Oil Seizure

16 September 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

Happy Friday, and as a bonus, we’re delighted to say that there are only 100 days until Christmas 🎄

Too soon?

As the dollar continues its surge upwards against other global currencies, Citigroup says that they see the dollar as the only hedge against what’s starting to look like the greatest wave of wealth destruction and financial asset declines since the Great Financial Crisis.

In other news, a key survey from the University of Michigan highlighted that consumer sentiment is rising slightly, and inflation expectations for the next year are at their lowest monthly level in 2022 😅

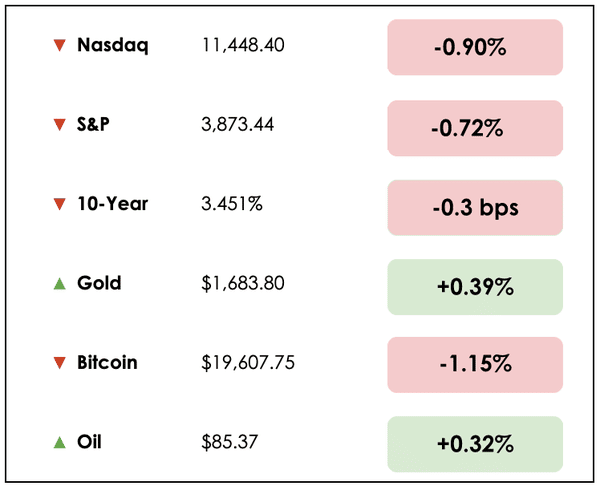

Here’s the market rundown:

*All prices as of market close at 4pm EST

Stocks had another rough day with the Nasdaq leading the way down. This marks the fourth out five weeks that equities have closed lower. Gold and oil got some relief after harsh selling recently.

Today, we’ll discuss Germany’s seizure of Russian oil, an ominous warning for the global economy, what FedEx’s earnings report means for investors, and a deep dive into understanding recessions.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

IN THE NEWS

🇩🇪 Germany’s Russian Oil Grab (Bloomberg)

Explained:

- Germany seized control of local units of a Russian oil company, Rosneft, to take greater command over its energy industry, secure supplies, and sever its dependence on Russian fuel.

- In total, three Russian-owned oil refineries were seized to secure gasoline, diesel, and aviation fuel supplies.

- Rosneft Deutschland accounts for about 12% of Germany’s oil refining capacity.

What to know:

- Germany’s economy ministry said the move was designed to “counter the threat to the security of energy supply.”

- Europe has been embroiled in a bitter energy stand-off with Russia since the invasion of Ukraine in February, and its imports of Russian oil and natural gas have fallen sharply.

- In May, the European Union agreed to ban 90% of Russian oil imports by the end of the year to choke off a vital source of funding for Moscow’s war in Ukraine.

⚠️ World Bank Warns Higher Rates Could Cause Global Recession (FT)

Explained:

- The World Bank has released a report warning the world’s central banks that they risk sending the global economy into a “devastating” recession next year if they continue to raise interest rates too high over the coming months.

- The Washington-based organization called on the world’s largest central banks to coordinate their actions to reduce the overall amount of tightening.

What to know:

- IMF chief economist Maurice Obstfeld echoed the World Bank’s findings and urged the monetary authorities to be less “zealous” in raising interest rates to curb inflation. He also said, “by simultaneously all going in the same direction, they risk reinforcing each other’s policy impacts without taking that feedback loop into account.”

- Energy and food prices have surged following Russia’s invasion of Ukraine, causing a cost of living crisis for many worldwide. To avoid letting inflation soar, the World Bank recommended governments provide targeted relief to the most vulnerable households instead of relying on tighter monetary policy.

✈️ FedEx Parks Planes and Trims Hours (CNN)

Explained:

- FedEx (FDX) seems to be stalled out on the side of the road with engine trouble. The company’s shares plummeted 23% in early trading Friday, and fell even further during the day, after the company announced late Thursday that a slowing economy will cause it to fall short of its revenue target by $500 million.

- A weakening global economy, mostly in Europe and Asia, was cited for the slowdown in FedEx’s delivery service.

- The company is responding by reducing flights and temporarily parking planes, trimming hours for staff, delaying hiring plans, and closing 90 FedEx Office locations, as well as five corporate offices.

What to know:

- In a concerning statement for investors, CEO Raj Subramaniam said he expects the economy to enter a worldwide recession.

- FedEx serves as a barometer for the economy’s health more broadly. The markets may be in for a rough fourth quarter if the FedEx results are any indicator of things to come.

DIVE DEEPER: DEFINING A RECESSION

Breaking it down

The question as to whether the U.S. is in a recession has been both a difficult one and a political one.

