Sovereign Downgrade

06 October 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

🍻 Congratulations readers, you’ve ~almost~ made it through another week, and we’re looking forward to Fall festivities this weekend.

Did someone say apple picking? 🍎

Before you start making your weekend plans, let’s run through the biggest things happening in financial markets.

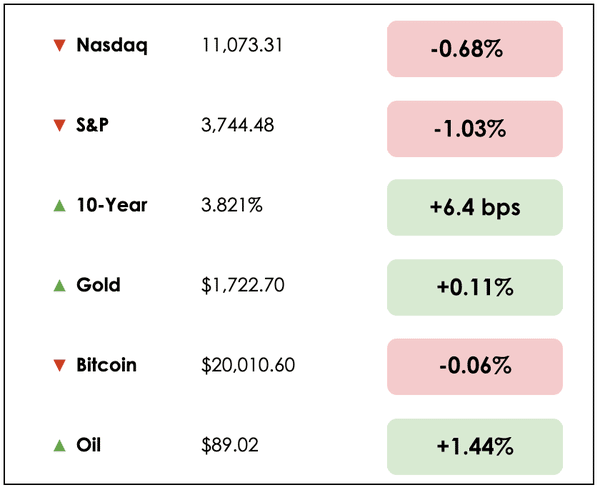

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss weakness in the labor market, rising gas prices, the risk of a major sovereign credit downgrade, and word on the active versus passive investing debate.

All this, and more, in just 5 minutes to read.

Let’s go! ⬇️

IN THE NEWS

💼 U.S. Weekly Jobless Claims Increase More Than Expected (Reuters)

Explained:

- New claims for unemployment benefits last week rose by 29,000, which at a seasonally adjusted rate, is 219,000 and surpassed expectations of 203,000.

- This comes as another early sign that the Fed’s rate hiking efforts are trickling through to the labor markets, after we learned earlier this week that job openings had declined by over a million.

What to know:

- Employers announced plans to hire 380,000 workers last month, but this marks the lowest figure since 2011.

- Jobless claims are expected to be quite volatile over the next few weeks following hurricane Ian’s destructive path across Florida and the Carolinas.

- On Friday, we’ll learn about September’s employment report for nonfarm payrolls, which economists anticipate will come in at 250,000 new jobs.

⛽ Gasoline Prices Are Climbing Again (WSJ)

Explained:

- After weeks of price declines that helped to keep inflationary figures from being even worse, U.S. gasoline prices are now ticking up and set to move higher. A gallon of regular gas is averaging nationally around $3.83.

- A move on Wednesday by the Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia, intends to cut oil production by 2 million barrels per day. And Russia is threatening to cut production even further if the U.S. and Europe go ahead with price cap sanctions.

- Prices are abnormally high this time of year, though some analysts are saying they don’t expect gas prices to move back to the $5 level seen back in June, since winter gasoline demand is typically less than in the summer.

What to know:

- The Biden administration has released millions of barrels of oil from the Strategic Petroleum Reserve, as an effort to subdue gas prices ahead of the important November midterm elections.

- Gasoline inventories in the U.S. were at their lowest levels last week since 2014 and down 8% from the same time last year.

- In part, the shortage has been made worse by a number of outages and scheduled maintenance at refineries across the country that have limited the output of various petroleum products.

⬇️ The UK Is At Risk Of Major Credit Ratings Downgrade (Bloomberg)

Explained:

- Fitch Ratings lowered the UK’s credit outlook to “negative” from “stable” and cited financial risk from the government’s controversial tax-cut-oriented growth plans.

- Analysts wrote, “The large fiscal stimulus, announced without compensatory measures or an independent evaluation of the macroeconomic and public finances’ impact…have in Fitch’s view, negatively impacted financial markets’ confidence and the credibility of the policy framework.”

What to know:

- Britain’s aggressive package of tax cuts, paired with plans for large-scale borrowing, nearly crashed the country’s debt and currency markets before the Bank of England intervened.

- S&P Global Ratings also lowered its outlook for the country’s credit rating last week due to concerns about its fiscal health with Moody’s issuing a similar warning.

BROUGHT TO YOU BY

Warren Buffett doesn’t just buy a company’s stock based on its financials.

He also looks for great management teams.

You need to be like Buffett when investing passively in real estate.

Get access to the free 7 Red Flags for Passive Real Estate Investing guide to learn what to look out for in a deal’s management team.

DIVE DEEPER: CAN ACTIVE INVESTING OUTPERFORM IN DOWN YEARS?

Overview

The status quo financial advice that most people hear is to invest broadly and passively (aka using index funds). And for most, this is great advice.

