Time Arbitrage

10 August 2022

Hi, The Investor’s Podcast Network Community!

Happy Wednesday and welcome back to We Study Markets!

Can we forget about another 75-basis-point increase by the Fed in September?

Today’s CPI report undershot expectations enough to convince traders that this may be the case (for now anyway). The Dow jumped over 500 points, and the Nasdaq surged 2% on the news.

Inflation remains the No. 1 concern for the market at the moment. Not only whether it is subsiding, but how quickly is the question.

Fed officials have said they want to see inflation easing meaningfully before considering a halt to rate increases.

Is today’s CPI report enough for them to put their foot on the brakes of future rate increases? We shall see.

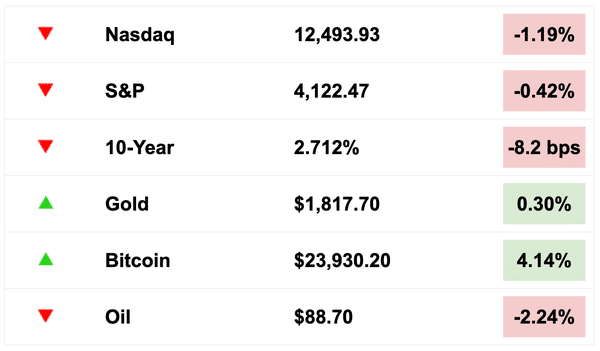

MARKETS

*Equities as of 4pm EST on prior day’s close. Bitcoin, bond, and oil prices as of this morning

Today, we’ll discuss pension fund woes, the first-ever single bond ETF, time arbitrage, today’s CPI report, and seven ideas for adjusting your portfolio.

All this, and more, in just 5 minutes to read.

Let’s go! ⬇️

IN THE NEWS

🤕 State And City Pension Funds On Pace For Worst Year Since 2009 (WSJ)

Explained:

- Through the first half of the year, public pension funds on median lost 7.9%. The results reflect a rare year in which both bond and equity markets have declined. Typically, these asset classes maintain an inverse correlation that allows them to effectively offset each other (to an extent). Or at least, that’s the conventional investing logic epitomized by the famed 60/40 portfolio, which we wrote about in our very first newsletter.

- The push to rein in inflation with higher short-term interest rates has pummeled markets and left both individual and institutional investors alike watching their portfolios drop. For public pension funds, which are typically underfunded, bad years like this pose a tremendous challenge for them in meeting their payout liabilities and may cause officials to raise taxes or cut spending elsewhere to offset funding gaps.

What to know:

-

-

- Even despite a booming decade of stock returns, many pension funds are billions of dollars short on covering future benefit obligations. To cover this shortfall, funds generally have devised aggressive investment approaches intended to compensate for chronic under-contributions, with a greater reliance on equities, private investments, and leverage.

- Return distributions are not necessarily even either. The largest pension funds, like the California Public Employees’ Retirement System, tend to attract the best asset managers which helps stabilize and maximize returns, though the performance gap may also be largely due to greater use of private equity and other alternative investments. Smaller state and city pensions, though, appear to be more vulnerable to both underfunding and volatile investment returns.

-

🤑 First Single-Bond ETF Looks To Revolutionize Access To Treasuries (FT)

Explained:

- The other day, we wrote about the seeming absurdity of single-stock ETFs only to conclude that there may actually be a reasonable purpose for their existence, if only to enable speculations among investors who normally lack access to leverage or short-selling. Now it appears, though, that we will soon have the first single-bond ETFs, as Wall Street increasingly brings to market more narrowly targeted products.

- There are actually three such ETFs now trading on the Nasdaq, with focuses on the ten-year, two-year, and three-month Treasury bonds and bills. F/m Investments is the issuer, and their President / CIO had this to say: “We believe the (ETFs) will revolutionize the financial markets, making the most liquid securities accessible to everyone in a more simplified way.”

