We Need To Talk About The Petrodollar

08 August 2022

Hey, The Investor’s Podcast Network Community!

We hope it was a great weekend for you, and welcome back to We Study Markets!

Stocks were mixed last week as a much stronger-than-expected jobs report revived investor concerns that the Federal Reserve will maintain an aggressive pace of interest rate hikes to tamp down high inflation.

We expect a quiet week with just 23 S&P 500 companies scheduled to report earnings for the second quarter.

In other news, the Senate passed the Inflation Reduction Act – a major climate, health care, and tax bill, which was a centerpiece of President Biden’s agenda. Vice President Harris broke a 50-50 tie. It now advances to the House for a vote.

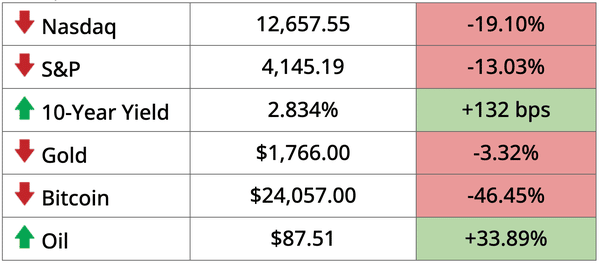

For the year, stocks have rallied from their lows but double-digit losses are still on investors’ minds. And despite high inflation and geopolitical uncertainty, gold has been down (as priced in dollars), while Bitcoin has lost almost half its market value.

*Equities as of 4pm EST on prior day’s close, Bitcoin, bond, and oil prices as of this morning

Today, we’ll discuss Ray Dalio’s thoughts on stagflation, second quarter results for Berkshire Hathaway, and wrapping your head around the petrodollar system and stablecoins.

All this, and more, in just 5 minutes to read.

Let’s dive in! ⬇️

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

📉 Berkshire Hathaway Posts $43.8 Billion Loss (Reuters)

Explained:

- Berkshire Hathaway’s earnings slid in the second quarter as market turmoil weighed heavily on the company’s stock portfolio. The company posted a loss of $43.8 billion compared to a profit of $28.1 billion in the year-earlier period. Despite fears of slowing growth, Berkshire Hathaway’s operating profits jumped 38.8% in the second quarter to $9.283 billion.

- Of some concern for investors was a loss of $53 billion on its investments for the quarter. Berkshire said, “the amount of investment gains/losses in any given quarter is usually meaningless and delivers figures for net earnings per share that can be extremely misleading to investors who have little to no knowledge of accounting rules.”

What to know:

- The company is a microcosm of the broader economy with such familiar brands as Dairy Queen, Duracell, Fruit of the Loom, and See’s Candies. Despite rising price pressures and cooling economic activity, Berkshire was able to pass on higher costs to customers in many of its business units.

- Berkshire repurchased just $1 billion of its own stock, down from $3.2 billion in the first quarter, compared with $51.7 billion for 2020 and 2021. The “Oracle of Omaha” has been steadily adding to his Occidental Petroleum stake since March and has acquired 19.4% of the company worth $10.9 billion. Occidental has been the best performing stock in the S&P 500 this year, more than doubling in price on the surge in oil prices.

💸 In Defense Of Stablecoins (FT)

Explained:

- Stablecoins have been a hot topic lately, and if you don’t know, they’re digital currencies meant to be explicitly pegged to popular fiat currencies like the dollar or the euro. For most stablecoins, the issuers use traditional currency reserves and short-term government debt as collateral to secure the value of their tokens with a one-to-one exchange rate to their pegged currency.

- Controversy comes then from a recent blow-up in TerraUSD which operated with a more unique (and flawed) “algorithmic” technology that didn’t necessarily focus on having fiat currency reserves that guarantee the exchange rate. Without diving too much into that mess, because TerraUSD should probably never have even been considered a stablecoin in the first place, as the FT highlights, the primary issue with this emerging space is not the technology so much as it is bad collateral.

What to know:

- As regulators globally seek to regulate DeFi, it’s important that technological innovation surrounding blockchains is not stifled. While the Terra case was likely a matter of bad technology, this is not true for many of the largest stablecoins, and the question is really the quality of their reserves.

- Tether, the biggest stablecoin in the world, has for example been the target of broad speculation about its underlying holdings, since they’ve never agreed to an audit. It’s possible then that they’ve invested their reserves in more risky assets to earn a higher return.

- Should a “bank run” ever occur, without the appropriate underlying collateral, stablecoins broadly risk losing their pegs, and regulators must work harder to ensure that stablecoin issuers are using cash, Treasuries, and other low-risk short-term bonds as collateral.

📉 SoftBank Reports Record Loss Amidst Tech Downturn (WSJ)

Explained:

- The infamous Japanese tech investing firm lost $23 billion this past quarter which topped their prior record loss from the first quarter of this year by about one and a half times. Rising interest rates and crackdowns in China on tech companies have fueled a seismic sell-off in the space, and SoftBank has been particularly notorious for its highly speculative bets.

- The group invested nearly $50 billion in a six-month span last year in a number of unprofitable companies at very high valuations. Now the firm’s CEO says that they have pivoted to playing defense by selling off assets, like its 3.2% stake in Uber, to raise cash, in addition to laying off employees.

What to know:

- For Softbank, as a Japanese firm, many of its losses have been made worse by a sharply weaker Yen, and since they have borrowed heavily in dollars, unfavorable exchange rates will make it even more challenging to pay down their leverage.

