Financial Tips For Small Business Owners

Starting and running a small business is an exciting venture, but it comes with its share of challenges—none more critical than managing your finances effectively. Strong financial health is the backbone of any successful business, ensuring not only survival but also enabling growth and innovation. In this blog post, we will explore several key financial tips that every small business owner should know. For those eager to dive deeper into financial management, read more about finance on MoneyFor’s blog.

Understanding Your Cash Flow

Cash flow is the lifeblood of your small business, representing the amount of money coming in and going out. Managing it effectively is crucial to maintaining solvency and supporting day-to-day operations. Here are several strategies to enhance your cash flow management:

-

- Monitor Regularly: Keep a close eye on your cash flow by setting up a system to track and analyze it weekly or monthly. This allows you to anticipate problems before they become crises.

- Improve Receivables:

-

-

- Invoice Promptly: Send invoices as soon as a job is completed or a product is delivered to speed up payments.

- Offer Multiple Payment Methods: Make it easy for customers to pay by accepting various forms of payment, including digital options.

- Implement Late Fees: Encourage timely payments by applying late fees for overdue invoices.

-

- Manage Payables:

-

- Negotiate with Suppliers: Try to get better terms such as extended payment periods or discounts for early payments.

- Prioritize Payments: Pay critical suppliers first and consider timing payments to align with your cash flow needs.

- Forecast Future Cash Flows: Use historical data to predict your future cash needs. This will help you make informed decisions about when to invest in growth opportunities and when to conserve cash.

- Maintain a Cash Reserve: Build a cash buffer to help you manage through slower periods or unexpected disruptions. This reserve can be a lifesaver when faced with sudden challenges.

Remember, effective cash flow management is not just about keeping your business afloat; it’s about setting the stage for future success.

Budgeting and Expense Management

Creating and adhering to a budget is one of the most fundamental aspects of sound financial management for small business owners. A well-crafted budget will guide your spending decisions and help ensure that your financial resources are allocated effectively to support your business goals. Start by understanding your revenue streams and typical expenses, and then outline expected costs for the upcoming period. This proactive approach allows you to anticipate financial needs and constraints, enabling better control over your cash flow.

While tracking your expenses, it’s crucial to differentiate between essential and non-essential spending. Essentials are expenditures necessary for the operation and growth of your business, such as rent, salaries, and supplies.

Non-essentials might include discretionary marketing campaigns or lavish office upgrades. By identifying and minimizing unnecessary expenses, you can free up resources to invest back into critical areas of your business, such as product development or customer acquisition.

Another important aspect of managing finances is the use of technology. Today, numerous software tools can automate expense tracking and reporting, reducing the likelihood of errors and saving you valuable time. These tools not only provide real-time insights into your financial health but also help you make data-driven decisions that can propel your business forward.

Maintaining Good Credit

Maintaining a good credit score is essential for small business owners, as it affects your ability to secure financing and negotiate favorable terms with suppliers. A strong credit score signals to lenders and business partners that your company is financially responsible and a low-risk borrower.

To begin with, always ensure that your business credit activities are reported to the appropriate credit bureaus. This might involve selecting lenders and credit institutions that report transactions. Regularly monitoring your credit report allows you to catch errors and address them promptly, which is crucial for maintaining your credit health.

Prompt payment of bills cannot be overstressed. Delayed payments can negatively impact your credit score significantly. Make it a practice to pay invoices and loans on time or even early if possible. If you’re facing cash flow issues, communicate proactively with creditors to negotiate payment terms that won’t hurt your credit.

Another tip is to manage your debt-to-credit ratio effectively. It’s advisable not to max out your credit lines; instead, aim to use a small percentage of the credit available to you. This not only helps in keeping your credit score high but also ensures that additional credit is available in times of emergency or when an opportunity arises that requires quick funding.

Tax Planning and Compliance

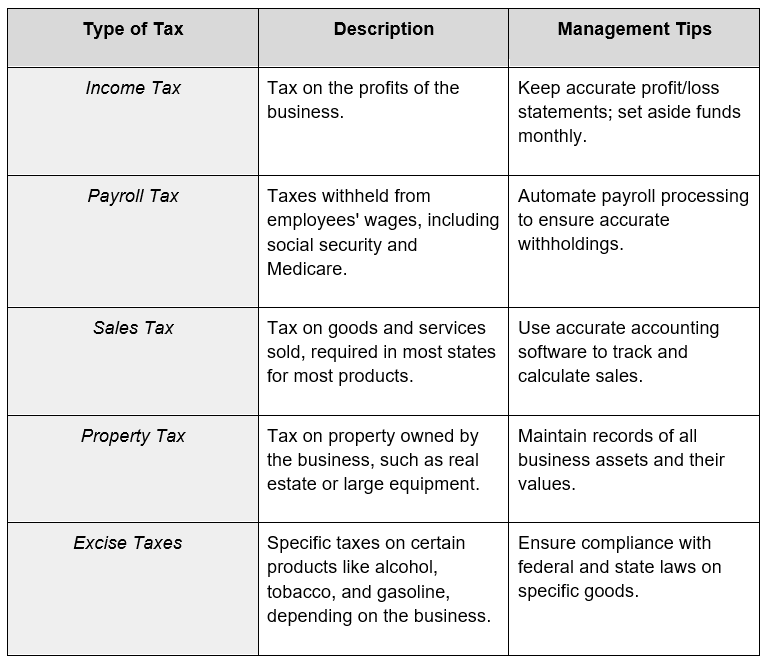

Navigating the complexities of tax obligations is a critical aspect of managing a small business. Effective tax planning and compliance not only help you avoid legal pitfalls but also maximize your financial resources.