What to know:

- Since many retail investment platforms like Robinhood do not allow investors to purchase and hold individual bonds, these ETFs offer a more direct way for doing so. To stay in line with their stated goals of tracking certain duration bonds, the funds will have to roll over their holdings periodically.

- After just a few months, for example, a purchased 10-year Treasury holding can become “off-the-run”, meaning that it’s supplanted by newly issued bonds. These off-the-run bonds tend to have less liquidity and lower prices, since they now hold a different spot on the yield curve. This means that the funds have to pay a premium to roll over their bonds or bills which will come at a cost to returns. We remain intrigued by new uses of ETFs.

🥂 Investors Cheer Lighter-than-Expected Inflation (CNBC)

Explained:

- The CPI inflation rate finally pulled back from a 40-year peak in July, as the index came in cooler than expected. The rate eased to 8.5%, retreating from June’s 9.1% annual inflation rate. The decrease raises hopes that the relentless surge in prices may have peaked.

- Economists had estimated yearly inflation would fall to 8.7%. Stocks shot higher on the better-than-expected news, as the S&P 500 rose 1.75%, while the Dow Jones Industrial Average jumped over 520 points.

What to know:

- The slowdown in July’s inflation is a promising sign and likely will be well received by the Federal Reserve which desperately wants to see inflation cool. However, one month of slower increases is not enough to declare that inflation has been vanquished, and Fed members have recently emphasized their commitment to rate hikes until they’re certain inflation is under control.

- The Fed still has much work to do as consumers continue to feel the pains of inflation daily, as food prices saw a 13% increase.

Tweet about this:

FEATURED SPONSOR

Stock investing is great, and it’s likely right for a portion of your portfolio, but it’s hard to beat truly passive income — mailbox money, as some call it. To make sure you’re investing with a great management team, learn the 7 Red Flags for Passive Real Estate Investing.

DIVE DEEPER: 7 IDEAS FOR ADJUSTING YOUR PORTFOLIO

Building wealth through investing is a challenge for most individual investors. Not armed with a cadre of analysts by your side suggesting your next move, the average retail investor is often left to their own devices, trying to figure out wise, prudent, and profitable investment decisions.

Your timeline, risk tolerance, and how much money you have to invest are all vital factors in determining your portfolio allocation, and everyone has different goals, needs, and objectives. There is not a one-size-fits-all blueprint to follow, but there are general principles that can apply to most investors.

The Wall Street Journal recently asked financial experts for their advice in a year when stocks are down, inflation is high, and a recession is looming. Some of them say that the conventional wisdom of owning a standard ratio of 60% stocks and 40% bonds may need some rethinking. Check out our thoughts on the traditional 60/40 portfolio here.

If you’re managing your own portfolio, here are our top takeaways to consider as we move into the latter stages of 2022:

Don’t just do something. Sit there – Selling losing stocks may provide some comfort in the moment, but it fails to consider how it relates to your long-term strategy or what to do with the proceeds. A long-term investor maintains conviction in their holdings and stays invested throughout market cycles. Making sure one owns only high-quality businesses with strong management that generate consistent value will help in holding through rocky economic times.

The rule of 120 – The rule of 120 states you should subtract your age from 120. This will determine how much should be in equities versus how much in fixed-income assets such as bonds. For example, a 40-year-old would have 80% (120-40) in equities and the remaining 20% in fixed-income assets. With this model, your overall risk level gets modestly reduced as you age, but this is a simplified approach meant only to guide your thinking generally.

The volatility factor – Most investors’ biggest economic asset is not necessarily their accumulated savings but their future earnings. Wage growth has a low correlation with stock returns, so future earnings represent a large explicit fixed-income holding. That means that most folks should hold close to 100% of the money they don’t need to cover regular monthly expenses in stocks, according to James Choi, a professor of finance at Yale School of Management.

