Good to Great Lessons

15 September 2022

Hi, The Investor’s Podcast Network Community!

Happy Thursday and welcome back to We Study Markets!

Can you imagine being upset about being listed as one the wealthiest people alive on Forbes?

Well, Yvon Chouinard, founder of Patagonia, was “really, really pissed off” about it.

The mountain climber turned reluctant billionaire said he felt he had failed in his life’s mission to make the world a fairer and better place when he read his name on the list.

Chouinard has donated his entire company (worth $3 billion) to charity to “help fight” the climate crisis. He said, “Earth is now our only shareholder.”

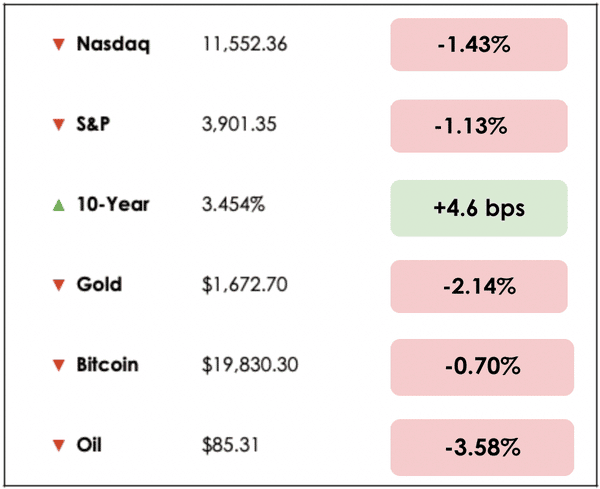

The market indexes were down today led by the Nasdaq as investors continue to fret about the size and timing of future interest-rate increases.

Adobe (ADBE) fell hard after announcing its plan to acquire web-based design tool company Figma for $20 billion (more on that below).

Early reports on “The Merge” seem to indicate the move to proof-of-stake for the second largest blockchain in the world has gone off without a hitch — so far.

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss a possible solution to the U.S. railway strike, Putin and Xi’s big meeting , Adobe’s acquisition moves, and our top takeaways from the classic book, Good to Great.

All this, and more, in just 5 minutes to read.

Let’s go! ⬇️

IN THE NEWS

🚂 Major U.S. Railroad Strike Averted (WSJ)

Explained:

- After 20 hours of tense talks ending on Thursday facilitated by President Biden’s administration, a last-minute rail shutdown appears to have been avoided, which would have been hugely costly to the nation’s food and fuel supply chains.

- Provisions include an immediate 14.1% wage increase with greater flexibility for workers to seek medical care without being punished for taking days off.

- Biden said the deal was a “win for tens of thousands of rail workers who worked tirelessly through the pandemic to ensure that America’s families and communities got deliveries of what have kept us going during these difficult years.”

What to know:

- Union members still must vote on the agreement, but for the time being, a strike that was set to begin tomorrow will at least be delayed by a few weeks now.

- A shutdown could have frozen around 30% of the U.S.’s cargo shipments (by weight) which surely would have added to supply chain issues and further stoked inflation. Some estimates show that a strike would cost the U.S. economy $2 billion daily.

- Due to technology and cost-cutting, the number of railway workers in the U.S. has declined from 600,000 in the 1970s to just 150,000 today.

👀 Chinese President Xi and Russia’s Putin Meet (FT)

Explained:

- In a meeting in Uzbekistan today, Putin turned to one of his few remaining allies, the Chinese Communist Party headed up by Xi Jinping.

- Surprisingly, Putin acknowledged Chinese “concerns” over the war in Ukraine for the first time, despite previously suggesting they had a “no limits partnership.”

- This no-limits partnership was announced just twenty days before the invasion of Ukraine, and it’s largely seen as a response to the U.S.-led Nato coalition.

What to know:

- While the U.S. and Europe seek help from countries globally in enforcing their sanctions on the Russian economy, China has sought to remain neutral while also showing a willingness to help Russia avoid the costs of sanctions.

- Following a congressional bill yesterday that would directly fund weapons to Taiwan for the first time while also enacting sanctions against Chinese state-owned banks, Putin used the meeting as an opportunity to declare his support for China’s claims to Taiwan.

- For Xi, whose regime has dealt harshly with Covid outbreaks in China, this marked his first trip abroad since the start of the pandemic.

💵 Adobe To Buy Collaboration-Software Company Figma For About $20 billion (WSJ)

Explained:

- Adobe (ADBE) has agreed to purchase the software firm, Figma, in the tech giant’s biggest acquisition to date.

- Adobe will fund the deal using roughly half cash and half stock, and the company currently trades with a market capitalization of around $174 billion.

- Its shares fell, though, on weak fourth-quarter guidance, which the company credited to foreign-exchange headwinds as the dollar’s rise has diminished the value of earnings in other currencies.

What to know:

- Based in San Francisco, Figma’s products are “akin to digital whiteboards in which designers and engineers can share design iterations and annotate them with feedback and suggestions.”

- Our very own Clay Finck recently did a deep dive on Adobe and calculated its intrinsic value. You can check out the podcast here for more.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

DIVE DEEPER: 5 LESSONS FROM GOOD TO GREAT

Patrick — Some of our readers may not know, but my talented co-writer, Shawn O’Malley, also co-hosts The Investor’s Podcast Network’s YouTube channel, in which he explores our favorite books and investing ideas.