Below we outlined common types of taxes that small businesses may encounter, along with strategies for management and compliance:

To ensure you’re not caught off-guard at tax time, it’s advisable to set aside money regularly to cover your tax liabilities. Additionally, keeping meticulous records of all business transactions is essential for supporting your income and expense claims. Leveraging tax deductions can significantly reduce your taxable income, so familiarize yourself with deductions available specifically for your business.

Consulting with a tax professional is advisable, as they can offer tailored strategies for tax efficiency and ensure compliance with the latest tax regulations. This proactive approach not only helps avoid penalties but also improves your business’s financial health.

Managing Debt Wisely

Debt management is a crucial element of financial strategy for any small business. When used correctly, debt can be a powerful tool to help finance new opportunities and support business growth. However, mismanaged debt can lead to financial strain and limit your business’s potential.

First and foremost, it’s important to understand the different types of debt available to small businesses. These can include:

- bank loans,

- credit lines,

- merchant cash advances.

- equipment financing.

Each type has its own terms, rates, and repayment structures. Knowing the specifics of each can help you choose the right debt instrument for your needs.

When considering taking on debt, assess the potential return on investment that the debt will finance. For example, borrowing to purchase new equipment may boost productivity, leading to increased revenue. However, if the additional revenue won’t cover the loan payments, this might not be a wise decision.

Another key aspect of managing debt wisely is maintaining a manageable debt-to-income ratio. This ensures that your business can comfortably meet debt obligations without compromising other financial needs. It’s also wise to have a clear repayment plan in place. This could include setting aside a portion of monthly revenue specifically for debt repayment.

Regularly reviewing your debt situation is vital. This means re-evaluating your outstanding debts, considering refinancing options, and possibly consolidating loans to secure lower interest rates or more favorable terms. Such strategic management not only keeps your debt levels healthy but also optimizes your financial operations for better stability and growth.

Planning for Growth and Scaling

As a small business owner, planning for growth and scaling is an essential part of your financial strategy. It involves not just increasing your capacity and market reach but also ensuring that your financial foundation can sustainably support this expansion.

Assessing Readiness for Scaling

Start by assessing the current state of your business to determine if you are ready to scale. Analyze your existing operations, market conditions, and financial health. Key indicators of readiness include consistent revenue growth, a strong customer base, and efficient operational processes. If these elements align, it might be time to consider expanding.

Financing Growth

Financial preparation is crucial when planning for growth. This typically requires additional funding, which can come from various sources such as reinvesting profits, securing loans, or finding investors. Each option has different implications for your business’s financial management and control. For example, taking on investors may mean sharing decision-making power, while loans will increase your debt load.

Managing Cash Flow During Expansion

An often overlooked aspect of scaling is the impact on cash flow. Expansion usually involves significant upfront investments, like hiring new staff, increasing marketing efforts, and purchasing equipment. These expenses can lead to cash flow challenges if not managed carefully. Therefore, developing a robust cash flow projection is essential. It should account for the expected changes in both income and expenses during the scaling process.

Upgrading Systems and Infrastructure

Consider the infrastructure and systems necessary to support a larger business operation. This might include upgrading technology, expanding facilities, or implementing more sophisticated financial management software. These investments should align with your long-term business goals and help improve efficiency and capacity.

Ongoing Oversight and Adjustment

Successful scaling requires careful planning, strategic investment, and ongoing financial oversight. Continuously monitor and adjust your strategies to respond to new challenges and opportunities as they arise. By taking a structured approach to growth, you can enhance your business’s prospects and ensure its longevity and profitability.

Saving and Emergency Funds

Establishing savings and an emergency fund is crucial for small business sustainability. These reserves help manage unforeseen expenses and economic downturns without jeopardizing the operational integrity of your business.

Aim to set aside 10% to 20% of monthly revenue into a dedicated savings account. This proactive approach not only provides a financial cushion but also enhances your business’s resilience against market volatility and unexpected financial demands. As a rule of thumb, try to build a reserve that covers at least three to six months of operating expenses.

Seeking Professional Advice

In summary, navigating the financial landscape of a small business requires a comprehensive approach, encompassing everything from meticulous cash flow management to strategic planning for growth and scaling. However, the complexity of these tasks often necessitates professional advice.

Consulting with financial advisors or accountants can provide you with tailored strategies that align with your business goals and help you navigate through the complexities of financial management. These professionals offer invaluable insights that can prevent costly mistakes and propel your business toward sustainable growth and success. Remember, investing in expert advice is investing in your business’s future.