We have no interest in being political, though the discussion raises interesting insights into how to think about business cycles.

So in that spirit, we recently listened to an excellent podcast with Lakshman Achuthan. On Wall Street, he’s seen as a go-to authority on the topic as a co-founder of the Economic Cycles Research Institute.

A process, not a statistic

He explains first by providing context about recessions. Achuthan calls them the “Achilles heel” of free-market economies, as these systems tend to ebb and flow.

Building on this, the takeaway is that a recession cannot be precisely measured by any single statistic, but rather, it more accurately represents a broad economic process.

While two-quarters of negative GDP growth is typically a good rule of thumb, “it’s not a necessary nor sufficient condition for recession.”

A recession, then, really means a contraction in economic activity that is “pronounced, pervasive, and persistent” and creates declines in “broad measures of output, employment, income, and sales.”

What to know

For Achuthan to believe that we have reached a recession, there needs to be unequivocal evidence of falling labor market activity, meaning significant layoffs and the destruction of new job openings.

He further clarifies that a recession cannot just impact one section or sector of the economy. As he’s said, it must be pervasive, which means that no one can truly hide from its effects.

With this in mind, the point is not to say that we aren’t nearing a recession or that the economy is in great shape, but rather, to highlight that there’s legitimate room for interpretation here.

There’s historical precedent, though, for a jobs decline to begin on a slight delay after the start of a recession (which can only be defined in retrospect), and this demonstrates why we should think of recessions as widespread processes.

Present state of markets and the economy

According to his economic indicators, we have not yet entered into what he calls a growth cycle downturn due to strengths in the labor market, so he’s advising investors generally to be cautious, but not all in on the bet that the U.S. economy is tanking.

At the same time, he also sees no evidence for a growth cycle upturn, which means that the summer “FOMO” rally in stocks was principally a bear market rally, not a legitimate market insight into the Fed achieving a “soft landing” with its rate hikes. In other words, the bear market in stocks is not over yet.

Achuthan goes on further to discuss the roles of quantitative easing (QE) and quantitative tightening (QT).

He argues that, since the Great Recession in 2008 and central bank implementations of QT, we’ve seen more truncated economic downturns and reduced volatility in financial markets in aggregate. So downturns that used to play out over quarters, now unfold over weeks.

Essentially, QE distorts and reduces the amplitude of business cycle swings, which on Wall Street has been called the “Great Moderation,” which past Fed Chairman Ben Bernanke has discussed.

Looking forward

On the flip side of this, as we move into an era of rising rates and quantitative tightening, it’s logical to believe that we may return to an environment where persistent economic and market declines are possible.

In this regard, Achuthan’s models say that the Fed has indeed responded too late to elevated inflation reports, thus making the possibility of a so-called “soft landing,” where rates can be tightened without causing a recession, highly unlikely.

In the past, under the guidance of Paul Volcker in the 1980s and Alan Greenspan in the 1990s, inflation was squashed while avoiding recession, because the Fed responded preemptively to price increases with higher interest rates.

The same cannot be said for our current Fed leadership which failed to address inflation when it first reared its ugly head in Fall 2020, and actually, the central bank continued to stimulate the economy for another whole year at least.

Takeaways

Perhaps, then, it seems entirely semantic for us to highlight this argument.

Where on the one hand, we do not currently meet the definition of a recession, yet on the other, we acknowledge that the Fed’s delayed response to inflation will eventually send the economy into recession.

This is a fair criticism, though, a precise understanding of the facts is imperative in investing.

Pondering recessions more abstractly, as a natural process in the business cycle born out of predominately free market systems, fosters a more complete view of reality.

The long and short of it is that, yes, the U.S.’s economic outlook appears to be weakening amidst higher interest rates and quantitative tightening.

However, until the labor market actually declines, leading experts like Achuthan do not think the current environment qualifies as a recession.

This may mean that the worst of a recession is still before us, and Achuthan encourages investors to have enough cash on hand to jump into markets when this transpires.

Wrapping it up

Tell us, readers, what you think — Do you disagree or agree with Achuthan?

What’s your outlook for the U.S. economy?

For more on recessions and the state of the economy, check out Preston Pysh’s Macro Mastermind podcast episode.

WHAT ELSE WE’RE INTO

- 🗞️ News: India’s Prime Minister scolds Russia’s Putin for invasion of Ukraine in a joint conference

- ✉️ Newsletter: “At a time of record profits, Big Oil is refusing to increase production to provide the American people some much needed relief at the gas pump”

- 📺 Video: Double-digit inflation in 2023? featuring Luke Gromen

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.