- Playing with fire (borrowed money and risky bets) produces great results during bull markets, but as we’ve seen, when the party stops, things get ugly. Softbank’s CEO captures the phenomenon perfectly, saying, “When we were turning out big profits, I became somewhat delirious, and looking back at myself now, I am quite embarrassed and remorseful.”

FEATURED SPONSOR

Are you worried about inflation? There are few better ways to beat inflation than real estate, but even real estate isn’t all sunshine and rainbows. Learn about the red flags from PassiveInvesting.com.

DIVE DEEPER: DEATH OF THE PETRODOLLAR?

What’s a petrodollar? Petrodollars are oil export revenues denominated in U.S. dollars. The term emerged in the 70s as the U.S. went off the gold standard and desperately needed a way to continue having the greenback be the global reserve currency.

Ultimately, Saudi Arabia agreed to price and settle oil contracts primarily in USD in exchange for U.S. military protections and arm sales. Since oil underpins the global economy, this extra demand has artificially propped up the dollar’s value and ensured its role in the global economy.

What was the outcome? This arrangement has allowed the U.S. to print dollars, buy oil, and keep demand high for the USD as most global commodities are largely settled in dollars now. Correspondingly, this has pressured countries to hold U.S. treasuries on their balance sheets. In effect, instead of the dollar being backed by gold, it became quasi-backed by oil.

What’s going on now? In February, Russia and China agreed to a 30-year natural gas pipeline deal that will be settled in Euros, while Russia has also sought to sell oil to India for rupees. And in March, Saudi Arabia announced that they’re considering accepting the Chinese yuan for all oil exports to China, which buys 25% of Saudi oil. Additionally, the Saudis also snubbed a Biden request to increase oil production in April.

Why it matters? The petrodollar system made in the 1970s, which created a great demand for U.S. dollars and Treasuries, while enabling the country to spend far beyond its means for years, is under serious pressure.

In the past, the U.S. has used its military to enforce this agreement on countries attempting to settle commodity purchases without using USD (i.e. Iraq and Libya). Today, with countries like China, Russia, and India are beginning to settle outside the dollar, that option remains untenable.

Strategy Implications: If continued agreements outside the petrodollar system are made, there’ll be less demand for U.S. Treasuries, which restricts the government’s ability to borrow towards funding itself and for future deficit spending.

In this scenario, the Fed will likely have to grow its balance sheet (purchase Treasuries) to offset reduced external demand. This would make it difficult to follow its current plans of raising interest rates and tapering asset purchases through quantitive easing.

By the numbers: According to Luke Gromen, countries around the world have collectively reduced the percentage composition of U.S. Treasuries on their balance sheets from a peak of 72% to around 59% today.

Bottom line: The second and third-order effects of this feared breakdown in the petrodollar will be something to keep your eye on over the coming years.

This would be sure to cause geopolitical alliances to shift, and the Fed may be forced pivot and make up the difference through quantitative easing. In this new world order, hard assets like gold and even Bitcoin, may become more attractive as neutral currencies not tied to any single country and its political whims.

WHAT IS STAGFLATION?

As the debate over whether the U.S. is truly in a recession continues, with elevated levels of inflation currently, the term “Stagflation” is likely to be thrown around a lot.

But what exactly does that mean?

We turned to none other than Ray Dalio’s hedge fund, Bridgewater, for insights.

Bridgewater anticipates an environment where the large, stimulative fiscal deficits and low interest rates / quantitative easing programs of 2020 & 2021 create lasting higher prices with lower real economic growth.

This is because of persistent increases in nominal spending anchored by a large credit expansion, and they explain that, “stimulation was applied for too long, and the offsetting monetary tightening is coming too late, resulting in…monetary inflation.”

For an explanation of how the economy works and is driven by credit growth, and correspondingly money supply growth, which creates business cycles and inflation, we love this video from Dalio.

To bring down inflation they explain, the Federal Reserve will have to aggressively raise interest rates, which raises borrowing costs for individuals and corporations throughout the economy.

As borrowing costs rise, decisions that involve taking out debt, such as mortgages, car loans, small business loans, corporate projects, etc. become unviable with higher interest and are delayed.

Such reductions in spending (of borrowed money) and greater costs of debt ripple through the economy, creating unemployment broadly as companies seek to cut expenses.

Takeaway

When we have a period of high inflation then, where the money supply has increased more than the supply of real goods and services in the economy, while also having an economic downturn, with high prices and rising interest rates discouraging consumption and investment, then this is what’s known as stagflation.

In other words, stagflation is the (hopefully) transitory period that arises between periods of high inflation and high real economic growth, and the period where reduced economic activity actually relieves price pressures such that a new business cycle can begin.

During this time of stagflation, everyone is pinched from two sides: prices remain high and increasing which drains on your standard of living and savings, while the risk of being laid off due to the economic downturn increases.

Not to be an alarmist, but this environment is largely seen as a worst case scenario for economic planners like central banks.

On the bright side, markets generally are not anticipating such a dire situation yet and expect that the Fed can cool inflation without plunging us all into a deep recession.

Bridgewater, though, sees things differently and warns of an extended stagflationary period in our near future, so we ought to at least understand what this could mean for us.

For more on investing during periods of high inflation, check out our excellent Millennial Investing podcast on the topic.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you tomorrow!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.