However, there is a caveat. When stock market volatility is extremely high, it can make sense to temporarily scale back one’s stock positions, because the average return doesn’t increase when volatility is high. So the market is considered a bad deal during those times. According to Choi, when the VIX (the market’s forecast of S&P 500 volatility over the next month) rises above 30, “I start thinking about modestly reducing my stock exposure.” If you sell stocks in response to a volatility increase though, be ready to come back into the market quickly as soon as volatility has died down.

Don’t lock in losses – It can be tempting to reduce your allocation to stocks right now, but it’s worth recognizing that half of the S&P 500’s best days in the past 20 years happened during a bear market. Another 34% of the market’s best days occurred in the first two months of a bull market. Missing those best days is far more harmful to your portfolio than staying the course through the market’s gyrations. A long-term investor realizes there will be inevitable periods of negative returns and will stomach the ride.

Seek out dividend-growth stocks – In times like today, the typical rule of thumb would be to allocate more funds to bonds as a safe haven. The problem with this line of thinking is we are also facing rising interest rates, and higher rates create an inverse relationship with bond prices. One bond fund, iShares Core U.S. Aggregate Bond ETF (AGG), is down over 8% for the year. Consider dividend-growth stocks to make up for the gains bonds typically would have provided during a recession.

Get back to your equities target – The recent stock decline may have altered your intended allocation ratio. A typical 60/40 portfolio at the beginning of the year would have drifted to a 58/42 split at the end of June. Adjusting the stock allocation to your intended ratio could help investors prepare for the next market upswing.

Factor in your company stock – Another thing to consider is your allocation to your employer’s stock. Will the company survive this economic environment? Be sure that you’re confident in your assessment, determine how much weight you should give to your employer’s shares, and adjust accordingly. Many people mistakenly invest heavily in their company’s stock, so if their employer struggles during an economic downturn, not only is their career made vulnerable to a possible layoff, but their savings are now at risk too should the company’s stock reflect this weakness.

Let us know how you’re handling adjustments to your portfolio in today’s market. We’d love to hear from you! (Just hit reply to this email)

Tweet about this:

QUOTE OF THE DAY

“Time arbitrage just means exploiting the fact that most investors tend to have very short-term time horizons, have rapid turnover, or are trying to exploit very short-term anomalies in the market. So the market looks extremely efficient in the short run. In an environment with massive short-term data over-load and with people concerned about minute-to-minute performance, the inefficiencies are likely to be looking out beyond, say, 12 months.”

Miller here touches on one of our favorite concepts: time arbitrage.

As he explains, the essential idea is that markets are hyper-efficient in forecasting over the next year or so, but as timelines lengthen, the efficiency of markets diminishes.

Not just because accuracy drops for further into the future projections, but rather, this is meant in regard to the market’s ability to effectively, and quickly, respond to and weigh changes in present information with respect to how they shape distant outcomes.

In other words, if most participants in equity markets, including hedge funds, mutual funds, individual investors, etc. tend to focus on anomalies immediately before them or on bets in a more tangible time frame, then the long-run effects of decisions made today may become neglected.

As a long-term value investor, Miller uses this to his advantage, in pondering deeply about what trends and actions today are likely to shape the future on a timeframe that others are unwilling to wait for.

For professional investors, this is chiefly because they’re graded on a quarterly and annual basis, so both implicitly and explicitly, this warps their perspectives.

If your job depends on how well you do next month, are you really likely to take seriously an opportunity that won’t be available for at least another three years?

The answer for most of us is probably no, and this is precisely why Miller has had so much success in his career implementing time arbitrage.

And for individual investors, most are simply not taught to think on such a long timeframe when evaluating investment opportunities, and even fewer are able to execute on this scale.

It’s just too tempting for many to buy a stock in anticipation of its upcoming earnings report, or on speculations that it may become the next meme stock swept up in a Reddit avalanche.

For those who want to learn more about how Bill Miller thinks and time arbitrage, our host William Green did an excellent interview with him recently on Richer, Wiser, Happier.

Tweet about this:

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you tomorrow!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.