We won’t pretend that, on average, there’s any historical reason to believe most people could actively beat the market, nor do most professional investors even do this after accounting for fees.

It’s a tired topic, and readers of this newsletter should be familiar with the various associated talking points.

What to know

Passive investing, generally speaking, is a better and safer approach, but if there weren’t ways to manage money yourself and invest differently, well you probably wouldn’t bother listening to our podcasts or reading our newsletters.

At a minimum, active investing is intellectually stimulating, uniquely challenging, and wildly rewarding when done well, which there’s something to be said for.

As we’ve hinted, though, the debate between “active” and “passive” investing is a nuanced one.

To add another wrinkle into this timeless conversation, our thinking today was inspired by a recent Bloomberg podcast that posits that so-called active investing styles are outperforming significantly this year.

This, then, raises an interesting question about the advantages of picking your own stocks during market downturns — Perhaps this is a time when active really can beat passive?

Let’s discuss.

Breaking it down

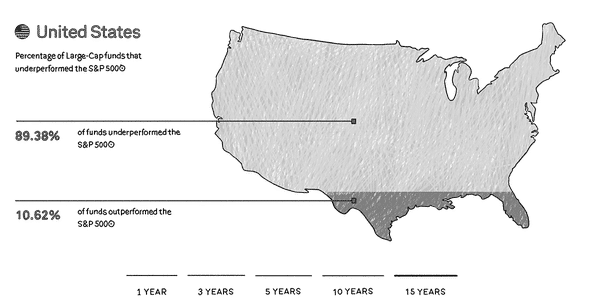

Tim Edwards, head of S&P Dow Jones Indices, runs the SPIVA report, which is a scorecard that contrasts how well active fund managers are doing against their passive benchmarks.

The report finds that 89.38% of large capitalization active funds in the U.S. underperformed the S&P 500 over the last 15 years. Over 5 years, that figure improves slightly to 84.47%.

The trend is international, too. In Europe, over the last 10 years, 87.81% of active equity funds underperformed against their benchmark S&P Europe 350 index.

In Japan, over the past decade, just 18.10% of large-cap funds beat the benchmark S&P/TOPIX 150 index.

And in the U.S., the trend is actually worse for small and mid-cap funds versus their respective indexes.

Trend change

This year though, active is doing quite well. Through the first half, 49% of active large-cap funds are beating the S&P 500 in 2022, according to Edwards.

He clarifies that this figure is typically closer to 33%, and there are a few reasons for this improved performance.

Dispersion in the markets, which is a measure of the performance differential between various stocks, has been higher than normal in this volatile trading year.

This means that there are greater extremes between winners and losers, thus setting the stage for good stock-pickers to shine.

The last time stock-pickers had such a strong showing was in 2009.

So, there may be reason to believe stock-pickers can perform well in aggregate when there’s significant levels of dispersion in markets, as commonly found during bear markets like the one we’ve experienced this year.

And to be fair, active investors are at a structural disadvantage (marginally), because index returns do not account for the real-world trading costs that detract from their performance.

That said, Edward argues that what really matters most is the fees these funds charge.

While few active funds outperform over any meaningful amount of time, the ones that do are typically in the lowest quadrant of fees charged.

The future of active investing

Another trend to watch out for is active funds becoming increasingly specialized in their “best picks.”

In other words, it appears that most financial advisors and individual investors don’t want to place their money anymore in an active fund that tries to pick, say, 100 different large-cap stocks in the U.S. and pay a 0.5% fee for that. Especially since they could just buy an S&P 500 index fund with a 0.05% fee.

But, there may be demand for niche active strategies going forward. For example, active funds that pick the best biotechnology companies.

So active funds are unlikely to be the “core” of peoples’ portfolios, as increasingly investment allocators choose passive models for this, but on the fringes, these active strategies can be used to speculatively augment portfolios.

Additionally, active investors have a much better track record in more inefficient markets.

Edwards highlights small-cap international stocks as a place where these stock-pickers can thrive, rather than trying to bet on whether Amazon (AMZN) or Apple (AAPL) will have a better year.

Wrapping up

Although passive strategies have come to dominate the investing world, there may still be room for active funds in years with high equity dispersion (often down years) and within concentrated niche strategies that can match a bet that an investor wants to place on a specific area.

Such as, turning to an active manager who can garner an expert opinion on overlooked and tiny sectors like cannabis, biotech, or small-cap emerging market stocks, where there may be meaningful room for stock-pickers to thrive.

You can read the full SPIVA report here.

And check out Clay Finck’s interview with Eric Balchunas on the rise of passive indexing.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.