He recently did a fantastic summary of the perennial classic by Jim Collins, Good to Great. I had last read the book in 2003, which had a big impact on me then, so listening to Shawn’s review was a great reminder of exactly why the book has sold over 4 million copies and is still relevant over 20 years since it was published.

The premise of the book was fairly simple. Collins and his research team started with 1,435 good companies, examined their performance over 40 years, found the 11 companies that became great, and shared their findings on the key essentials of business that can transform a company.

Good is the enemy of great, and few people or companies manage to achieve greatness because they settle too quickly for a comfortable life.

One of the overriding themes of the book is the necessity of discipline. To go from a good to great company, you need disciplined people, disciplined thought, and disciplined action.

Whether you’re a business owner or a stock investor, reviewing the key concepts from Good to Great to level up your business and investing results is useful.

Here are my top 5 takeaways:

- Level 5 leadership — There was something markedly different about the CEOs of the eleven companies studied in the book. Collins and his team debated what the difference was.

Ultimately, they settled on the characteristics of humility and a drive to do the right thing for the good of the company, not themselves.

In other words, they were not egoic leaders like a Lee Iacocca of Chrysler, but rather self-effacing like Abraham Lincoln, with a strong tenacity to do good for their customers, employees, and shareholders to build something greater than themselves.

This quote from Harry Truman summarizes the philosophy of a Level 5 leader: “You can accomplish anything in life provided you don’t mind who gets the credit.”

- The flywheel — Collins says to imagine a huge, heavy flywheel — a massive, metal disk mounted horizontally on an axle.

It’s 100 feet in diameter, 10 feet thick, and weighs 25 tons. The flywheel represents your company.

The goal is to get the flywheel moving as fast as possible because momentum (mass times velocity) is what will generate outstanding economic results over time.

Instead of trying to have one massive breakthrough, Good to Great companies take consistent daily actions and keep pushing the flywheel in the same direction.

They don’t start and stop new initiatives and lose momentum. Instead, each push of the flywheel builds on all the previous thousands of pushes and moves a company one step closer from good to great.

- Get the right people on the bus — Good to Great companies focus first on finding and hiring the right people rather than launching new business initiatives.

Getting the right people takes precedence over strategy and vision, which may be the most important idea of the book, as nothing is more important than the talent a business employs.

The right people are self-motivated, and they want to be part of a team that is expected to produce great results. Equally important is getting the wrong people off the bus.

Even if you’re headed in the right direction, having the wrong people will never result in a great company. Great vision with mediocre people will always produce mediocre results.

- Confront the brutal facts — “Dealing with reality as it is” is a rule Level 5 leaders follow. They seek to understand the challenges before them, and without unwarranted optimism, remain steadfast in overcoming them.

Life is unfair, and we will all experience disappointments and crushing events with no one to blame. As Collins says, “what separates people is not the presence or absence of difficulty, but how they deal with the inevitable difficulties of life.”

One good to great CEO asked the brutal question, “why have we sucked for 100 years?” This type of disciplined question is what is necessary to ignite transformation.

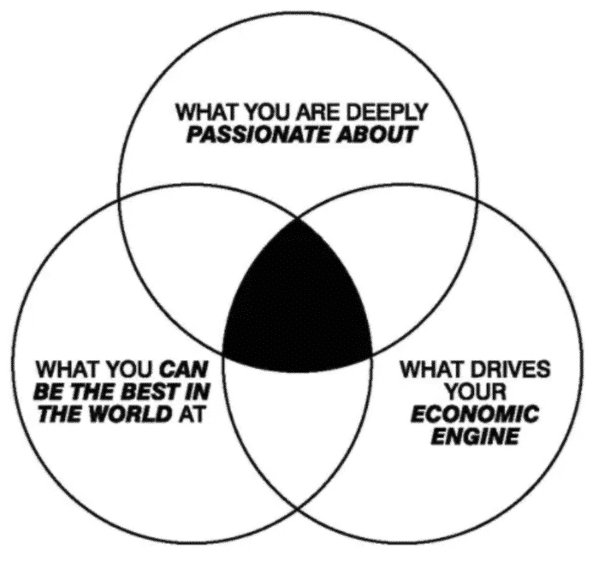

- The hedgehog concept — One of the key Good to Great principles is what Collins calls The Hedgehog Concept.

There’s an Ancient Greek parable about a hedgehog and a fox. The fox is cunning and knows many small things, and changes tactics easily.

The hedgehog knows one big thing and knows it well. As it turns out, all good to great leaders are hedgehogs and are able to simplify a complex world down to one unifying idea.

The hedgehog concept boils down to the intersection of three circles: what you can be the best in the world at, what you are deeply passionate about, and understanding what drives your economic engine.

It takes considerable time to think about and discover a company’s hedgehog concept. It took, on average, four years for the Good to Great companies to clarify their hedgehog.

Good to great companies stick to doing what they’re best at and avoid getting distracted by shiny, new initiatives.

Questions to ask

Consider the companies you’ve invested in or for which you work.

Do they display the Good to Great qualities that can transform a business?

Even if you’re not a CEO of a company, the principles of Good to Great can be applied in our own lives to create a pocket of greatness.

Start by considering if we have the right people on the bus or how to create a flywheel effect in our own lives.

It may also be good to consider the hedgehog concept for our lives.

What can you be the best at?

What are you passionate about?

And what will people pay you for?

Wrap up

For a more in-depth video review of the book, check out Shawn’s top takeaways on YouTube from Good to Great here.

Let us know what you think. Has Good to Great had an impact on your life and career?

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.