that accreditation requirements haven’t meaningfully contributed to this dynamic, where regular people hold most of their financial assets in public assets and the richer among us hold theirs in exclusive alternative asset classes.

Increasingly, we expect that the strategies once available only to accredited investors will become more mainstream, and the differences in composition between accredited portfolios and regular investor portfolios will narrow.

For example, there are a number of new crowdfunding platforms that seek to make opportunities in the venture capital and private equity space available to the average investor, like WeFunder, NextSeed, and StartEngine (we haven’t vetted these platforms nor are we endorsing them).

Evidently, financial markets are increasingly being democratized, as technology tears down barriers to entry and frictional costs.

Though the benefits to investors from alternative investment crowdfunding platforms still remain to be seen, it’s an interesting space to watch develop.

Wrap up

For more on this topic, don’t miss Trey Lockerbie’s excellent interview with Michael Weisz breaking down how everyday investors can access the alternative asset space.

Let us know — Is there anything we’re overlooking here?

How do you feel about accreditation requirements?

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.